[ad_1]

With the fourth Bitcoin halving simply 12 days away, the group is buzzing with anticipation, speculating on the potential for Bitcoin to breach the numerous $100,000 threshold. Joe Consorti of Theya Analysis has supplied a complete evaluation, diving into the intricacies of Bitcoin’s present market place and the elements which may catapult its worth to new heights.

This occasion, a cornerstone in Bitcoin’s design to halve the rewards for mining new blocks each 4 years, traditionally triggers a bullish momentum, and the current situation seems to be aligning with previous precedents.

The Significance Of Bitcoin’s Consolidation Part

Consorti’s evaluation titled, “Bitcoin’s 4th Halving Is [12] Days Away, and $100,000 Isn’t A lot Additional Behind It”, begins with a deep dive into Bitcoin’s ongoing consolidation part, which he argues is a important interval that precedes a possible bull run.

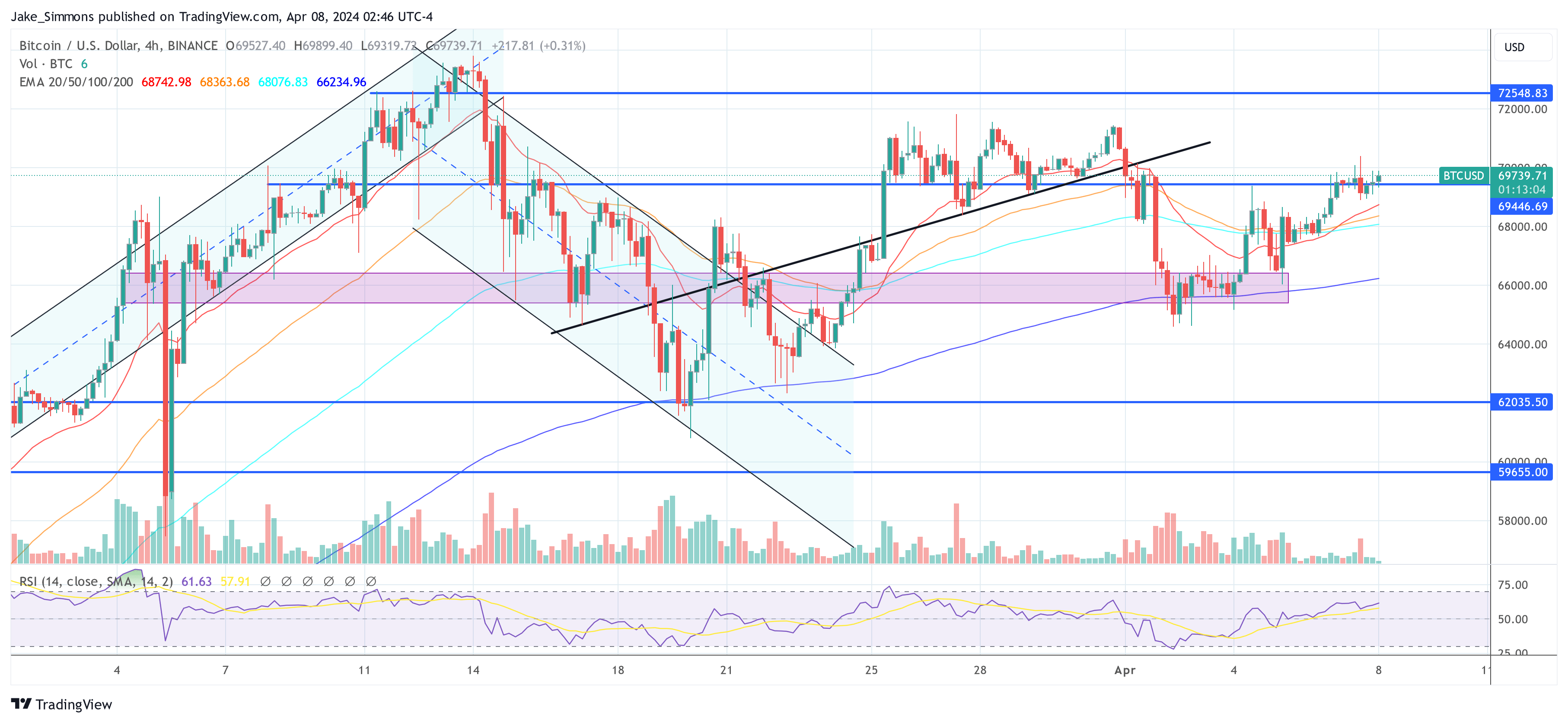

“Bitcoin continues its consolidation. Consistent with its earlier phases of consolidation at $30k and $40k, BTC spends a number of weeks at key psychological worth ranges exchanging fingers between patrons and sellers earlier than advancing increased,” Consorti acknowledged on X.

He emphasizes that that is the sixth week of Bitcoin’s consolidation above $60,000, marking the least risky interval at this worth degree and following a brand new all-time excessive. This, in accordance with Consorti, alerts a robust market confidence that could possibly be the inspiration for the following surge.

The evaluation additional explores the broader market dynamics, significantly the correlation breaks throughout the present cycle which have made the inventory market an unreliable indicator of US financial sentiment. “The market at massive has skilled huge correlation breaks this cycle […] This has a terrific deal to do with companies extending their debt maturity throughout 2021 when charges had been nonetheless low, and the US Treasury’s huge crisis-level fiscal deficit,” Consorti explains.

He argues that these elements have contributed to the decoupling of conventional financial indicators from the inventory market’s efficiency, inadvertently benefiting asset costs, together with Bitcoin.

The Function Of ETFs And The Spot Market

A good portion of Consorti’s evaluation is devoted to the conduct of Bitcoin ETFs and their interplay with the spot market.

Regardless of a slowdown in web inflows to Bitcoin ETFs, the amount stays strong, indicating a wholesome market. “This was one of many lowest weeks but for BTC ETF inflows, though while you web within the outflows they’re nonetheless wholesome in comparison with earlier weeks,” Consorti notes, suggesting that ETF shares are actively exchanging fingers, mirroring the consolidation seen within the spot market.

This interaction between ETFs and the spot market, in accordance with Consorti, supplies a steady basis for Bitcoin’s worth, additional solidifying the case for an impending bull run. “The funding charge is extraordinarily muted, and we’re nonetheless on the similar worth [around $70,000]. On this interval of consolidation, the spot market has actually taken management of Bitcoin worth motion. This can imply extra steady footing for the following bull run, elevating my confidence additional that this consolidation is previous a transfer increased moderately than decrease,” Consorti concluded.

Knowledgeable Consensus On The Bullish Outlook

Consorti’s optimistic forecast is echoed by different business consultants, who’ve additionally shared their bullish predictions. CRG, one other famend analyst, emphasised the importance of Bitcoin’s latest efficiency, stating, “Nice weekly shut. Recent all-time highs this week,” indicating a optimistic momentum that could possibly be sustained within the post-halving interval.

Nice weekly shut

Recent all time highs this week

Supply: my plums pic.twitter.com/wyxwomdDjZ

— CRG (@MacroCRG) April 8, 2024

TechDev, a crypto analyst, highlighted a uncommon sample in Bitcoin’s buying and selling historical past: “It doesn’t occur usually. Bitcoin closed 2 consecutive months over the higher Bollinger band. Every time it has then doubled inside 3 months earlier than the following crimson candle.” This historic sample, if repeated, may doubtlessly drive Bitcoin’s worth method past $100,000.

It would not occur usually.#Bitcoin closed 2 consecutive months over the higher Bollinger band.

Every time it has then doubled inside 3 months earlier than the following crimson candle. pic.twitter.com/veOOOmT8Id

— TechDev (@TechDev_52) April 7, 2024

Daan Crypto Trades offered a technical perspective, specializing in Bitcoin’s resistance ranges and potential targets: “Thoses earlier ‘resistances’ didn’t find yourself placing a lot of a battle. It’s simply the earlier all-time excessive that’s making the worth stall in the meanwhile. Targets above are concepts for worth discovery if we are able to depart this space behind us.” Daan’s targets are the 1.272 Fib at $83,562, the 1.414 Fib at $91,164 and the 1.618 Fib at $102,085.”

#Bitcoin Excessive Timeframe Stage Cheat Sheet ✍️

Thoses earlier "resistances" did not find yourself placing a lot of a battle. It is simply the earlier all time excessive that is making worth stall in the meanwhile.

Targets above are concepts for worth discovery if we are able to depart this space behind us. https://t.co/AeP9vzOk7M pic.twitter.com/BWvcg8EjLE

— Daan Crypto Trades (@DaanCrypto) April 7, 2024

At press time, BTC traded at $69,739.

Featured picture created with DALL·E, chart from TradingView.com

Disclaimer: The article is offered for academic functions solely. It doesn’t signify the opinions of NewsBTC on whether or not to purchase, promote or maintain any investments and naturally investing carries dangers. You might be suggested to conduct your personal analysis earlier than making any funding choices. Use info offered on this web site completely at your personal danger.

[ad_2]