[ad_1]

Hispanics are an rising American financial drive, and demographics present they are going to be for many years. Tricolor founder and CEO Daniel Chu has a plan to serve them.

In keeping with McKinsey, monetary providers income from Hispanics will triple from north of $90 billion to $265 billion by 2030. If the greater than 60 million Hispanics in the US have been their very own economic system, it will be the world’s eighth-largest. Greater than 80% of the workforce development is due to Hispanics; by 2060, they’ll symbolize 30% of the workforce. Their common age is three a long time youthful than that of whites.

(Chu careworn this isn’t a border problem. The typical Tricolor buyer has lived in the US for 15 years.)

Regardless of being close to the underside of the labor hierarchy, or maybe due to it, Hispanics withstood the pandemic in first rate form. Chu stated they benefited from the availability imbalance, rising with greater incomes than earlier than COVID-19. They’re resilient, and with a median family measurement 2.5 occasions bigger than non-Hispanic households, there are pure safeguards towards collapse.

The options scarcity dealing with Hispanics

The American economic system has been sluggish to reply. Greater than 50% of Hispanics are unhappy with their monetary providers. One-third can not entry reasonably priced credit score.

“Hispanics are closing the revenue hole versus the white inhabitants within the U.S.,” Chu stated. In case you have a look at the mixed academic attainment, Hispanics are possibly 15% behind, however family wealth for the white inhabitants is six occasions larger than Hispanics’.

“So the true secret is that Hispanics should take part in homeownership. That’s how the low-income inhabitants can in the end accumulate some wealth, and that matches squarely in our enterprise. Round 60% of our prospects who don’t have a FICO rating, don’t have a social safety quantity, we will construct a credit score rating because of our financing.”

Tricolor thrived through the pandemic

Regardless of difficult financial occasions, Tricolor has posted 40% annual development charges, with 2024 income projections of $1.3 billion. Losses didn’t explode through the pandemic. Chu attributes that to Tricolor’s buyer moat.

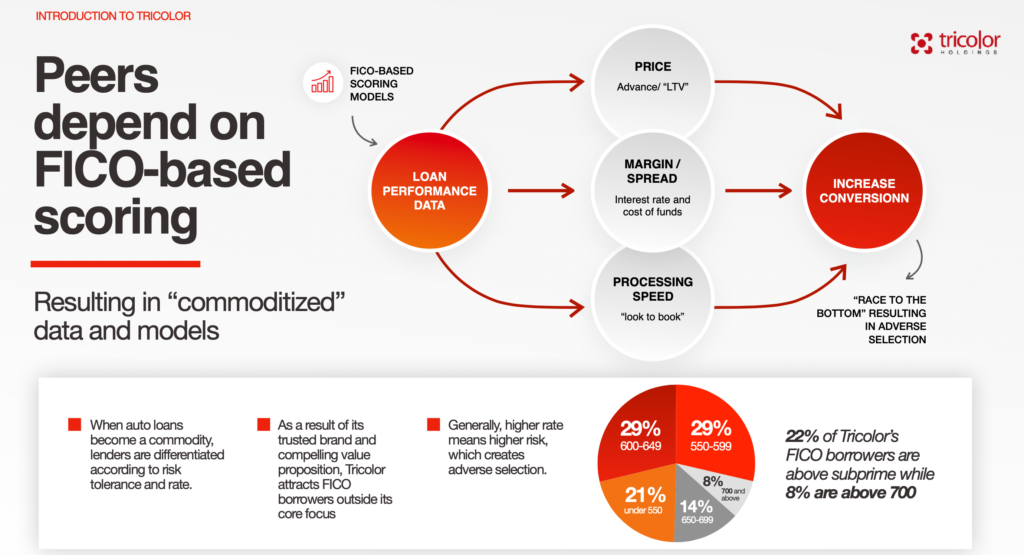

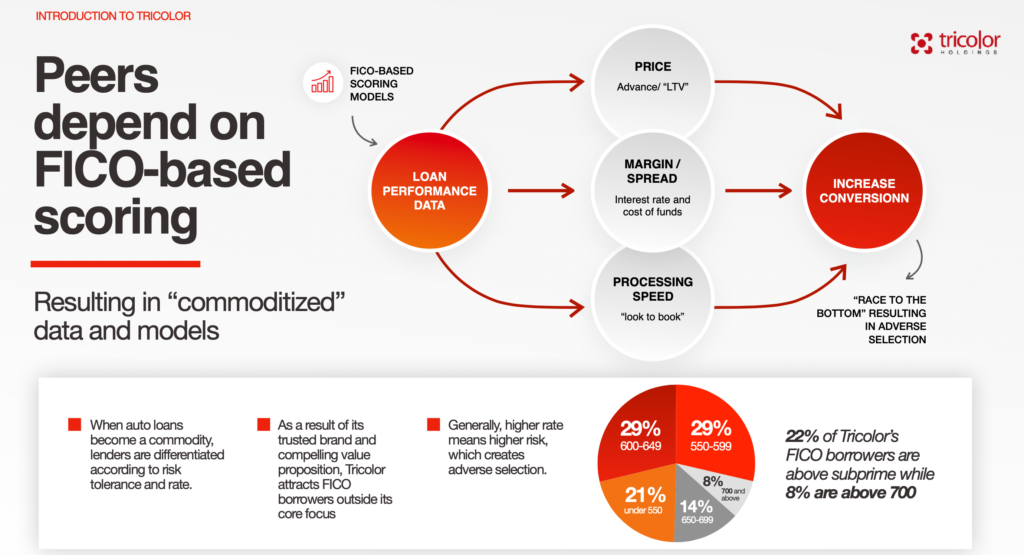

“Everyone else is chasing the identical common market shopper. Once more, we’re addressing a shopper that has this huge, aggressive moat round them,” he defined. “All the opposite fashions are actually commoditized fashions, and their commodity is capital, the commodity is FICO knowledge, and so they don’t have any capability to tell apart themselves.”

Tricolor’s expertise isn’t proprietary, however Chu doesn’t share it. That exclusivity and 45 million distinctive knowledge factors Tricolor correlated through the years is the important thing to its success, driving profitability from nearly day one.

Philosophy additionally performed a task. Chu stated Tricolor moved the danger to the highest of the funnel by utilizing expertise to phase early. That augments lead technology and improves underwriting.

It drastically improves the historically adversarial relationship between automotive sellers and lenders. Sellers search revenue maximization, whereas lenders wish to underwrite a very good mortgage.

“As a result of we now have an built-in mannequin, we will align advertising and dangers,” Chu stated. “We will use our knowledge to say that this mix of attributes will grade and carry out effectively. You’ll be able to push them via social media with Fb or different digital campaigns, and we will work with the shoppers we all know will carry out.

“So not like the standard mannequin, the place vendor and lender are adversarial, we market to prospects we all know we wish to finance. We align gross sales and advertising with danger and underwriting, and that’s a robust dynamic.

Different knowledge enhancements

“If we will phase that buyer earlier and provides them a proposal, give them an thought of what they’ll qualify for earlier within the course of, their probabilities of transferring via the funnel efficiently enhance.”

Strides in decoding various knowledge have assisted that course of. Two years in the past, Chu stated there was no profit. At this time, there are extra sources, even for non-bureau prospects, which have correlative worth and may scale back fraud by as a lot as 20 foundation factors.

AI concerns

Chu’s largest concern about AI is sustaining knowledge integrity. All knowledge integrated into fashions should be collectable, verifiable, and validated. Tricolor solely makes use of beforehand validated knowledge in credit score selections.

It’s a profitable technique that regulators approve of. Chu stated they wish to see weak shoppers like Hispanics achieve entry to extra and higher monetary providers.

It beats sticking with simpler bets, ones with sufficient mainstream knowledge to assist predict efficiency.

“We’ve been extra constant than any issuer in subprime auto loans for the final 4 years,” Chu stated. “That speaks to our capability to validate our mannequin. In case you’re not doing fixed mannequin validation in a risky surroundings, you can be topic to some unintended consequence of a development that everyone else is lacking.”

One such instance is the masking impact of pandemic stimulus and forbearance. Chu stated Tricolor carried out fixed mannequin validations that instructed they have been on track.

“Once we did mannequin validations through the lockdown, we requested prospects how many individuals lived of their family,” Chu stated. “I imply, I don’t assume that query on a credit score app, however we might see a giant correlation. So we weighted that just a little bit heavier.”

Additionally learn:

[ad_2]