[ad_1]

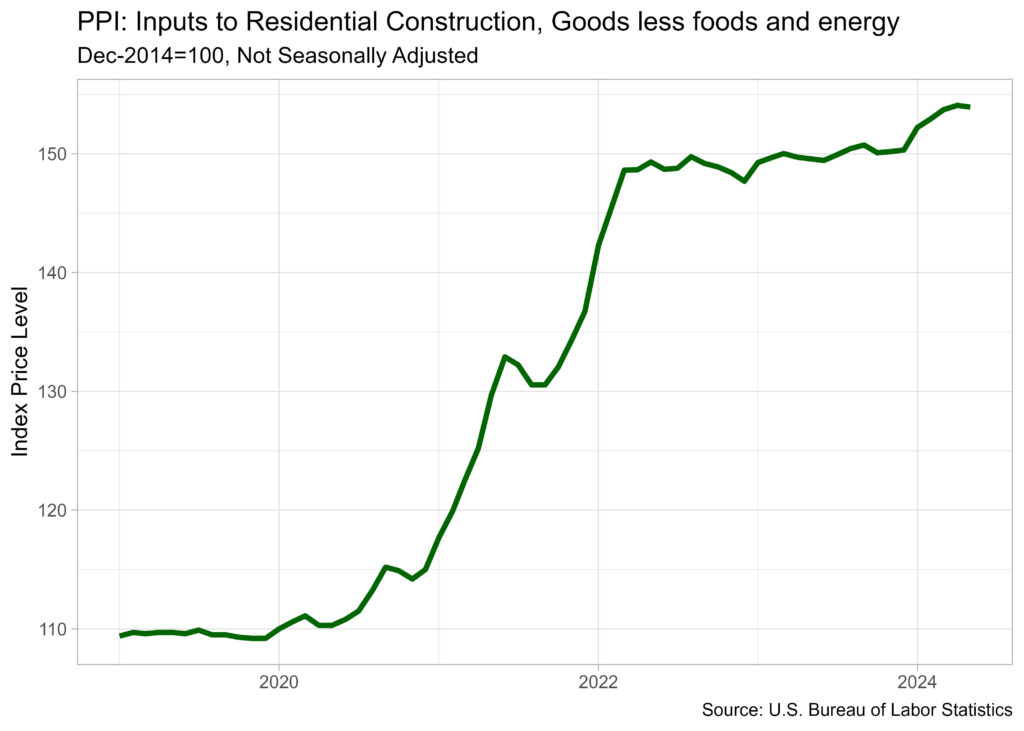

Inputs to residential building, items much less meals and power, fell 0.09% over the month in keeping with the latest producer value index (PPI) report printed by the U.S. Bureau of Labor Statistics. The index for inputs to residential building, items much less meals and power, represents constructing supplies utilized in residential building. This was the primary lower within the index since October of final 12 months. Whereas the index fell over the month, it was 2.91% larger than Could of final 12 months.

The seasonally adjusted PPI for remaining demand items decreased 0.78% in Could, after growing a revised 0.41% in April. This was the biggest lower within the index for remaining demand items since a 1.24% decline in October of final 12 months. In accordance with BLS, round 60% of the month-to-month decline in Could was as a consequence of a 7.11% drop within the index for gasoline. The PPI for remaining demand power and remaining demand meals each fell at 4.76% and 0.10% respectively. On the identical time, the PPI for remaining demand items, much less meals and power, rose 0.26%.

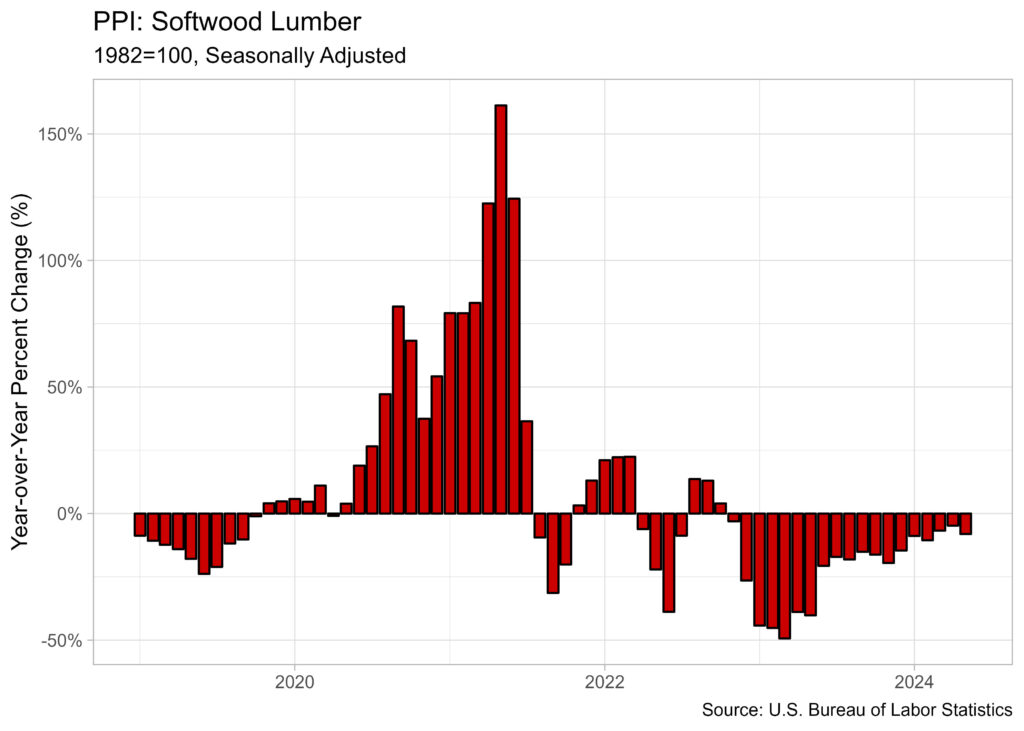

The seasonally adjusted PPI for softwood lumber fell for the primary time since February, down 5% over the month. Costs for softwood lumber stay decrease than final 12 months at 8.10% beneath Could of 2023. It was the 19th consecutive month the place the softwood lumber index was decrease than one 12 months in the past.

The non-seasonally adjusted particular commodity grouping PPI for copper rose 8.47% in Could after rising 3.44% in April. Over the 12 months, the index was up 17.14%. Given the worldwide targets of electrification, copper is a vital commodity for a lot of electrical items given its environment friendly conductivity properties. A current report from the Worldwide Power Company exhibits that copper mine provide ranges won’t meet future demand. Anticipated whole demand of copper is predicted to outpace future anticipated provide by 43.38% by 2040.

The non-seasonally adjusted PPI for gypsum constructing supplies was unchanged over the month however was up 2.09% over the 12 months. Value development for gypsum constructing supplies has slowed from the expansion we noticed in the course of the pandemic and has remained muted from in regards to the second half of 2022.

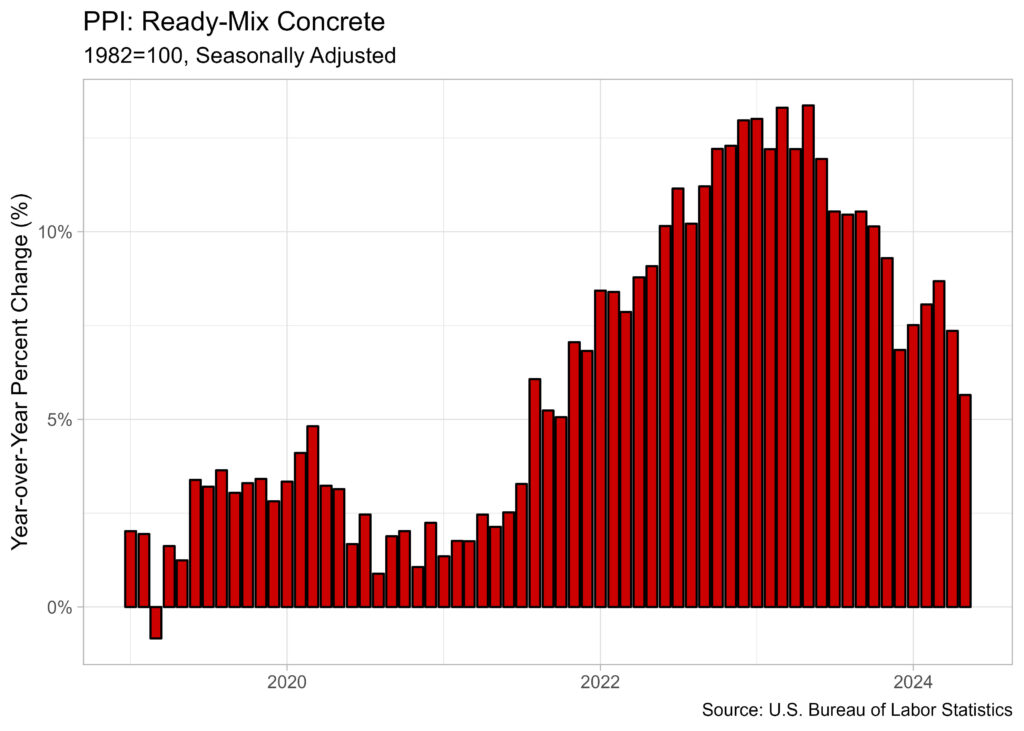

The seasonally adjusted PPI for ready-mix concrete fell for the second consecutive month, down 0.13% in Could after falling from 0.9% in April. Prepared-mix concrete stays effectively above final 12 months’s stage, up 5.65% since a 12 months in the past.

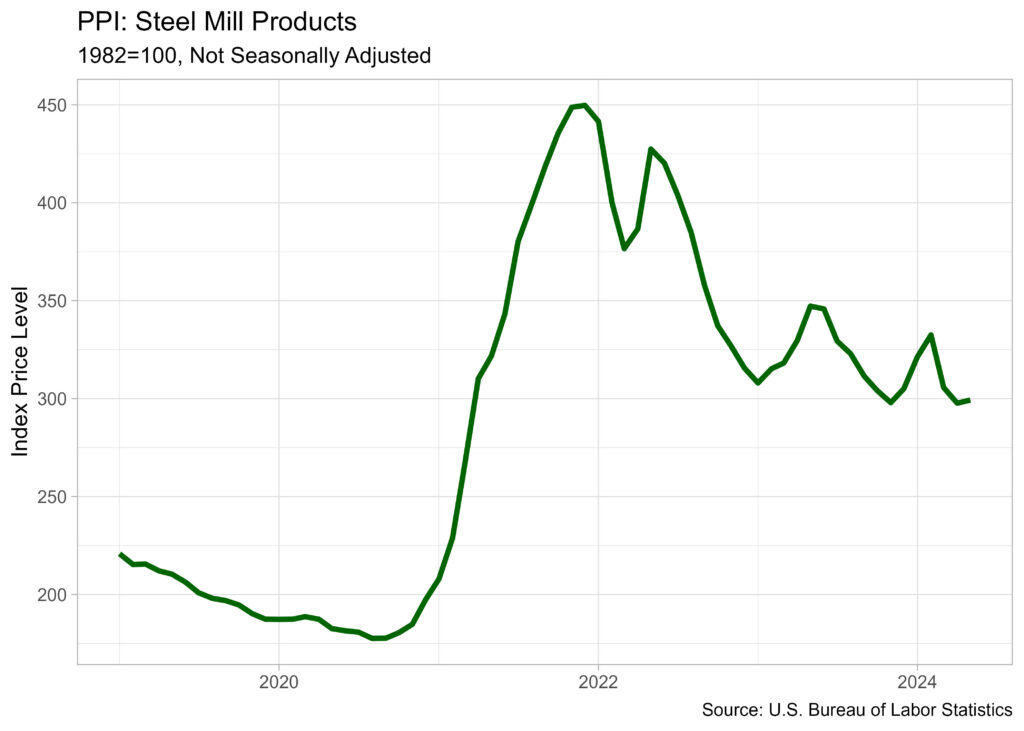

The non-seasonally adjusted PPI for metal mill merchandise rose 0.54% in Could after falling within the two earlier months. 12 months-over-year, metal mill product costs have been decrease than one 12 months in the past for the third straight month, down 13.81% from Could of final 12 months.

Uncover extra from Eye On Housing

Subscribe to get the most recent posts to your e mail.

[ad_2]