[ad_1]

In April 2023, the then governor of the Reserve Financial institution of Australia gave a speech to the Nationwide Press Membership in Sydney – Financial Coverage, Demand and Provide = the day after the RBA determined to finish (for a month) its charge hikes after climbing the earlier 10 conferences of the RBA Board, the physique that determines financial coverage settings. The inflation charge had been falling for some months by this time but the RBA was nonetheless hanging on to its narratives that the speed hikes have been essential to “fight the best charge of inflation skilled in Australia in additional than 30 years”, regardless of, for instance, the Financial institution of Japan holding charges fixed and experiencing a extra fast decline in its inflation charge as the availability constraints abated. The RBA had vehemently claimed that wage pressures have been mounting, which needed to be curtailed and denied categorically that there was any revenue gouging or margin push concerned within the inflationary pressures. There was no proof on the time to assist their claims about wages and nominal wages development has remained average since. Nonetheless, there was ample proof, each in Australia and throughout the globe that firms have been profiting from the availability constraints to push their revenue margins out. A latest report launched by Oxfam Australia report (June 19, 2024) – Cashing in on Disaster – demonstrates that revenue and worth gouging was instrumental in creating and sustaining the inflationary pressures. The RBA was in denial all alongside and demonstrated that they’re basically simply a part of the ideological equipment supporting neoliberalism and the extraction of better earnings on the expense of staff.

Throughout his April 2023 Speech, the then RBA boss claimed that:

When it comes to price-setting, the expertise differs throughout companies and industries. Nonetheless, on the mixture stage, the share of earnings in nationwide revenue – excluding the sources sector, the place costs are set in world markets – has not modified very a lot over latest instances … An inexpensive interpretation of that is that, whereas companies on common have been in a position to cross on greater prices and preserve revenue margins, inflation has not been pushed by ever-widening revenue margins.

Over the previous few years, the RBA has been working a concerted marketing campaign to push staff out of their jobs (aiming to extend unemployment by about 150,000) based mostly on their declare that the unemployment charge was beneath the NAIRU = though at varied instances they denied that they may really estimate a particular NAIRU.

They assume that in the event that they push charges up far sufficient then whole spending will crash and staff might be sacked.

They masks that by claiming they only need to battle inflation however they’ve been tripping up frequently as they disguise their agenda with nonsensical statements in regards to the NAIRU (for instance, in June 2023) and the dearth of a NAIRU (for instance, in November 2023).

The actual fact is that their charge hikes have achieved little to suppress inflation which was falling quickly anyway as a result of its sources have been in decline.

However the persistence of the inflation, which the RBA claimed was because of wage pressures has been extra to do with revenue push than something.

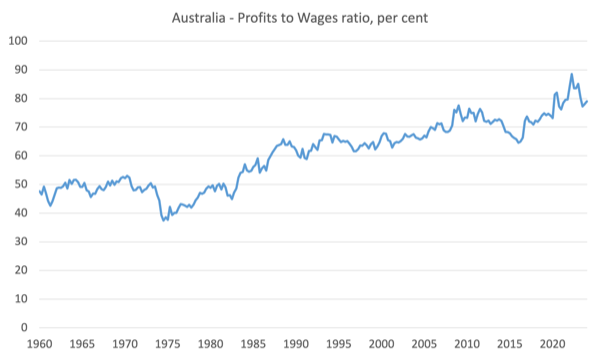

The next graph is calculated from the Nationwide Accounts Nationwide Earnings information and present the ratio of gross earnings to the compensation paid to staff from the March-quarter 1960 to the March-quarter 2024, expressed as a proportion.

Previous to the neoliberal period that ratio was regular at round 50 per cent.

However because the mid-1975, when the federal authorities deserted its dedication to sustaining full employment, the ratio has steadily risen and reached a peak of 88.5 per cent within the June-quarter 2022.

Within the interval, coinciding with the inflation construct up – successfully from the June-quarter 2021 to the December-quarter 2022 – the profit-to-wages ratio was largely rising and sharply.

The inflation began to abate not lengthy after the profit-to-wage ratio peaked after which fell.

From the March-quarter 2001, as much as the inflation peak, nominal wage funds grew by 15.8 per cent (over 7 quarters), whereas over the identical interval, gross earnings rose by 27 per cent.

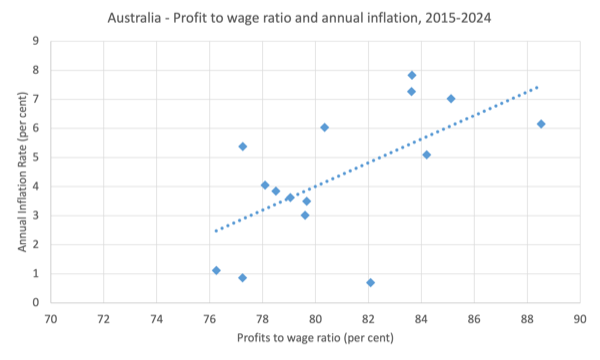

The subsequent graph exhibits the connection between the profit-to-wage ratio (horizontal axis) and the annual CPI inflation charge (vertical axis) because the March-quarter 2020.

The dotted line is a straightforward linear regression (which in statistical phrases may be very vital and tells us that for each 1 level rise within the profit-to-wage ratio, the inflation charge rises by about 0.4 factors).

A warning although: additional evaluation is all the time required earlier than the path of the impact proven in cross plots is known.

However the supporting proof would counsel that earnings push was an vital driver of the inflationary pressures.

At this time, responding to political stress that it’s letting the company world get together on the expense of the remainder of us, the Federal authorities introduced that was imposing a compulsory behaviour code on supermarkets, which is a extremely concentrated sector in Australia.

The present transfer is aiming to cease the oligopolist retailers from squeezing their suppliers in order that the grocery store homeowners could make greater earnings.

There are various examples now of how grocery store chains have punished wholesale suppliers who reject the calls for for worth and amount from the retailers.

There’s additionally an inquiry being achieved on client pricing by the supermarkets, which can report later within the yr and the federal government has now commenced a worth monitoring course of to additional put stress on the grocery store chains.

All of those modifications are minimal and can do little to vary the profit-gouging mentality that’s rife in Australian firms.

Simply how a lot profiteering has been happening was revealed in an Oxfam Australia report launched final week (June 19, 2024) – Cashing in on Disaster.

The findings of the Oxfam report demonstrates that revenue and worth gouging was instrumental in creating and sustaining the inflationary pressures.

The Oxfam Report did what the earlier RBA governor ought to have achieved in higher element:

… in contrast the 2021-2022 and 2022-2023 internet earnings of the highest 500 Australian firms with their common earnings made between 2017-2018 and 2020-2021.

They usually discovered:

… they raked in $98 billion in extra windfall earnings, or ‘disaster earnings’, that they wouldn’t have made beneath regular circumstances. Oxfam believes making billions throughout and off-the-back of overlapping crises is company profiteering. These earnings are a part of a wider crisis-fuelled inequality story, the place billionaires have been in a position to enhance their wealth and increase their financial institution balances whereas the remainder of us endured rising prices of dwelling.

Just about the alternative of the story the RBA has been feeding the Australian public because it tried to put the blame for the persistent inflation on wage earners.

The profiteering was most concentrated within the “mining, finance and grocery store and grocery sectors”.

The profiteering has additionally seen nationwide revenue redistributed to the wealthy on the expense of the lower-income households, which signifies that revenue and wealth inequality has risen.

Oxfam summarise this in additional lurid phrases on the world stage:

At present charges, we may have our first trillionaire in 10 years, but we’re 230 years away from eliminating poverty.

And for Australia:

In 2022-2023, the richest 10% of households held 44% of all wealth in Australia, whereas Australian billionaires have achieved significantly properly of late, rising their wealth by 70.5%, or $120 billion since 2020.1

Sadly, the Oxfam evaluation will get caught up of their perception that taxes on the wealthy will “increase the price range when disaster hits” and because of this a number of the validity of the evaluation is misplaced.

Tying motion on revenue gouging with serving to to take care of the “stretched” authorities “price range” is selling the type of narratives which have allowed the companies to flee an efficient regulatory construction.

We learn silly claims that by introducing a “disaster tax”:

This income may have contributed to the price of responding to the dual crises of the early 2020s and assuaging poverty It may have paid for the $47.9 billion in elevated prices to the healthcare system from COVID-19, the $20 billion coronavirus complement to revenue assist (which lifted three million folks out of poverty),19 and the $3 billion in power invoice reduction. It additionally may have doubled our support price range to round $9.8 billion for 2 years, and nonetheless left $7 billion for much-needed funding in social housing.

All of which may have been achieved merely by way of the present fiscal capability of the federal authorities.

If the actual sources have been accessible to perform these objectives then no extra taxes would have been mandatory.

I agree with Oxfam that the:

The system is damaged and requires pressing consideration to deal with the rising inequality. Along with sorely wanted reform of company competitors legal guidelines, a tax on the disaster earnings of firms could be a disincentive to cost gouging …

That’s justification sufficient for motion.

They need to depart the ‘repair the price range’ stuff out of it.

Whereas taxing these firms would cut back their political energy (lobbying and many others) it will even have the extra benefit of sustaining decrease inflation charges and undermine the central financial institution’s charge climbing obsession, which, by its personal, has redistributed nationwide revenue to the rich.

Take into consideration that.

The causality runs like this:

1. Firms with an excessive amount of market energy gouge earnings within the disaster.

2. The CPI will increase.

3. The central financial institution hikes charges, which redistributes nationwide revenue from low-income mortgage holders to high-income and/or wealth holders of monetary belongings.

4. Earnings rise even additional (particularly the banks).

That’s the system in place at current and it represents the anathema of something that an individual involved with social justice and equity would give you.

Conclusion

The general conclusion from Oxfam is legitimate although:

Between the COVID-19 pandemic and excessive inflation attributable to struggle and company profiteering, it was a tricky begin to the last decade for many. Even in comparatively rich international locations like Australia, hundreds of thousands of individuals have been pushed to the brink by rising costs of meals, power and unaffordable lease. In stark distinction, this has been a earnings bonanza for a few of Australia’s largest firms.

We’re a good distance from fixing that mess.

The journey has to start out with progressive organisations reminiscent of Oxfam rejecting the mainstream macroeconomic narratives in regards to the authorities being a family with monetary constraints.

That’s sufficient for right now!

(c) Copyright 2024 William Mitchell. All Rights Reserved.

[ad_2]