[ad_1]

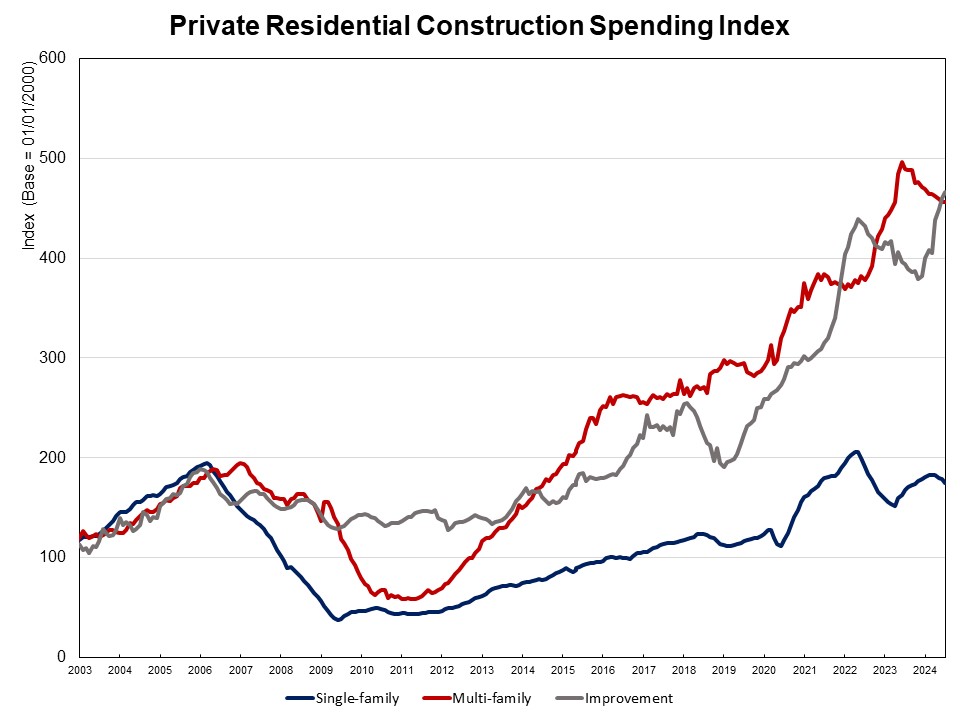

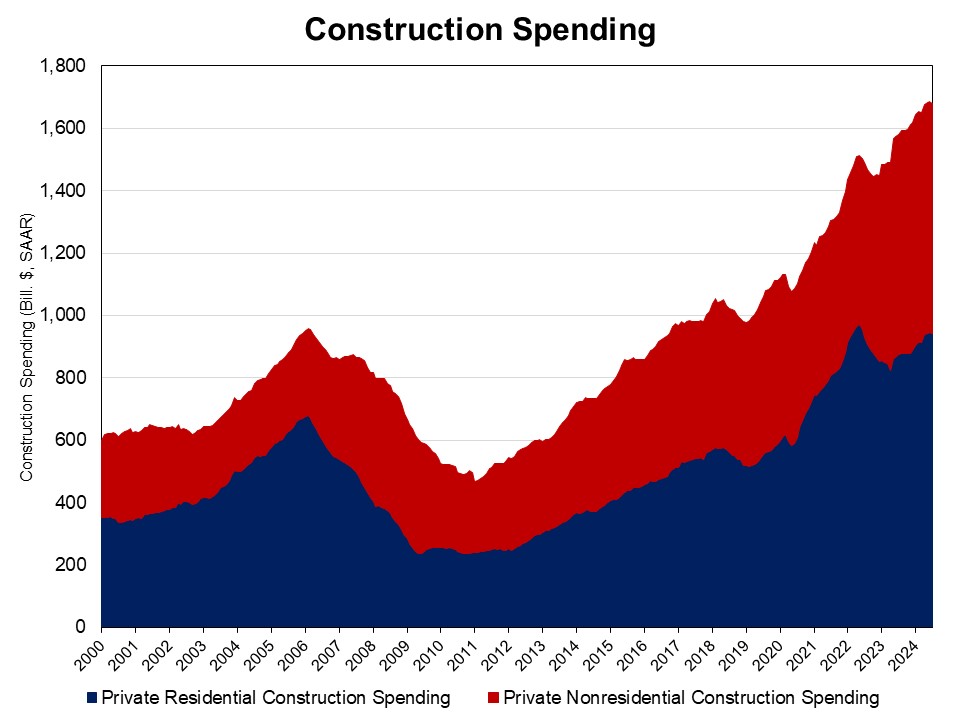

Personal residential development spending fell 0.4% in July, based on the Census Building Spending knowledge. Nonetheless, spending remained 7.7% increased in comparison with a 12 months in the past. The month-to-month decline in complete non-public development spending for July was largely on account of diminished spending on single-family development. Spending on single-family development plunged by 1.9% in July, following a dip of 1.1% in June. This marks the fourth consecutive month-to-month lower. Elevated mortgage rates of interest have cooled the housing market, dampening residence builder confidence and new residence begins. Regardless of these challenges, spending on single-family development was nonetheless 4% increased than it was a 12 months earlier.

Multifamily development spending stayed flat in July after a dip of 0.6% in June. Yr-over-year, spending on multifamily development declined 6.7%, as an elevated degree of residences underneath development is being accomplished. Personal residential enchancment spending elevated 1.2% in July and was 18.3% increased in comparison with a 12 months in the past.

The NAHB development spending index is proven within the graph under (the bottom is January 2000). The index illustrates how spending on single-family development has slowed down the tempo since early 2024 underneath the stress of elevated rates of interest. Multifamily development spending progress slowed down after the height in July 2023, whereas enchancment spending elevated its tempo since late 2023.

Spending on non-public nonresidential development was up 4.5% over a 12 months in the past. The annual non-public nonresidential spending enhance was primarily on account of increased spending for the category of producing ($39.7 billion), adopted by the ability class ($1 billion).

Uncover extra from Eye On Housing

Subscribe to get the most recent posts despatched to your e-mail.

[ad_2]