[ad_1]

A fast break from guide authorship to share an enchanting set of knowledge and charts, by way of Sam Ro. In his weekly missive, Sam factors to some superb charts from International Monetary Information. They’re primarily based on historic information that appears at 200 Years of Market Focus.

You is perhaps stunned on the findings.

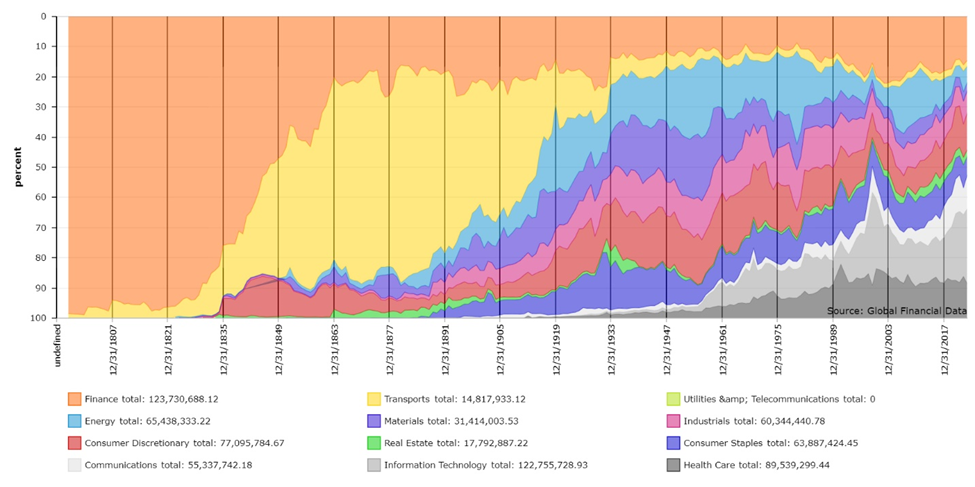

Because the chart above exhibits, shares expertise lengthy intervals of time the place market focus is excessive. These mirror the financial dominance of 1 particular a part of the financial system or one other for a really lengthy stretch. Dr. Bryan Taylor, Chief Economist at International Monetary Information, breaks these into seven distinct eras over the previous 235 years:

1790 to 1840 The Financial institution of america Dominates

1840 to 1875 The Rise of the Railroads

1875 to 1929 The American Business Revolution

1929 to 1964 The First Magnificent Seven

1964 to 1993 Free Commerce Results in International Enlargement

1993 to 2014 The Rise of Fall of the Inventory Market

2014 to Current Know-how Shares Take Over

You may quibble with the exact beginning factors, however the concept may be very stable: Main shifts in underlying financial progress engines will result in a distinct group of shares dominating the indices.

I recommend you go learn your complete piece, right here.

Spoiler alert: “Evaluation of the previous 150 years, there appears no purpose to imagine that the elevated focus of the previous ten years is the harbinger of a significant bear market. Elevated focus is an indication of a bull market and bear markets cut back focus.”

Sources:

200 Years of Market Focus

Bryan Taylor,

International Monetary Information Might 22, 2024

The underside line is trying up for shares

Sam Ro,

TKer, June 16, 2024

[ad_2]