[ad_1]

Are you tempted to consider that there are magical options to your monetary issues?

The extra overwhelmed you might be by your monetary state of affairs, or the extra you evaluate your self to others and end up missing, the extra doubtless you might be to consider that there exist suggestions and tips that, have been you solely to know them!, would completely enhance—possibly even vastly!—your monetary state of affairs.

The temptation of such magic is one cause you may rent a monetary planner…or obsessively watch social media personal-finance grifters.

There Is No Magic in Private Finance.

Dick Wagner, a long-time monetary advisor and big affect on the career, is credited with saying (paraphrased) that these are the keys to success in private finance:

- Spend lower than you make.

- Save as a lot as you may.

- Don’t do something silly.

Snore. Sooooo not magical. However true. Oh, how true.

Following these guidelines will get you approach approach approach additional along with your funds than spending any time searching for magical options.

You possibly can achieve your funds with none magic. You can not succeed in case you ignore these three guidelines (or, extra precisely, in case you succeed, it’ll be from luck, not effort or ability).

Besides…It Form of Feels Like There Is?

All that stated, there are methods and techniques which have at all times felt kinda magical to me. Once I queried fellow monetary planners, I obtained a bunch extra concepts.

After all, not one of the “magic” I relate under can evaluate to what feels just like the actual magic of realizing (or serving to somebody understand) you could begin utilizing your cash to develop and stay a life that’s actually fulfilling and significant. However that’s a bit too woo-woo for this explicit weblog publish.

I needed to share a few of these methods and techniques with you as a result of they’re, not less than in my skilled opinion, enjoyable and even generally thrilling to implement. Typically they could even really feel like (authorized) dishonest.

Once we planners first talk about these concepts with our purchasers, their eyes typically bug out, or they sputter one thing about “What? That’s allowed?!”

Sure. These are all authentic, and even widespread (amongst skilled monetary planners), methods to enhance your monetary state of affairs. Take into account that I’m not writing a How To guide right here. In case you are intrigued, please go study extra of the main points or work with an excellent planner or CPA to truly implement.

Finally, there is no such thing as a magic. Simply an unusually deep understanding of how the tax code works.

Automating Duties You Know You Ought to Do (The Final “Nudge”)

One of many greatest, most over-arching items of magic you may create for your self in your funds is the magic of automation.

Automate paying off your bank cards each month. Automate paying additional in your mortgage each month. Automate donating to charity. Automate saving to your 401(ok) or IRA or taxable funding account or Emergency Fund.

There’s an excellent cause that the phrase “automagic” exists. [If you are interested by the idea of how to effectively “trick” yourself (or others) into doing the right thing, check out the book Nudge. I read the first edition through and was fascinated. The updated edition, I abandoned half-way through, but perhaps because I’d already read most of it.]

The magic: You are taking just some minutes to arrange some automation. Then you definately overlook about it. Tune in a yr later and WOW, The place did all that cash come from?! How did my debt get so low?! How did I assist my favourite causes a lot?!

Donating to Charity with Additional Tax Advantages or Comfort

There’s a lot magic on the subject of donating to charity (above and past the true magic of serving to individuals and causes who need to be helped).

Donate Inventory As an alternative of Money and “Double” the Tax Profit

The best option to donate cash is to easily put it in your bank card, or different types of money donation. You could or might not get tax advantages from donating that approach. That’s okay. The primary level of donating cash is to assist causes you care about, not tax financial savings, in any case.

You’re going to get a tax profit solely in case you itemize your deductions (as a substitute of claiming the usual deduction, which, ever because the Tax Cuts and Jobs Act handed in 2017, isn’t very doubtless).

When you don’t itemize, you get no tax advantages.

Enter donating inventory. (Extra precisely, donating “appreciated securities,” i.e., investments owned in a taxable account which have grown in worth since you purchased them. “Inventory” is just the best and commonest instance, so I’ll use that.)

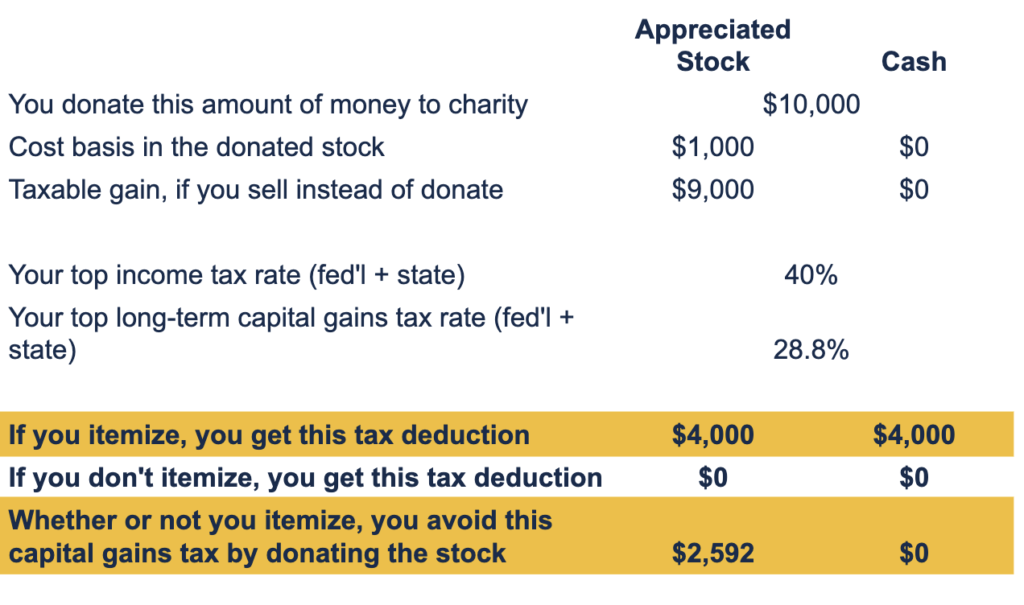

Let’s say you personal 1000 shares of a inventory. You acquire it for $1/share (you spent $1000 to buy it; that is your “value foundation”) years in the past. Now it’s price $10/share ($10,000 altogether). That’s a $9 acquire per share. When you have been to promote it, you’d pay taxes on that $9 acquire.

Now let’s say you donate $10,000 to a charity. When you have been to donate $10,000 in money, you get tax advantages provided that you itemize your deductions. When you itemize, additionally, you will get these tax advantages from donating $10,000 price of inventory.

By donating inventory, you’ll additionally get a second tax profit: You don’t need to pay taxes on the $9000 of positive factors in that $10,000 of inventory worth. The charity nonetheless receives $10,000 of cash (they by no means owe taxes), you may itemize, and also you undoubtedly keep away from the taxes on the acquire. Growth!

If it’s your organization inventory, you’re doubtless searching for methods to have much less of it, with out incurring an enormous tax invoice. It is a nice technique for doing that!

Or, if it’s a inventory you really need to personal, you may nonetheless profit! Let’s say you donate $10,000 of the fascinating inventory. You get all of the above tax advantages. Then you should use the $10,000 of money you’d have in any other case donated to re-buy the inventory.

Now, as a substitute of getting a price foundation of $1000 (which means you’ll pay taxes on any acquire above $1000 once you finally promote), you’ll have a price foundation of $10,000 (which means that you simply’ll pay taxes solely on any acquire above $10,000).

I began incorporating this “re-buy the inventory” tactic into my very own charitable giving technique final yr. (I’m taking a multi-year strategy to constructing out a sturdy charitable giving technique. It’s been very gratifying!)

The magic: You possibly can decrease your present tax invoice in two other ways, not only one, and it could decrease danger in your portfolio and/or decrease the tax invoice in your investments sooner or later!

Utilizing a Donor-Suggested Fund

When you’re within the tech business, you doubtless already learn about Donor Suggested Funds. They’re sexaaaaay.

I used to poo poo DAFs far more than I do now. Now I feel they are often fairly fantastic (I opened one for myself and my husband in 2022 as a step within the evolution of our formal charitable giving plan), although they aren’t panaceas and a few DAFs are approach higher than others.

There are two important promoting level, in my world, for DAFs:

- You possibly can separate the tax-saving occasion (donating cash to the DAF) from the philanthropic occasion (getting the cash to a charity of your selection). You possibly can donate to a DAF in a single yr and spend years determining the place to direct the cash, in reality.

This separation of tax occasion from philanthropic occasion is especially helpful when you’ve windfalls like IPOs, the place, for one or two years, your earnings (and subsequently your tax charge) is unusually excessive. It’s nice to get a tax write-off (from donating to a DAF) in excessive tax-rate years! You possibly can “rush” that donation with out dashing the selection of charities.

For instance, let’s say your organization goes IPO in 2024. You could have an enormous earnings in 2024 and likewise in 2025 as a result of plenty of RSUs vest in annually. You make a DAF contribution in 2024 to get the tax write-off at your 37% (highest potential) federal earnings tax charge. However you don’t distribute cash out of your DAF to charities till 2027, after which once more in 2030, and once more in 2045.

- It eases the executive burden of donating inventory as a substitute of money. Donating inventory is normally extra cumbersome than donating money. When you use a DAF, you may donate inventory solely as soon as (to the DAF) after which simply distribute money to the ten charities you care about, as a substitute of making an attempt to donate inventory individually to every of 10 charities.

The magic: Your charitable donation might be So A lot Simpler whereas nonetheless maximizing the tax advantages.

Donating to Charity Immediately from Your IRA (If You’re Older)

When you learn my weblog, you’re doubtless not in your 70s (wassup, Mother and Dad!). So, you gained’t personally want this info for a very long time. However possibly you may cross it on to your mother and father?

You in all probability have a standard IRA (versus a Roth IRA). Below present legislation, when you attain age 75, you’ll be required to take cash out of it yearly. That is referred to as your Required Minimal Distribution (RMD).

Not solely will it’s a must to pay earnings tax on this cash, it is going to drive up your complete earnings quantity, which in flip can drive up your Medicare Half B premiums and the quantity of your Social Safety earnings topic to earnings tax. Which makes for a fair increased efficient tax charge on all of your earnings. (There are doubtless different oblique prices. I don’t specialize.)

In case you are already donating cash to charity, as a substitute of donating money out of your checking account, or possibly even as a substitute of donating appreciated securities, you may donate your RMD on to a charity. That is referred to as a Certified Charitable Distribution (QCD). (A CPA or retirement-focused planner ought to have the ability to decide which methodology of donating will prevent more cash general.)

Donating your RMD by way of QCD (whee! acronyms!) implies that the RMD cash does not depend as a part of your earnings. So, not solely do you not need to pay earnings tax on the cash that comes out of your IRA, it additionally not directly saves you cash by decreasing your Medicare Half B premium and reducing the quantity of your Social Safety earnings topic to earnings tax.

The magic: By donating cash instantly out of your IRA, you not solely remove taxes on that donated cash, however it could decrease your tax charge on a number of different sources of earnings.

Contributing to a Roth Account, With a Excessive Revenue and In Giant Quantities

Listed below are two strict guidelines about contributing to a Roth IRA:

- You possibly can solely contribute to a Roth IRA in case you make beneath $153k/yr (single) or $228k/yr (joint).

- You possibly can solely contribute $7000/yr ($8000 in case you’re 50 or older). Reference

Besides, after all, when you may legally break these guidelines.

Roth 401(ok) Contributions

The best answer right here is to have a 401(ok) that means that you can contribute to a Roth account not simply to a pre-tax account. Although there are earnings limits on eligibility to contribute to a Roth IRA, no such limits exist for Roth 401(ok)s. Make $400k/yr? You possibly can nonetheless make Roth contributions to your 401(ok) (assuming your plan permits it, and I’ve by no means seen a plan within the tech business that doesn’t enable it).

The magic: Revenue restrict on contributions? Ha!

“Backdoor” Roth Contributions

However you may even nonetheless contribute to a Roth IRA in case your earnings is simply too excessive! It’s referred to as a backdoor Roth IRA contribution. The TLDR is:

- You make a contribution to your conventional IRA

- You don’t take a tax deduction for that cash (making it after-tax cash)

- Then you definately convert that cash out of your conventional IRA to your Roth IRA.

- The sticky wicket right here is you could’t have every other pre-tax cash in your conventional IRA. Oh, and likewise, the requisite tax kind submitting.

The magic: Revenue restrict on contributions? (Smaller) Ha!

“Mega” Backdoor Roth Contributions

When you’re fortunate sufficient to have a 401(ok) that gives after-tax contributions (and moreover fortunate to have the ability to save even extra than the $23,000 you may contribute pre-tax or Roth), then you can also make a “mega” backdoor Roth contribution.

Once I first wrote this weblog publish about after-tax contributions in 2018, they have been a uncommon and exquisite creature. Since then, it looks like each main tech firm has began providing them. And it’s nice.

With mega backdoor Roth contributions, a complete of $69,000 might be put into your 401(ok) in 2024, between your payroll deferrals (that $23,000), firm match, different firm contributions (uncommon, in my expertise), and your after-tax contributions. $69,000 is a sight bigger than the $23,000 we normally take into consideration!

The magic: So. A lot. Cash. that’s endlessly extra tax-free.

Tangential: Discovering “Foundation” in a Conventional IRA

Any contributions to a standard IRA for which you haven’t gotten a tax deduction are thought-about “foundation” in that IRA. This will help you in two methods:

- When you roll the cash right into a Roth account, it gained’t be taxed.

- When you withdraw the cash from the normal IRA, it gained’t be taxed.

(Be aware that that is difficult by the truth that you may’t withdraw or rollover solely the after-tax {dollars}, leaving the pre-tax {dollars} behind. It’s at all times pro-rated throughout your complete IRA steadiness.)

The kicker, although, is that many individuals have foundation of their conventional IRAs with out realizing it. As one planner reported, she loves the “magic” of taking a look at a couple of years of a consumer’s tax return and “discovering” foundation within the IRA (non-deductible contributions must be recorded in a tax return), which is able to assist decrease the consumer’s tax invoice sooner or later. Usually this foundation comes as a whole, and joyful, shock to the consumer!

The magic: Oooh! Shock tax-free cash!

Getting Free or Low Value Well being Insurance coverage

Having simply gone by way of open enrollment on the ACA market and having the consideration of paying over $20k/yr in premiums for a high-deductible (actually excessive deductible) plan for my household of 4, the thought of “free or low-cost medical health insurance” will get my consideration…and makes me need to cry.

(Aspect notice: “Inexpensive Care Act,” my butt.)

Throughout Low-Revenue Years (Sabbatical, Laid Off, Beginning a Enterprise)

There are a lot of causes, some good some unhealthy, why your family earnings may plummet in a selected yr. A few of our purchasers have taken sabbaticals. Some have been laid off and brought some time to return to a job. Some have began a enterprise (and brought a couple of years to ramp up their earnings).

When you don’t have one other supply of medical health insurance (a accomplice’s medical health insurance, COBRA), then the “magic” right here is Medicaid. Critically.

Medicaid is a state-specific program, so I can’t personally attest to experiences in something aside from Washington state. However many states help you use Medicaid in case your earnings is low sufficient, utterly ignoring wealth.

Once I began Circulate, and my husband stop his job to turn into the stay-at-home father or mother, our family earnings dropped to $0, and we misplaced his employer medical health insurance. I attempted to enroll in an ACA plan in Washington. The system led me inexorably to Apple Well being (Washington’s Medicaid) and enrolled me there.

It was maybe one of the best medical health insurance expertise I’d ever had. Free. Didn’t have to vary docs. And except for the state’s web site (which…ugh), was administratively really easy.

If you end up with no medical health insurance and no or low earnings, take a look at your state Medicaid program.

The magic: Straight up free medical health insurance and healthcare that, in case you’re fortunate like I used to be, can also be administratively (comparatively) straightforward. Virtually as if we’re not dwelling within the USA!

Inexpensive Care Act Market Premium Tax Credit

Even in case you make an excessive amount of cash for Medicaid, you may nonetheless get “premium tax credit” for the plan you buy within the ACA market.

For instance, in my case, we moved off of Medicaid inside two years, however have been paying just a few hundred {dollars} monthly for insurance coverage for 4 for some time, because of the premium credit we obtained.

One colleague reported getting a married couple he labored with a $20,000 tax credit score, by managing their sources of earnings and likewise, after all, letting them know this was even a factor they may get.

The magic: Medical health insurance premiums which can be low sufficient to really feel humane.

If You’re Keen to Kill Off Your Dad and mom. (I Jest!)

You have to know two issues with the intention to respect this technique:

- What value foundation is, and the way it impacts your taxes. As already mentioned above, once you purchase a inventory, the worth you buy it at is the price foundation. If you promote that inventory, in a daily ol’ taxable funding account, and it has gained worth (i.e., it’s price greater than the price foundation), you’ll owe capital positive factors tax on that acquire.

- If you die, your taxable investments, like that inventory, get a “step up in foundation,” which means that the price foundation is ready to regardless of the present worth of the inventory is. Which implies that whoever inherits that inventory can promote it ASAP and pay $0 in taxes, as a result of the price foundation is similar as the present worth and there’s no taxable acquire.

So! What magic can we get if we mix these two info?

- You personal a extremely appreciated funding, (i.e., it has gained in worth so much because you acquired it, and promoting it could set off a giant tax invoice). Let’s say it’s shares of inventory.

- You give (as in, a legally binding present) this inventory to your (aged) mother and father. They now personal this inventory outright. You don’t have any extra declare or management over it.

- You await them to die. You really want them to attend not less than 12 months, however ideally not all that for much longer.

- After they die, they go away that inventory to you. The inventory will get a step-up in foundation upon their loss of life, making their value foundation equal to the present worth.

- You personal the inventory as soon as once more, however with no taxable acquire this time. You may promote the inventory and pay no taxes!

Please notice: There are significant dangers and complexities to such an association. I’m simply touching the floor. Additionally notice that it doesn’t need to be your mother and father; it may be just about anybody you belief sufficient to go away the funding to you after they die.

The magic: You remove the taxable acquire on investments you personal.

Promoting RSU Shares with Little to No Tax Influence

There’s mighty confusion about how Restricted Inventory Models work, particularly the tax influence. When your RSUs vest, it’s the vesting that creates a tax occasion for you. If $10,000 price of RSUs vest, you owe abnormal earnings tax on $10,000, simply as in case you’d gotten a $10,000 money bonus or if that was only a common wage paycheck.

The knock-on impact of that is that in case you promote your RSUs instantly after they vest, you’ll owe little to no taxes on that sale. Why? As a result of once you pay taxes on that $10,000, your value foundation in these shares of inventory is ready at $10,000. When you then promote the shares for $10,000, there is no such thing as a acquire above the price foundation, and subsequently no tax is owed.

Usually, you may’t promote the RSU shares instantly after they vest. You might need to attend a couple of days or even weeks, by which period, the inventory value has doubtless modified. If the worth has gone down, you may promote the shares and never owe any taxes. If the worth has gone up, then you definitely’ll owe taxes on the acquire from the worth at which it vested, however most probably the acquire continues to be fairly small, and subsequently the tax influence shall be small.

Individuals who get RSUs typically don’t understand how small the tax influence is when promoting shares from RSUs. You don’t have to attend a yr after the RSUs vest! This typically leads of us to unnecessarily holding onto the inventory approach longer than they need to, constructing a dangerous, massive pile of their firm inventory.

The magic: Scale back danger in your portfolio and get more cash to both stay your present life or make investments in the direction of your future life…all with little to no tax invoice!

Utilizing Your Investments to Purchase Stuff, With out Having to Promote Something

A considerably morbid time period for this technique is “Purchase, Borrow, Die.” This moniker reveals that it’s typically higher suited to older of us who’ve an excellent cause to count on to die in not too a few years. (Is it potential to debate such methods with out feeling like a ghoul? ‘Trigger I kinda am proper now.)

Be aware, although, that we now have helped a number of purchasers of their 30s and 40s use it moderately and efficiently.

Let’s say you need to purchase a house and wish a giant down cost. You could have the cash in a taxable funding account. So, you might promote the investments and use that money to purchase your property. However in case you promote these investments, you’ll:

- Need to pay taxes on the positive factors

- Now not give that cash an opportunity to develop within the inventory market

As an alternative, you may borrow in opposition to that portfolio, taking out what is named a “securities-backed mortgage.” Your funding account serves because the collateral for the mortgage.

Now you’ve purchased obtained your down cost (or purchased one thing else) and likewise:

- Averted capital positive factors taxes

- Allowed your portfolio to proceed to develop (hopefully) out there

After all, this tactic isn’t free. It’s important to pay curiosity on the mortgage, and that rate of interest is variable. In low-interest-rate environments (ahhh, 2020), this can be a inexpensive strategy, and in high-interest charge environments (boo, 2022!), this can be a dearer strategy.

There are two main, direct dangers of a securities-backed mortgage:

- The rate of interest might rise so much earlier than you’re capable of pay it off. In case your rate of interest rises to, say, 10%, it’s exhausting to argue that you could possibly be incomes more cash by leaving your cash invested and taking out the mortgage.

- The worth of your portfolio might fall. This might not solely make you want you’d merely bought the investments after they have been price extra, however the financial institution that has made the mortgage may power you to repay a part of the mortgage. The mortgage can turn into too massive a share of the account worth, and the financial institution requires that you simply scale back that share. This might doubtless power you to promote your investments on the completely mistaken time out there (i.e., “low,” not “excessive”).

How do you pay again this mortgage? Nicely, a typical approach is to die. (Easy!) These investments get a step-up in foundation (talked about above), your property can promote them with out owing taxes, and it could pay again the mortgage. That is the “Purchase, Borrow, Die.”

Our purchasers aren’t that previous. So “Die” would come as a whole shock to our purchasers. For our purchasers, they generally pay it off from ongoing earnings (they earn excess of they spend and so have extra cash every month or every quarter).

They could additionally expect a windfall within the close to future. An IPO, an inheritance, or the sale of a house, for instance. Let’s say you need to purchase a brand new residence, however you continue to personal your first residence. You possibly can take a securities-backed mortgage as a “bridge mortgage,” to bridge the time from shopping for your second residence till you promote your first residence. If you promote your first residence, you may repay the securities-backed mortgage.

You might need heard of The Wealthy doing this type of factor, and it’s, in reality, obtainable to Regular Individuals!

The magic: Keep away from taxes in your investments and let these investments develop…whereas nonetheless utilizing that self-same cash to pay on your life.

“HSAs, simply generally”

This was maybe my favourite response from a colleague (monetary planner Michael Golosovker). Everyone seems to be entering into some nerdy degree of element about their magical answer. And he simply says, “HSAs, simply generally.” Ha!

However he’s proper: the concept that we are able to get a tax deduction now, make investments the cash so it could develop, tax free, after which we are able to take it out tax free sooner or later, after it’s grown…a “triple-tax benefit.” Seems like magic!

The magic: No taxes. Ever.

My colleagues had extra strategies of “magical” monetary planning. I needed to lower it off someplace. As you maybe seen, nearly the entire magic I checklist above has to do with benefiting from the tax code. Which is why (oooh, let me get out my drum so I can beat it once more) working with a tax-aware monetary planner and undoubtedly an excellent CPA might be so rattling useful, if not outright vital, in as we speak’s (stupidly) difficult monetary panorama.

In order for you a pondering accomplice to determine which of those techniques is perhaps worthwhile on your state of affairs, attain out and schedule a free session or ship us an e-mail.

Join Circulate’s twice-monthly weblog e-mail to remain on prime of our weblog posts and movies.

Disclaimer: This text is offered for academic, basic info, and illustration functions solely. Nothing contained within the materials constitutes tax recommendation, a suggestion for buy or sale of any safety, or funding advisory companies. We encourage you to seek the advice of a monetary planner, accountant, and/or authorized counsel for recommendation particular to your state of affairs. Replica of this materials is prohibited with out written permission from Circulate Monetary Planning, LLC, and all rights are reserved. Learn the total Disclaimer.

[ad_2]