[ad_1]

Chainlink (LINK) has surged over 10% prior to now few hours, pushing its worth to $11.39 on the time of writing. This vital achieve comes after two weeks of sideways consolidation, signaling a possible shift in momentum.

Associated Studying

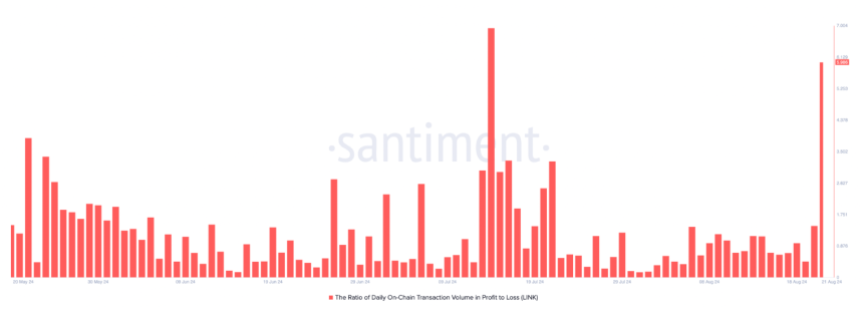

As LINK rallies, knowledge from Santiment, a number one crypto knowledge intelligence platform, reveals that some day by day merchants are already taking income, capitalizing on the current worth improve.

This profit-taking exercise highlights buyers’ cautious optimism as LINK’s worth good points momentum and reaches technical resistance within the 4-hour timeframe.

LINK’s On-Chain Transaction Quantity Displaying Revenue-Taking

LINK’s day by day profit-to-loss transaction quantity has reached its highest degree since July 14, with the ratio at 5.986. This implies there are practically six transactions in revenue for each transaction in loss, signaling that short-term holders are actively taking income following the current transfer up. Such a excessive ratio signifies that buyers are capitalizing on a major worth improve or aid rally, locking in good points because the market assessments key ranges.

This profit-taking pattern reveals the dynamics prevailing amongst merchants, whilst LINK’s worth continues to achieve momentum available in the market. With the token testing native provide across the $11.40 mark, the market sentiment is one among cautious anticipation. Merchants are keenly conscious of the fragile steadiness between additional good points and potential pullbacks.

Traders will look ahead to indicators of a sustained breakout or a possible reversal as LINK approaches this threshold. The result at this degree may set the tone for LINK’s worth motion within the coming days, making it a important juncture for merchants and buyers alike.

Technical Particulars: LINK Value In Vital Stage

LINK is buying and selling at $11.31 after breaking an area excessive of $10.83 set on August 8, confirming an uptrend on the day by day timeframe. The worth rally paused at $11.40, proper on the 4-hour (4H) 200 exponential transferring common (EMA), underscoring the importance of this technical indicator in decrease time frames.

This indicator acts as a dynamic help or resistance degree, usually indicating the pattern in decrease time frames. For LINK, reclaiming this degree is essential to substantiate bullish momentum.

For LINK Bulls to take care of momentum, the subsequent essential step is to retake the 4H 200 EMA and intention for $13. Conversely, if LINK fails to consolidate above this indicator, it may result in a retest of the earlier resistance at $10.83 and doubtlessly a dip to the upper low round $9.90.

Associated Studying

Regardless of some day merchants locking in income, this exercise needs to be seen as an indication of wholesome profit-taking after a modest rally. The present worth motion displays a market in consolidation, with merchants intently expecting the subsequent transfer. As LINK hovers close to important ranges, the approaching days will probably be pivotal in figuring out whether or not the uptrend continues or if a pullback is on the horizon.

Cowl picture from Dall-E, Charts from Tradingview

[ad_2]