[ad_1]

I’ve simply completed studying a report from the Inhabitants Technique Council (PSC) of Japan – 令和6年・地方自治体「持続可能性」分析レポート (2024 Native authorities “sustainability” evaluation report) – that was launched final week April 24, 2024). The examine discovered that round 40 per cent of the cities (municipalities) in Japan will probably disappear as a result of their populations are in fast decline on account of extraordinarily low start charges. The shrinking Japanese inhabitants and the way in which through which native authorities areas are being challenged by main inhabitants outflows (to Tokyo for instance) mixed with very low start charges makes for a fantastic case examine for analysis. There are such a lot of points that come up and lots of of which problem the mainstream economics narrative regarding fiscal and financial impacts of accelerating dependency ratios on authorities solvency. From my perspective, Japan gives us with a very good instance of how degrowth, if managed appropriately may be achieved with low adjustment prices. The state of affairs will definitely preserve me for the years to return.

The PSC is a personal sector analysis physique and outlined the danger of disappearing as being if the inhabitants of girls aged between 20 and 39 years would fall by 50 per cent between 2020 and 2050.

The work was a decade-update on a examine launched by the Japan Coverage Council in 2014.

That organisation now not exists and its work has been changed by the PSC.

In 2014, the JPC thought of 896 native municipalities would disappear.

The newest examine concluded that out of 1,729 native areas examined (translated from unique):

… there are 744 native governments the place the speed of decline within the younger feminine inhabitants, assuming migration, can be 50% or extra between 2020 and 2050 (native governments prone to disappear). This can be a slight enchancment in comparison with 896 native governments in 2014 … Of those, if we exclude municipalities in Fukushima Prefecture, which weren’t included within the earlier survey, the entire quantity is 711. This time, 239 native governments escaped the standing of native governments prone to extinction. Of the 744 native governments, 99 (together with 33 native governments in Fukushima Prefecture) had been newly labeled as native governments, that are nonetheless prone to extinction each final time and this time, however the decline fee of younger feminine inhabitants has improved.

They cautioned although that whereas there had been some enchancment, the start fee in Japan has not modified a lot – falling barely.

The advance they recognized has come from the truth that there at the moment are extra foreigners dwelling and dealing in Japan that there have been in 2014.

The analysis relies on projections offered by the – Nationwide Institute of Inhabitants and Social Safety Analysis – which is a authorities physique underneath the oversight of the Ministry of Well being, Labour and Welfare and features “to gather correct and detailed information relating to the present state of the Japanese inhabitants and its fertility fee and to provide extremely correct estimations of future developments based mostly on cautious scientific analyses perforated on that information.”

Their most up-to-date projections from 2021 to 2070 – Inhabitants Projections for Japan (2021-2070): Abstract of Outcomes – additionally offered long-range projections from 2071 to 2120.

They estimate that in June 2023, the “variety of overseas residents in Japan reached an all-time excessive of three.22 million … and complete measures for acceptance and coexistence of overseas nationals are being applied.”

So the notion that Japan is “closed to foreigners” is “present process main adjustments”.

The PSC examine additionally provided concepts on what measures native space authorities may take to redress the numerous inhabitants shrinkage of their localities.

After the 2014 Report, native governments turned their consideration to scale back the web migration outflow – each to Tokyo (as a serious attractor) and neighbouring areas.

The Report stated:

Such zero-sum game-like efforts don’t essentially result in a rise in birthrates, and their effectiveness in altering the general development of inhabitants decline in Japan is restricted.

So, relatively than competing with one another for inhabitants, the Report is evident that the chronically low start fee in Japan should be addressed if the speed of extinction amongst municipalities is to be reversed.

Additionally they discovered that small municipalities had been in danger as a result of each demographic elements had been in operation – outflow and low start charges, whereas the bigger centres had been attractors for outflow from smaller areas however had been nonetheless in danger due to the low start charges.

The spatial distribution of the danger throughout the areas can be attention-grabbing.

In Hokkaido, “there are 117 native governments which might be prone to disappearing” and many of the native authorities areas on the island have been experiencing “extreme inhabitants outflows” – primarily to the southern islands (notably Honshu).

Nevertheless, within the north of Honshu – Tohoku – has 165 municipalities prone to extinction – which is the “highest quantity and share within the nation, and nearly all of native governments require each social attrition and pure attrition measures” – that’s to stem the outflow and raise the start fee.

Within the Kanto area – centred on Tokyo – the primary drawback is a low start fee which has created what the Report phrases “black gap municipalities” – those who depend on inhabitants inflows given their extraordinarily low start charges.

Down south, Kyushu and Okinawa have the least variety of in danger native authorities areas.

Most of the areas within the south have change into ‘self-reliant and sustainable’ that means they’ve been capable of raise the start fee considerably and stemmed the outflow of individuals to the north.

The inhabitants decline has occupied authorities officers in Japan for a very long time now.

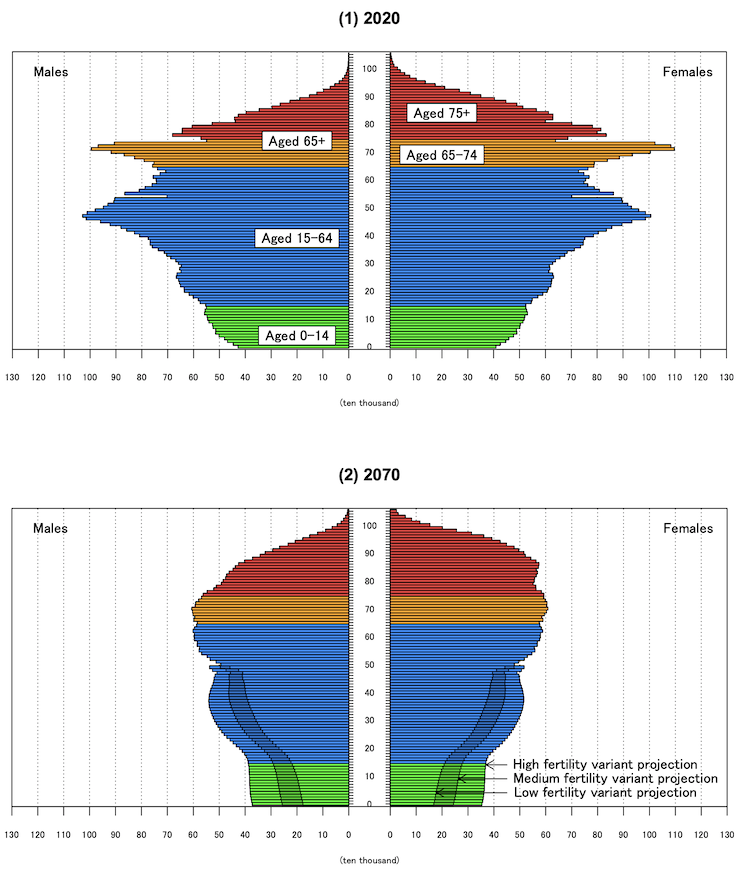

The next inhabitants pyramid graph, which embodies three fertility projections present how shortly the Japanese inhabitants will age.

The Nationwide Institute of Inhabitants and Social Safety Analysis estimates that the dependency ratio in Japan which is – “the extent of burden on 15-64 years previous inhabitants to assist your complete 0-14 years previous inhabitants and inhabitants aged 65 years and over” – will rise (utilizing medium fertility assumptions) from 68 in 2020 to 80.1 per cent in 2039 and 91.8 per cent in 2070.

One other method of expressing that is to take the inverse of the ratio which implies in 2020 there have been 1.47 individuals of working age supporting every dependent individual, 1.25 in 2039, and 1.1 in 2070.

In 2022, the Australian dependency ratio was 54.05 per cent which has similarities to the UK and the US.

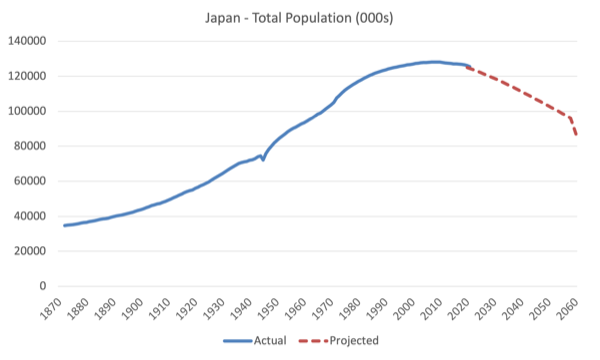

The next graphs present the Japanese inhabitants from 1872 to 2022 (precise) after which projected out to 2070 (based mostly on medium fertility) after which break up between women and men.

The male inhabitants is falling sooner than the feminine.

In 2020, there have been 94.7 males per 100 females; and by 2070 that is estimated to drop to 93.8.

And right here is the projected trajectory by main age teams (medium fertility).

In January 2024, the PSC suggested the Japanese authorities {that a} inhabitants goal of 80 million by 2100, which they declare would permit the economic system to continue to grow at a fee of 0.9 per cent every year till 2100.

This may require start charges to rise to 1.6 youngsters per lady to 1.8 by 2050 and a couple of.07 by 2060.

So a dramatic reconfiguration of the household construction.

The issue with these aspirations is that the housing inventory wouldn’t have the ability to address that improve inside every home.

Whereas the declining inhabitants and municipalities current issues of 1 variety, the try to extend the variety of kids per lady can be problematic for housing causes.

The overriding challenge is whether or not the declining inhabitants and the unequal unfold of the shrinkage, which is main to those predictions of disappearing municipalities is a serious drawback or a chance.

This IMF article from their Finance and Growth journal (March 2020) – Shrinkonomics: Classes from Japan – demonstrates the mainstream considerations.

The IMF rehearses the standard considerations:

Assembly social safety–associated obligations whereas sustaining a sustainable fiscal place and intergenerational fairness is a thorny activity for Japan’s authorities and can probably require essential adjustments to each the advantages framework and its financing construction …

Amongst choices associated to financing, a steady and gradual adjustment of the consumption tax dominates different potential measures to finance the price of ageing, together with greater social safety contributions, delaying fiscal adjustment (with an implied extended interval of debt financing), and elevated well being copayment charges … suspending adjustment via debt financing leads to a big crowding-out of personal sector funding—by as much as 8 p.c—with detrimental effects on long-term GDP and welfare.

So one hopes the Japanese authorities is ignoring this kind of recommendation.

First, there isn’t any ‘financing’ drawback concerned right here for the Japanese authorities.

It’s the sole issuer of the yen and can have the ability to fund greater pension commitments, preserve well being care requirements and no matter with out query.

The uncertainty is simply whether or not there can be educated docs and nurses out there to individual the hospitals and aged care amenities.

And based mostly on the dependency ratios above, guaranteeing these actual assets can be found would require some planning and a set of incentives or guidelines that assure the well being care sector will get entry to educated and educated labour.

Second, the crowding out claims are fictional.

The debt-to-GDP ratio in Japan has been on the highest finish for years and but rates of interest are all the time round zero.

The Financial institution of Japan has demonstrated it will probably set the rate of interest at no matter stage it needs.

The IMF concern is simply an software of the usual mainstream macroeconomic mannequin which is fictional at finest.

The federal government may additionally determine to cease issuing JGBs altogether if it needed.

The IMF fiction then claims youthful employees will come into battle with older dependent individuals:

Rising revenue inequality between younger and previous is a priority in Japan, notably as an more and more smaller share of the inhabitants is requested to shoulder the financing prices for rising social safety transfers.

Every technology chooses its personal tax burden.

Taxes is not going to should rise to ‘fund’ something.

The Japanese authorities spends yen into existence as a result of it’s the sole issuer and doesn’t want tax income with the intention to do this.

There is no such thing as a motive why the youthful cohorts ought to expertise elevated tax burdens.

The fact is that every one generations should scale back their materials footprint to cope with local weather change, a degree I’ll come again to.

The IMF is anxious that business banks will change into unprofitable due to a scarcity of depositors (to screw):

Japan’s demographic headwinds represent a problem for all Japanese monetary establishments, however notably for regional monetary corporations. Due to their dependence on native deposit-taking and lending actions, Japan’s regional banks are delicate to adjustments within the native setting …

Except Japan’s regional banks discover different sources and makes use of of funds, the nation’s shrinking populations will essentially result in smaller steadiness sheets and declining loan-to-deposit ratios. This, in flip, will proceed to place downward strain on already low ranges of profitability.

Is that an issue?

I can’t see how it may be aside from for the shareholders of the banks.

The Japanese authorities may simply nationalise the banking system and guarantee it really works within the pursuits of the shoppers relatively than to make earnings for the shareholders.

This additionally pertains to what I’ll say about degrowth later.

The IMF additionally thinks that financial coverage will change into ineffective as a result of rates of interest should stay low.

This isn’t an issue in any respect and the Financial institution of Japan has already demonstrated over a couple of many years what occurs when rates of interest are round zero – nothing a lot!

Three closing factors.

First, the actual drawback of the ageing inhabitants is productiveness.

The youthful generations should be extra productive than the older generations to take care of materials requirements of dwelling given there can be much less producers and extra dependents.

That means much more funding needs to be diverted into schooling and coaching whereas the IMF desires much less authorities spending on these belongings as a part of its ‘consolidation’ strategy.

The best way to make the inhabitants extra productive is to speculate closely within the expertise and data of the individuals.

That ought to stay a precedence for the Japanese authorities.

However, second, the productiveness level needs to be seen within the context of local weather changes.

Japan’s inhabitants dynamics really present it with the chance to prepared the ground right into a degrowth future.

If there are much less individuals general then much less must be produced.

I’ve beforehand mentioned that almost all of small and medium companies in Japan are owned by individuals above 70 years of age and there’s a bias in opposition to promoting the companies exterior the household.

But, the youngsters are likely to wish to keep away from taking up the companies.

The federal government is obsessive about discovering methods to cease these companies closing down when the proprietor will get too previous.

However they might see it as a chance to scale back the dimensions of enterprise.

Whereas all of us have favorite little retailers in our localities (and definitely I hang-out a couple of locations when I’m dwelling in Kyoto annually).

However we might discover different favourites quickly sufficient.

So whereas the youthful individuals needs to be given the very best alternatives to be productive within the slim (bean counter) sense Japan ought to chill out and settle for that its materials way of life should decline anyway to cope with the local weather problem.

And if that adjustment doesn’t have to return with elevated unemployment – as a result of the provision of labour is shrinking anyway – then that can be a lot simpler than it is going to be for nations with youthful populations who should endure the identical transition away from carbon and progress.

Third, one of many tasks I’m concerned in regarding Japan is figuring out learn how to improve decentralisation.

It’s crucial that the federal government rebuilds populations within the areas by lowering the density within the main cities, notably the Kanto (Tokyo) area.

A serious motive for that is to scale back the damages that can be incurred when the subsequent East coast earthquake hits Japan, notably whether it is concentrated within the Tokyo Bay space.

The opposite main motive is to make sure these declining municipalities can obtain some sustainability as famous above.

A serious obstacle to decentralisation makes an attempt is the relative poverty of public transport exterior of the hyperlinks between the most important cities – that are top quality.

The Japanese authorities needs to be investing in excessive pace rail past the railway community that runs down the backbone of the primary island.

Conclusion

Japan has been my actual world laboratory for a couple of many years now.

And its inhabitants dynamics guarantee it’ll stay that method.

That’s sufficient for at present!

(c) Copyright 2024 William Mitchell. All Rights Reserved.

[ad_2]