[ad_1]

Immediately (March 27, 2024), the Australian Bureau of Statistics (ABS) launched the most recent – Month-to-month Client Value Index Indicator – for February 2024, which confirmed that the annual inflation fee steadied at 3.4 per cent. Immediately’s figures are the closest we’ve got to what’s really occurring in the intervening time and present most of the elements that drove the sudden burst in inflation are actually abating and the present elements which can be vital are extra to do with abuse of market energy than overspending or extreme wage calls for. Considerably, if we take a look at the All Teams CPI excluding risky objects (that are objects that fluctuate up and down repeatedly attributable to pure disasters, sudden occasions like OPEC worth hikes, and so on) then the month-to-month inflation fee was zero and the annualised fee during the last six months is 2.5 per cent – which is in the course of the RBA’s inflation targetting vary. If we take the annualised fee of that collection, during the last three months, then the inflation fee is 2 per cent, on the backside of the RBA’s vary. The final conclusion is that the worldwide elements that had been liable for the inflation pressures are abating pretty rapidly because the world adapts to Covid, Ukraine and OPEC revenue gouging. This inflation was by no means about overspending.

The newest month-to-month ABS CPI information exhibits for February 2024 that:

- The All teams CPI measure was regular at 3.4 per cent.

- Meals and non-alcoholic drinks rose by 3.6 per cent (4.4 per cent in January).

- Clothes and footwear 0.8 per cent (0.4 per cent in January).

- Housing 4.6 per cent (4.6 per cent in January). Rents (7.6 per cent cf. 7.4 per cent).

- Furnishings and family tools -0.3 per cent (0.3 per cent in January).

- Well being 3.9 per cent (3.9 per cent in January).

- Transport 3.4 per cent (3 per cent in January).

- Communications 1.7 per cent (2 per cent in January).

- Recreation and tradition 0.4 per cent (-1.7 per cent in January).

- Schooling 5.1 per cent (4.7 per cent in January).

- Insurance coverage and monetary providers 8.4 per cent (8.2 per cent in January).

The ABS Media Launch (February 28, 2024) – Month-to-month CPI indicator rose 3.4 per cent within the 12 months to February 2024 – famous that:

Annual inflation was unchanged in February and has been 3.4 per cent for 3 consecutive months …

Essentially the most vital contributors to the February annual improve had been Housing (+4.6 per cent), Meals and non-alcoholic drinks (+3.6 per cent), Alcohol and tobacco (+6.1 per cent) and Insurance coverage and monetary providers (+8.4 per cent). …

Lease costs rose 7.4 per cent within the 12 months to January, reflecting a good rental market and low emptiness charges throughout the nation …

Though Taylor Swift performances noticed resort costs rise in Sydney and Melbourne, elsewhere lodging and airfare costs fell in February as a result of finish of the height journey throughout the January faculty vacation interval.

So a number of observations:

1. The inflation state of affairs has stabilised and can steadily decline over the subsequent a number of months.

2. Considerably, if we take a look at the All Teams CPI excluding risky objects (that are objects that fluctuate up and down repeatedly attributable to pure disasters, sudden occasions like OPEC worth hikes, and so on) then the month-to-month inflation fee was zero and the annualised fee during the last six months is 2.5 per cent – which is in the course of the RBA’s inflation targetting vary.

3. If we take the annualised fee of that collection, during the last three months, then the inflation fee is 2 per cent, on the backside of the RBA’s vary.

5. The hire inflation is partly as a result of RBA’s personal fee hikes as landlords in a good housing market simply move on the upper borrowing prices – so the so-called inflation-fighting fee hikes are literally driving inflation.

6. Insurance coverage inflation displays the impression of a number of pure disasters (floods, fires, and so on) – that are ephemeral occasions. This part can be being pushed by the non-competitive banking sector gouging earnings.

7. The final conclusion is that the worldwide elements that had been liable for the inflation pressures are abating pretty rapidly because the world adapts to Covid, Ukraine and OPEC revenue gouging.

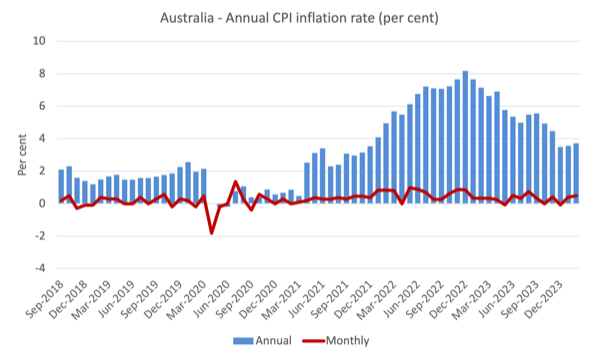

The subsequent graph exhibits, the annual fee of inflation is heading in a single route – down with month-to-month variations reflecting particular occasions or changes (similar to, seasonal pure disasters, annual indexing preparations and so on).

The blue columns present the annual fee whereas the crimson line exhibits the month-to-month actions within the All Objects CPI.

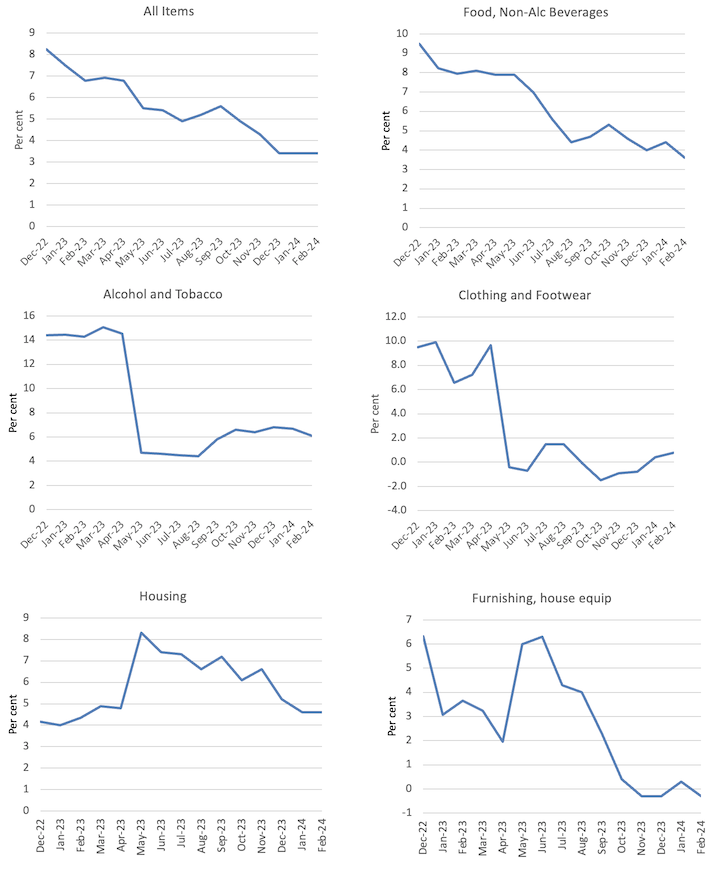

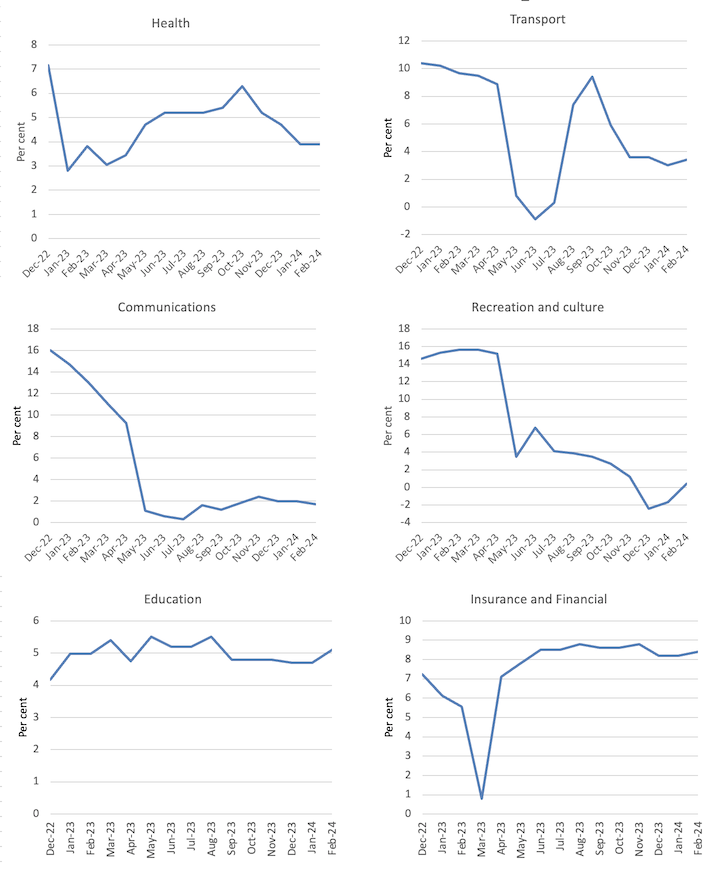

The subsequent graphs present the actions between January 2022 and February 2024 for the principle parts of the All Objects CPI.

On the whole, most parts are seeing dramatic reductions in worth rises as famous above and the exceptions don’t present the RBA with any justification for additional rate of interest rises.

For instance, the Recreation and Tradition part that was driving inflation in 2023 is now deflating – this simply mirrored the non permanent bounceback of journey and associated actions after the intensive lockdowns and different restrictions within the early years of the Pandemic.

It was all the time going to regulate again to extra regular behaviour.

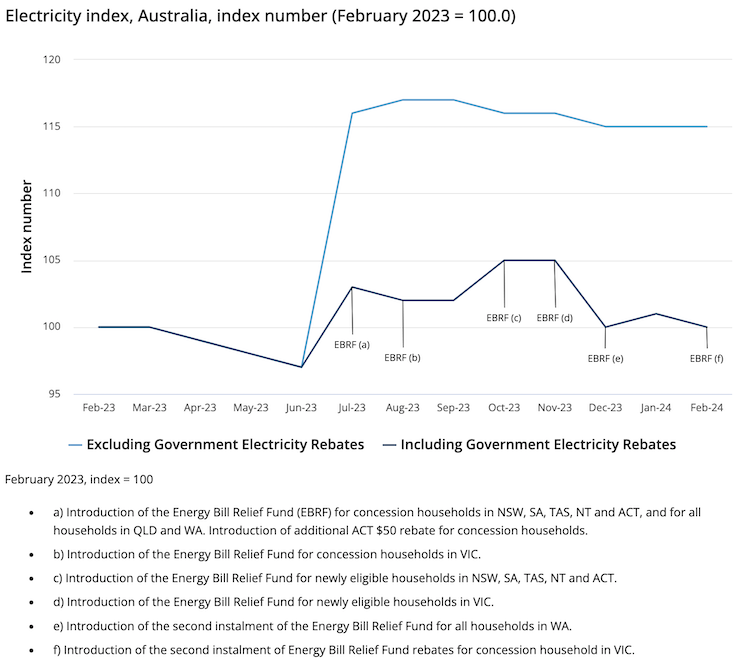

The ABS additionally revealed an fascinating graph, which compares the electrical energy costs below the Federal authorities’s – Vitality Invoice Aid Fund – rebates which had been launched in July 2023 and what they might have been within the absence of that fiscal intervention.

The Aid Fund offered subsidies to households and small companies relying on the locality.

For instance, a Victorian family was given a rebate of $250.

The ABS report that with out the rebates “Electrical energy costs would have elevated 14.9% within the 12 months to February 2024”.

Right here is the impression of that easy and really modest scheme.

It demonstrates that targetted fiscal coverage can certainly be anti-inflationary, which implies that the spending-inflation nexus is rarely simple because the mainstream narratives may need you imagine.

The issue although is that the impression of fiscal coverage general has been unfavorable over the previous few years.

There was a significant slowdown in GDP progress and the declining retail gross sales figures as fiscal coverage has shifted from producing deficits to surpluses during the last 12 months.

The mainstream perspective is that it has been the rate of interest hikes which have prompted the slowdown.

However throughout the GFC, the Australian Treasury carried out analysis to estimate the relative contributions of financial and financial coverage to the modest restoration in GDP after the huge world monetary shock that we imported.

Within the first 4 quarters of the GFC (January-quarter on), they estimated that the fiscal stimulus had contributed considerably to the quarterly progress fee.

On January 8, 2009 the Federal Treasury made a presentation entitled – The Return of Fiscal Coverage – to the Australian Enterprise Economists Annual Forecasting Convention 2009.

I wrote about that on this weblog put up – Lesson for at this time: the general public sector saved us (January 21, 2009).

The opposite fascinating a part of their work was the estimates of the impression of the speedy discount in rates of interest by the Reserve Financial institution on GDP progress charges

This evaluation offered a direct comparability between expansionary fiscal coverage and loosening of financial coverage.

The conclusion was clear:

… this fall in actual borrowing charges would have contributed lower than 1 per cent to GDP progress over the 12 months to the September quarter 2009, in contrast with the estimated contribution from the discretionary fiscal packages of about 2.4 per cent over the identical interval.

So discretionary fiscal coverage modifications was estimated to be round 2.4 instances simpler than financial coverage modifications (which had been of report proportions).

Whereas rates of interest have been hiked 11 instances since Could 2022, the fiscal stability has shifted from a deficit of 6.4 per cent of GDP in 2020-21 and a deficit of 1.4 per cent of GDP in 2021-22, to a surplus of 0.9 per cent of GDP in 2022-23.

The Federal authorities is projecting one other surplus within the present monetary 12 months.

That may be a main fiscal shift and the fiscal drag explains a lot of the slowdown in progress and expenditure.

One commentator wrote at this time – Can Australia pull off the once-impossible with jobs and inflation? – that it was puzzling economists that with the rising rates of interest, unemployment remained low.

There isn’t a actual shock on this as soon as we keep in mind two elements:

1. The current inflation episode was not pushed because the central bankers have claimed (excluding Japan) by extreme demand forces (over-spending).

It was a particular occasion and the elements that drove the acceleration within the worth degree had been of a supply-side origin and largely invariant to rate of interest hikes, which made the entire response by central banks ridiculous and pointless.

The inflation was all the time going to fall.

2. However the fee hikes have had a requirement impact, which pertains to the asymmetry of financial coverage – a attribute that central bankers don’t need to discuss.

This asymmetry pertains to the spending propensities of the totally different earnings teams which can be affected by rate of interest modifications.

Excessive earnings teams have decrease marginal propensities to eat (that means they save extra per additional greenback of disposable earnings) than low earnings households.

In addition they have extra monetary wealth.

When rates of interest rise, complete spending by low earnings households doesn’t change a lot as a result of they’re already spending all their earnings.

Solely the composition modifications.

In addition they personal little or no monetary wealth so don’t get any earnings boosts through the rising returns.

For prime earnings households, they acquire an enormous increase in earnings from their monetary belongings and though they save greater than low earnings households, their spending will increase considerably through the wealth impact.

These modifications don’t function in reverse.

So the place monetary wealth is larger – for instance, the US – and the fiscal coverage is much less restrictive, we’re observing continued financial progress and low unemployment AND inflation falling.

The rationale why the Phillips curve trade-off is just not working (falling inflation is just not being accompanied by rising unemployment) is as a result of the inflation was a supply-side moderately than a demand-side occasion.

Most central bankers and economists bought this very mistaken.

So, it’s more likely that slowdown in GDP in Australia is the results of the fiscal drag moderately than the rate of interest will increase, given the wealth results of these with monetary belongings is more likely to be decrease in Australia than, say, within the US.

Music – When Did You Depart Heaven

That is what I’ve been listening to whereas working this morning.

I used to be trying by means of cabinets the opposite day the place I’ve a lot of outdated LPs saved and got here throughout and outdated report from the Nineteen Fifties by US guitarist and singer – Massive Invoice Broonzy.

He was the most effective guitarist-singers within the blues custom and impressed many who adopted him.

The music – ‘When Did You Depart Heaven’ – was recorded in 1936 as a part of the film – Sing, Child, Sing.

It has been lined many instances since.

This model got here from a stay live performance recorded in Antwerp, Belgium in 1956.

Aside from the nice singing and enjoying, the video is a murals.

He died inside 2 years of this live performance from throat most cancers (discover his smoking on the finish!).

That’s sufficient for at this time!

(c) Copyright 2024 William Mitchell. All Rights Reserved.

[ad_2]