[ad_1]

Earlier this week, the German statistical company, De Statis launched – Press launch No.316 of 19 August 2024 – which confirmed that Germany continues to run coverage settings that undermine the viability of the widespread foreign money. In the course of the pandemic, Germany’s commerce surplus declined considerably and the mainstream commentariat all pronounced that Germany had shifted course and had lastly discovered that operating an obsessive, export-led technique that relied on suppression of home demand and rising commerce deficits elsewhere was fraught. Such a technique had ensured the GFC was worse in Europe than elsewhere. The issue with that narrative is that it was incorrect. The declining commerce surpluses had been pushed by the non permanent value will increase (largely power) that adopted the pandemic and the worth gouging by OPEC. The newest commerce information exhibits that the economic system has absorbed these shocks and is as soon as once more transferring into giant export surpluses that not solely violate EU guidelines but in addition will additional promote defensive methods amongst its buying and selling companions.

Earlier this week, the German statistical company, De Statis launched – Press launch No.316 of 19 August 2024 – which confirmed that Germany continues to run coverage settings that undermine the viability of the widespread foreign money.

The newest information launched earlier this week (August 19, 2024) exhibits that:

German exports decreased by 1.6% to 801.7 billion euros yr on yr within the first half of 2024. Items to the overall worth of 662.8 billion euros had been imported to Germany within the first six months of 2024. This was a lower of 6.2% in contrast with the primary half of 2023. Germany’s international commerce stability (exports minus imports) amounted to +138.8 billion euros within the first half of 2024, and was subsequently 28.7% larger than within the first half of 2023 (+107.9 billion euros).

So though export development is down a bit, the suppression of home demand in Germany has seen a a lot bigger decline in import expenditure and therefore a widening of the commerce surplus.

As I argue under, which means that removed from in search of to a finer stability between exports and imports, German authorities proceed to observe an export-led development technique, which depends on exterior deficits of different nations.

Because the pandemic there was a rise in protectionist considering the world over and if nations do begin pursuing extra home methods (for instance, import alternative insurance policies) then Germany is in jeopardy.

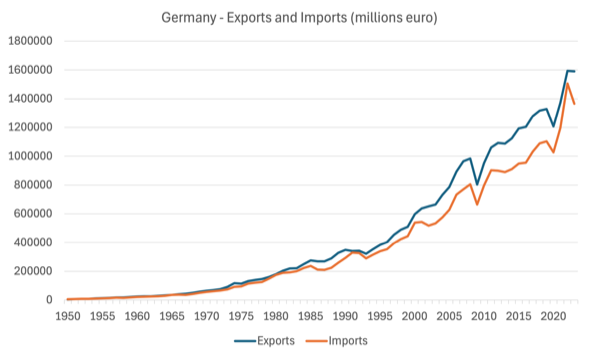

The primary graph exhibits the evolution of German exports and imports since 1950 (in thousands and thousands of euros) – Supply Knowledge.

The behaviour shifted within the early Nineties after the Maastricht Treaty started the method in the direction of the widespread foreign money.

All through the Nineties, the German economic system more and more pursued aggressive export methods, whereas on the similar time suppressed home demand (Hartz reforms and many others), which meant the commerce surplus elevated considerably.

Final month, the – Press launch No.283 of twenty-two July 2024 – confirmed that “German exports to international locations outdoors the European Union (third international locations) had been down 2.6%”, however the actuality is that they’ve been flat for greater than two years and at the moment are in decline.

A lot for the technique to divert exports away from their depressed Eurozone companions in the direction of the expansion economies within the East.

Now that China is consolidating considerably and digesting its actual property issues, Germany is caught.

Its European companions can not maintain the demand for German exports enough to maintain development.

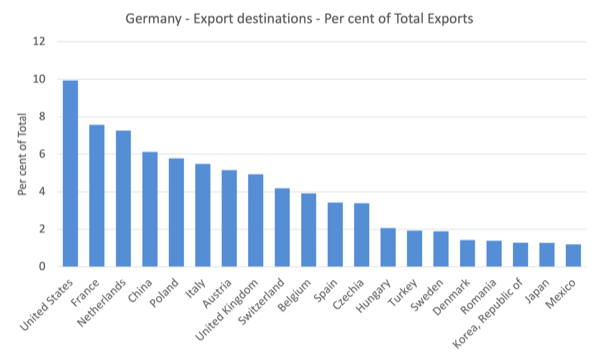

The next graph, which exhibits the highest 20 locations for German exports in 2023 by way of the proportion of whole exports, demonstrates Germany’s on-going reliance on intra-European commerce markets for its exports.

When it comes to its expenditure on imports, China is the highest (11.5 per cent of whole import spending), then Netherlands (7.7 per cent), the US (6.9 per cent), Poland (6 per cent), Italy (5.3 per cent), France (5.1 per cent), Czechia (4.5 per cent), Austria (4 per cent), Belgium (3.9 per cent) and Switzerland (3.8 per cent).

Final yr (2023), Germany exports to its Eurozone neighbours totalled 1,590,063,399 thousand euros, whereas its imports from these neighbours solely totalled 1,365,822,677 thousand euros – an enormous commerce surplus of 126,007,025 thousand euros.

So there’s a leakage from German commerce outdoors the Eurozone – that’s, Germany doesn’t recycle the export income its receives from its Eurozone companions again into demand for Eurozone imports.

That may be a deflationary scenario and is what made the GFC a lot worse than it might need been for Europe.

The deliberate determination of the German authorities to suppress home demand, meant that the export surpluses had little alternative for worthwhile returns by investing within the German economic system.

In consequence, German commerce surpluses had been recycled again into speculative actual property ventures within the different Eurozone nations within the lead as much as the GFC, which created an outsized actual property growth (building sector turned abnormally giant in some nations) that unfolded rapidly when the US economic system crashed on the again of the monetary meltdown.

Inside the EU governance framework, Germany is a serial offender and breaches the so-called – Macroeconomic Imbalance Process – which decrees that no nation ought to run commerce surpluses in extra of 6 per cent of GDP.

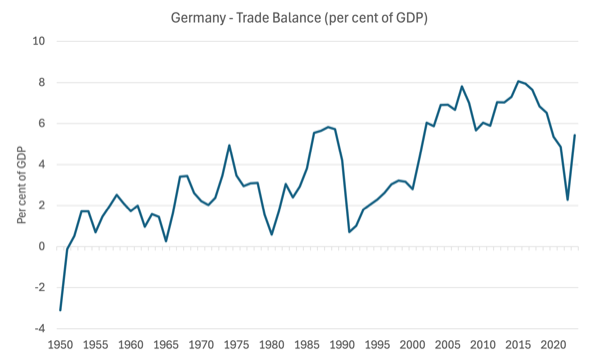

The next graph exhibits the commerce stability as a % of GDP since 1950.

The information is barely strictly comparable publish 1991.

Since 2000, Germany has been in violation of the MIP guidelines on present accounts in 16 of the 24 years.

And 4 of the years that it was inside the MIP thresholds had been through the pandemic interval when import costs for power rose considerably because of the provision constraints and OPEC+ worth gouging.

The commentators who initially claimed that the declining exterior surplus through the pandemic marked a brand new period for Germany the place exports and imports could be extra balances had been incorrect.

The lower within the commerce surplus was non permanent and the general coverage bias in Germany stays to generate giant export surpluses with suppression of home demand on the forefront of that technique.

Non-public consumption expenditure development is weak (wage suppression continues) and alternatives for worthwhile funding inside Germany are diminished as a consequence.

The newest information suggests it’s heading again into MIP default – the commerce stability was 5.44 per cent in 2023.

But the European Fee turns a blind eye to it.

Extra worryingly is that the German export surplus obsession, along with undermining dwelling requirements for German residents (by suppressing wages development and home demand), endangers world stability.

By refusing to recycle the export income into import expenditure, Germany locations strain on the commercial bases of the nations it runs surpluses towards.

These nations then have a choice to make.

They’ll both turn into hostage to the German (and Chinese language) manufacturing sectors, which leaves them susceptible to the kinds of product high quality and provide shortfalls that we noticed through the pandemic, or they will search to revitalise their very own manufacturing sectors and scale back their reliance on exports.

We now have already seen an rising debate about self-reliance because the pandemic.

In Might 2024, the Australian authorities, for instance, has launched its – Future Made in Australia – Nationwide Curiosity Framework – which offers:

Authorities assist is required to crowd-in the mandatory non-public funding to scale up precedence industries that may assist the Australian economic system navigate and prosper by these challenges …

(the) agenda fall into considered one of two streams:

- the Web Zero Transformation Stream, which incorporates industries the place Australia could have a comparative benefit as the worldwide economic system transitions to internet zero

- the Financial Resilience and Safety Stream, which incorporates industries the place some degree of home functionality is important to ship financial resilience and safety.

The Authorities is not going to admit that the Plan is protectionist however bear in mind the – Duck check.

The purpose is that if these kinds of domestically-orientated approaches turn into extra widespread and the World Commerce Organisation begins to lose traction, then Germany is in serious trouble and can convey the remainder of the Eurozone down with it.

In her 1936 guide – Essays within the Concept of Employment (Basil Blackwell, Oxford) which was re-released in 1947, Joan Robinson sought “to use the rules of Mr. Keynes’ Common Concept of Employment, Curiosity and Cash to plenty of explicit issues”.

In Half III, she offers an essay “Beggar-My-Neighbour Cures for Unemployment” which is relevant to the present scenario.

She wrote (p.156):

For anyone nation a rise within the stability of commerce is equal to a rise in funding and usually leads (given the extent of dwelling funding) to a rise in employment … However a rise in employment led to on this approach is of a completely completely different nature from a rise attributable to dwelling funding. For a rise in dwelling funding brings a couple of internet enhance in employment for the world as an entire, whereas a rise within the stability of commerce of 1 nation at the very least leaves the extent of employment for the world as an entire unaffected.

She then famous that:

In instances of normal unemployment a sport of beggar-my-neighbour is performed between nations, every one endeavouring to throw a bigger share of the burden upon the others. As quickly as one succeeds in rising its commerce stability on the expense of the remaining, others retaliate, and the overall quantity of worldwide commerce sinks constantly, relative to the overall quantity of world exercise.

She went on to stipulate the assorted coverage gadgets that nations can use to precipitate a beggar-my-neighbour warfare together with change charge depreciation, slicing wages, export subsidies and import restrictions (tariffs, quotas and many others).

To some extent that is what Germany did after it entered the widespread foreign money.

The labour market deregulation (Hartz) and different insurance policies shifted exterior competitiveness in favour of Germany on the expense of its Eurozone companions.

Germany sought to alter its revenue distribution away from staff in the direction of the export industries as a deliberate reply to the lack of change charge variability.

The technique punished the commerce deficit nations, who having misplaced the change charge capability to regulate, had been pressured into harsh home austerity to chop wage prices and many others because of the German export obsession.

If these nations begin to deploy beggar-my-neighbour methods – and why wouldn’t they – then there will likely be a significant world recession because the nations alter to the brand new actuality.

Conclusion

It’s clear that Germany hasn’t discovered a lot from the previous and the European Fee continues to disregard its breaches of the MIP guidelines.

That can’t finish properly.

That’s sufficient for immediately!

(c) Copyright 2024 William Mitchell. All Rights Reserved.

[ad_2]