[ad_1]

Yesterday, in a 7-2 vote, the U.S. Supreme Court docket dominated that the funding construction of the Shopper Monetary Safety Bureau is constitutional.

It is a massive deal for monetary establishments. Although the company has been a thorn within the aspect of many fintechs and banks, if the Supreme Court docket discovered it unconstitutional, it will undo greater than a decade of labor and will imply chaos for the business.

Now, we are able to transfer on with confidence. Whether or not or not we just like the CFPB, its proper to exist is now settled.

One of many CFPB’s massive new initiatives is implementing its rulemaking on open banking, referred to as Part 1033.

It will seemingly result in a flurry of fintech innovation that may give shoppers management over their very own information, and that’s thrilling to me.

Featured

> Supreme Court docket Ruling on CFPB Paves Path for Open Banking

Studying the Thursday (Might 16) Supreme Court docket ruling upholding the constitutionality of the Shopper Monetary Safety Bureau’s funding mechanisms — and guaranteeing the company’s survival — takes one by way of centuries of historical past. All the way in which again to England, Parliament and the Crown.

From Fintech Nexus

> Stash proclaims new B2B providing known as StashWorks

By Peter Renton

StashWorks is the brand new B2B providing from Stash, permitting any employer so as to add financial savings and investing as a profit to workers.

> Era Z has it harder than millennials: TransUnion report

By Tony Zerucha

Whereas each Era Z and millennials are maturing throughout troublesome monetary occasions, TransUnion’s examine Fixing for Z reveals Era Z has it tougher.

Podcast

Brendan Carroll, Co-Founder & Senior Accomplice of Victory Park Capital, on the expansion of personal credit score

The Co-Founding father of Victory Park takes us by way of the historical past of asset backed lending, how the business has grown, and what…

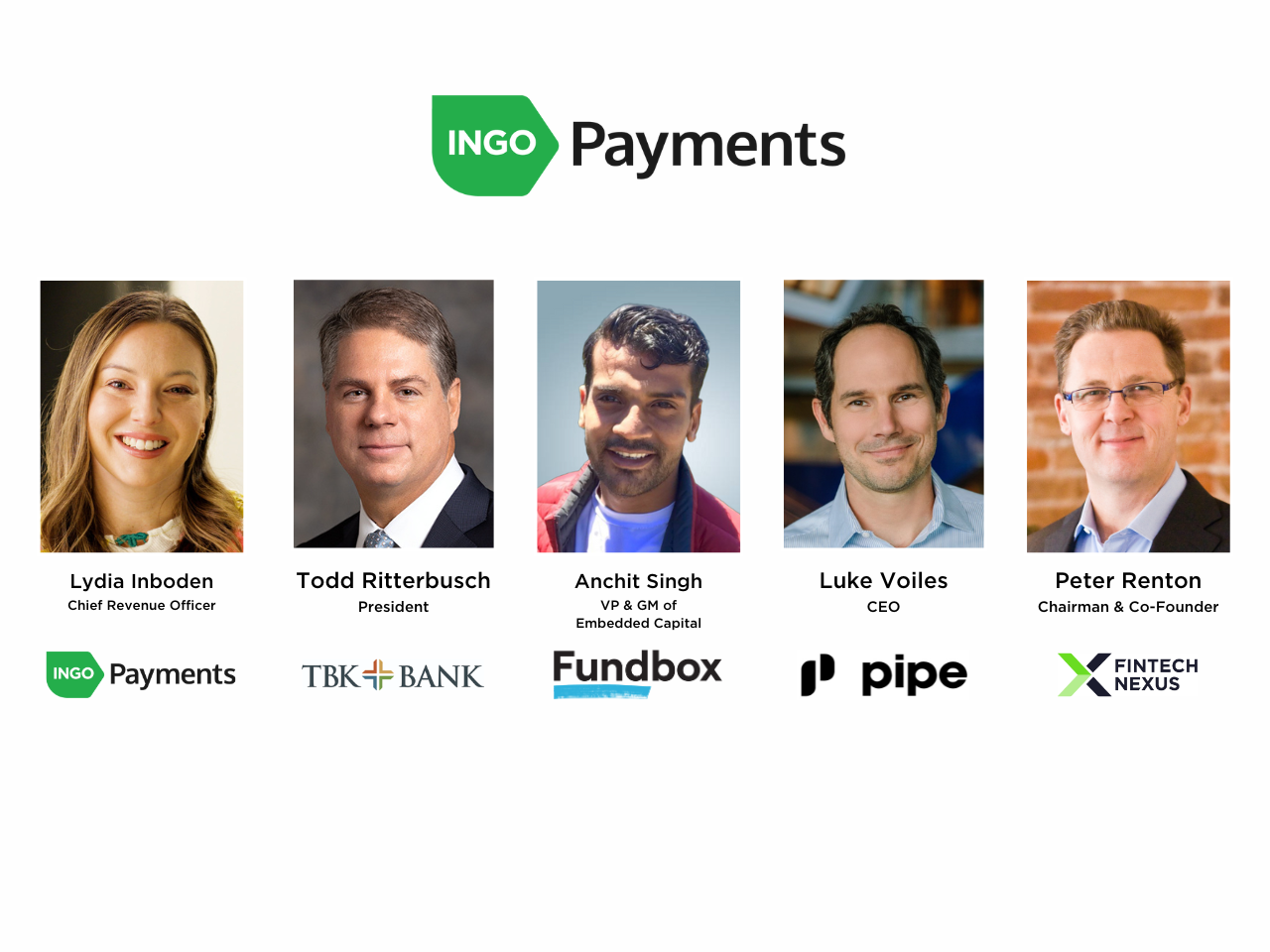

Webinar

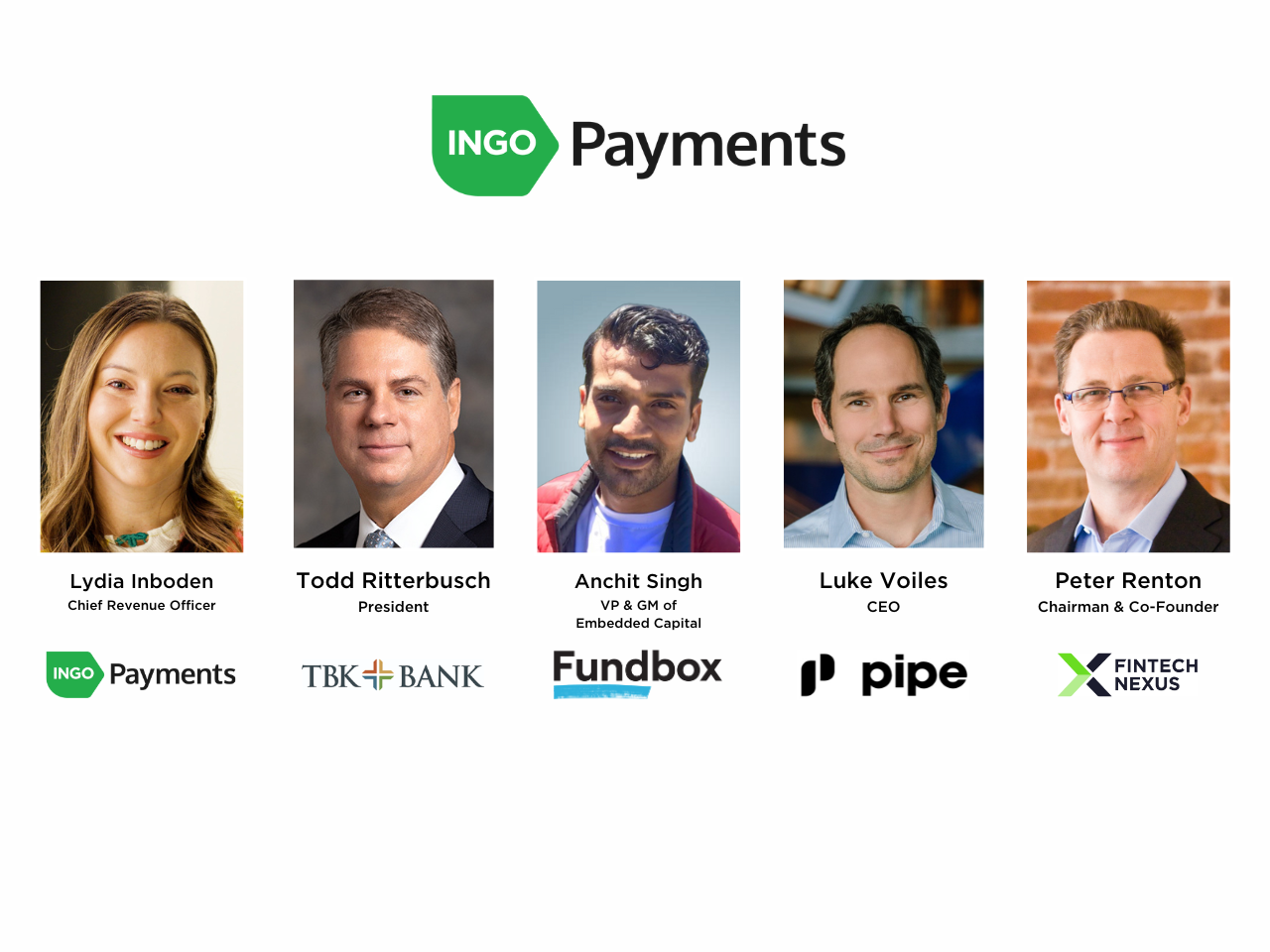

Prompt funds orchestration: a vital instrument now for lending and factoring

Jun 5, 2pm EDT

In at this time’s on-demand economic system, prompt funds are shifting from a nice-to-have to a must have. Within the small enterprise area,…

Additionally Making Information

- Asia: Hong Kong permits China’s digital yuan for use in native outlets

Hong Kong will permit mainland China’s pilot digital foreign money for use in outlets within the metropolis, the top of its de facto central financial institution mentioned on Friday, marking a step ahead for Beijing’s efforts to internationalize the yuan amid rising geopolitical tensions.

To sponsor our newsletters and attain 180,000 fintech fans along with your message, contact us right here.

[ad_2]