[ad_1]

LoanPro has made a reputation for themselves as a scalable lending platform. Now, they’re beefing up their bank card platform with the announcement of a brand new integration with Visa.

Visa DPS (Debit Processing Service) is without doubt one of the world’s largest issuer processors of Visa debit transactions globally and with this integration with LoanPro it’s going to assist corporations higher launch, service and handle card packages.

One of many distinctive new options is Transaction Degree Credit score™ which permits for extra exact transaction administration by permitting card packages to customise rates of interest, credit score limits, and style intervals primarily based on transaction specifics.

There’s a motion within the fintech area in direction of credit score in response to stress on debit card charges and the expansion of pay by financial institution. This new program from LoanPro will make it simpler for these corporations to make the leap.

The most important revenue heart for many banks is their lending enterprise, which incorporates bank cards. It’s inevitable that it will quickly be true for fintech corporations.

Featured

> How LoanPro’s Visa DPS Integration Will ‘Broaden The Availability Of Credit score In This Nation’

By Renato Capelj

LoanPro, a number one credit score platform, introduced a direct integration with Visa DPS, one of many largest issuer processors for Visa debit transactions.

From Fintech Nexus

> Plaid launches a brand new product to take money move underwriting mainstream

By Peter Renton

Plaid has introduced a brand new money move underwriting device name Client Report that’s the most complete providing for lenders but.

Podcast

Anthony Sharett, President of Pathward, on the right way to do banking-as-a-service proper

Whereas the BaaS area is having a second proper now, there are some banks, like Pathward, that proceed to serve their many…

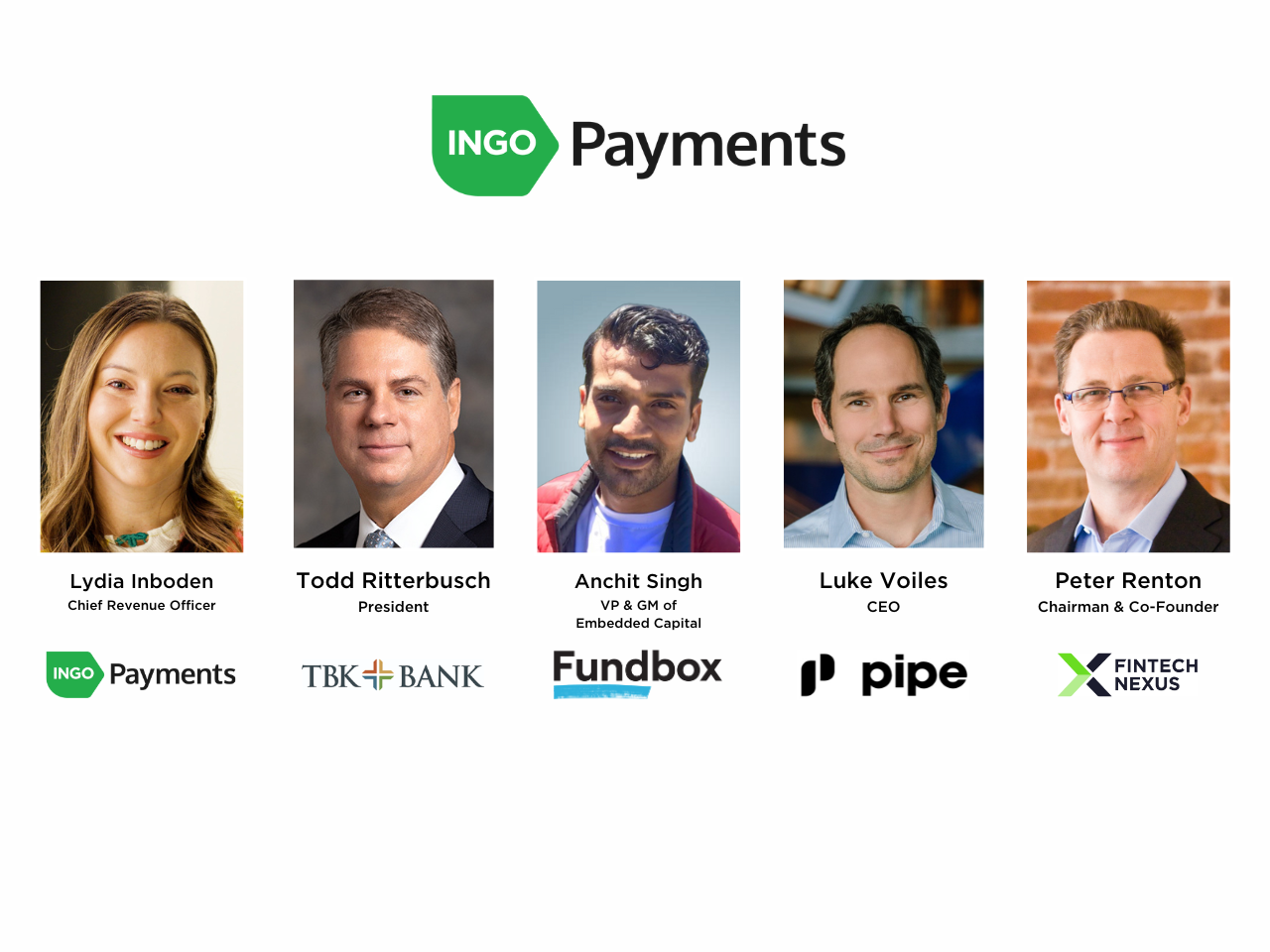

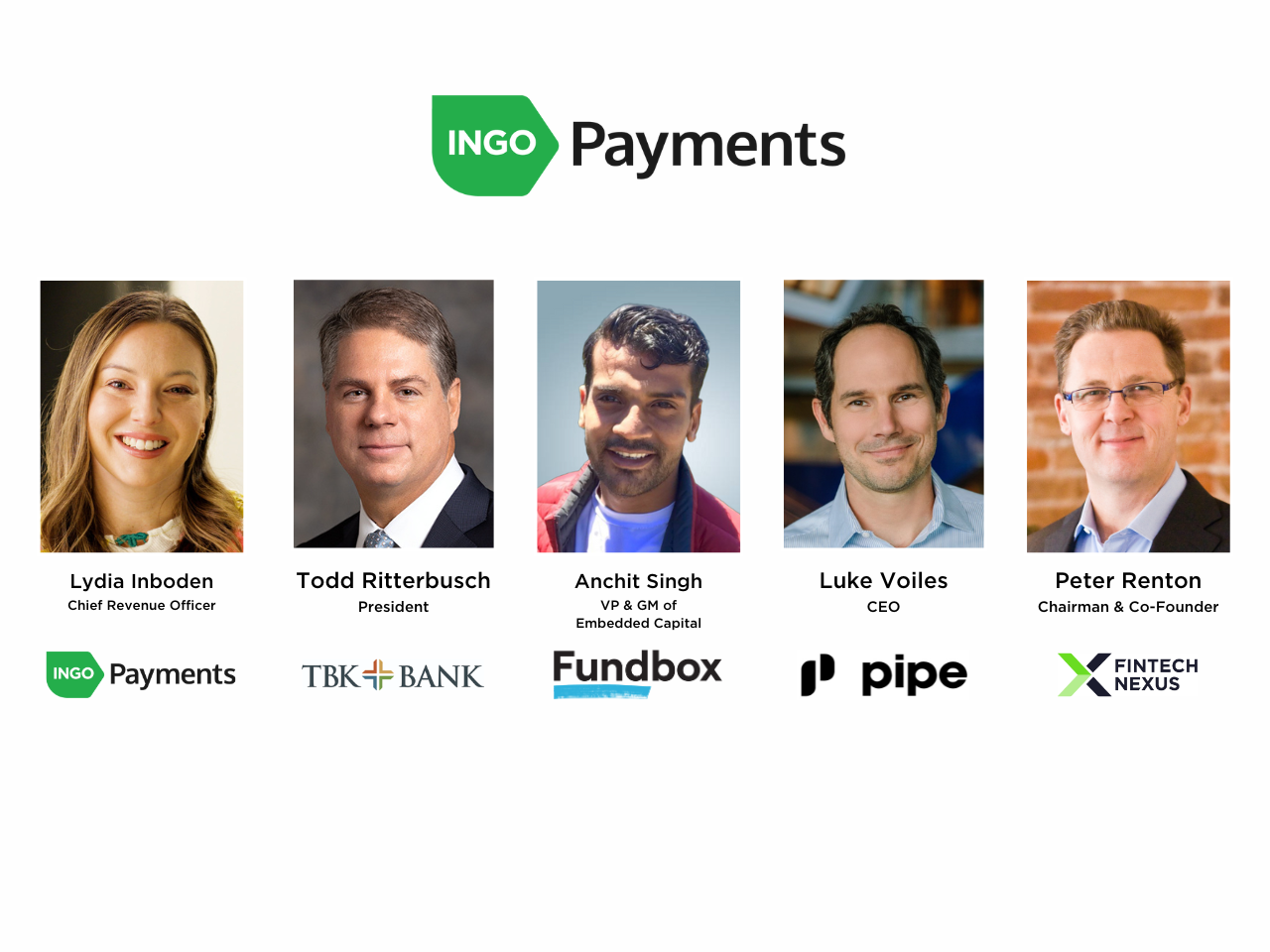

Webinar

Immediate funds orchestration: a necessary device now for lending and factoring

Jun 5, 2pm EDT

In at this time’s on-demand economic system, prompt funds are shifting from a nice-to-have to a must have. Within the small enterprise area…

Additionally Making Information

- USA: Reside Oak Financial institution Launches First Embedded Banking Partnership

Reside Oak Financial institution has launched its first embedded banking partnership. Powered by the financial institution’s in-house expertise and a Finxact core, this providing permits software program corporations to instantly ship Reside Oak banking services to their very own clients, Reside Oak Financial institution mentioned in a Monday (June 3) press launch.

To sponsor our newsletters and attain 180,000 fintech lovers together with your message, contact us right here.

[ad_2]