[ad_1]

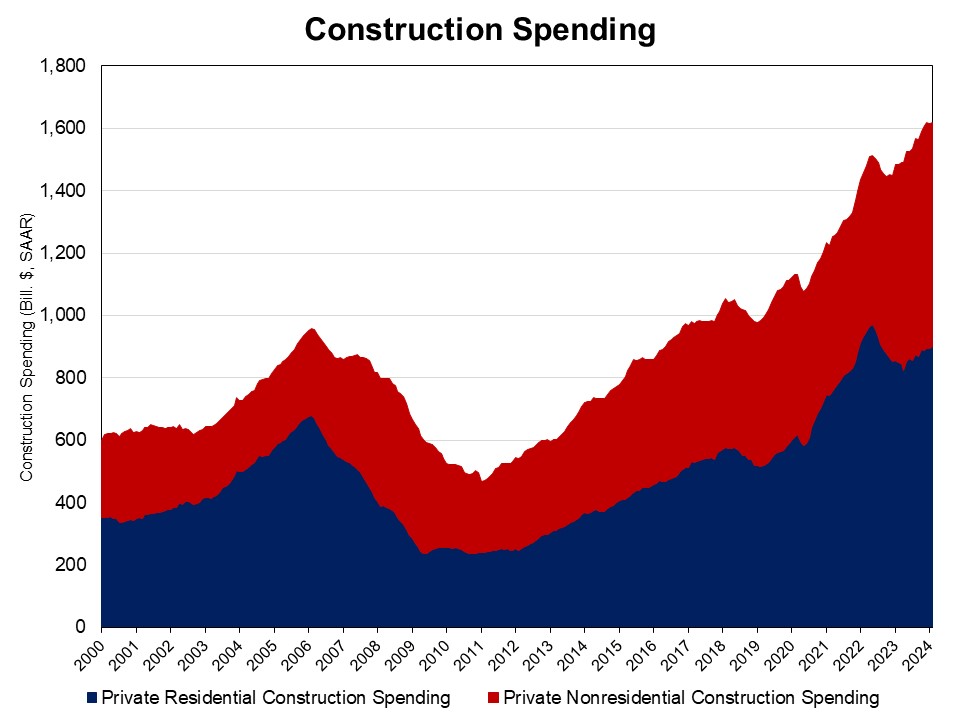

NAHB evaluation of Census information reveals that personal residential development spending rose 0.7% in February, the third month of positive factors in a row. It stood at a seasonally adjusted annual tempo of $901.1 billion.

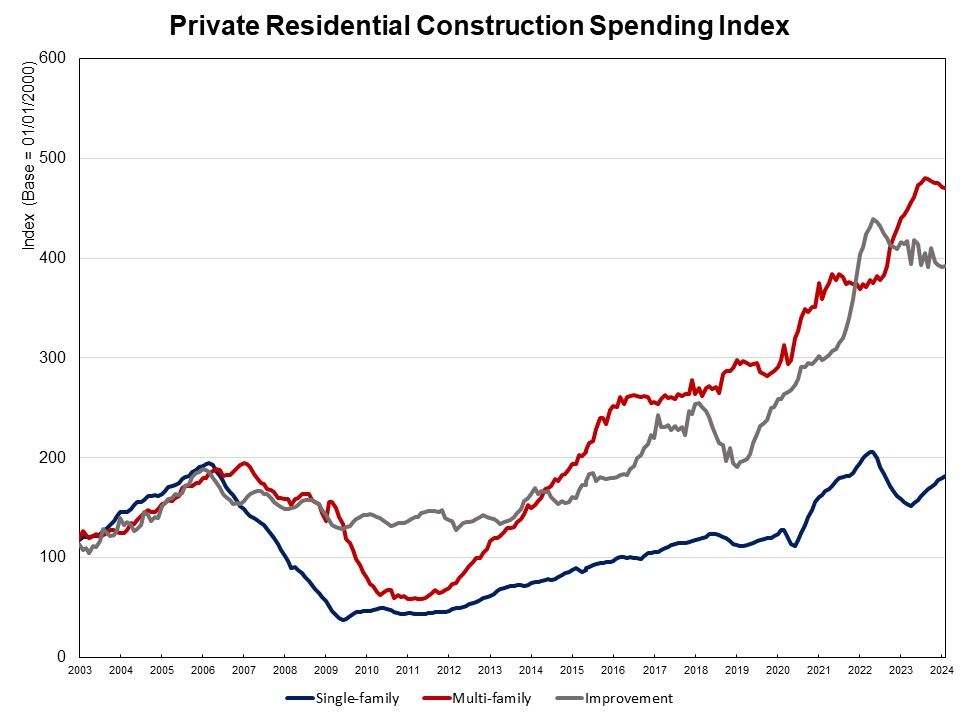

The month-to-month improve in whole development spending is attributed to extra single-family development and enhancements. Spending on single-family development rose 1.4% in February. This marks the tenth straight month of will increase since April 2023. The achieve for single-family development is aligned with the sturdy studying of single-family begins and rising builder sentiment, as the shortage of present residence stock and robust demand are boosting new development. In comparison with a yr in the past, spending on single-family development was 17.2% greater. Multifamily development spending went down 0.2% in February after a dip of 0.8% in January. Nonetheless, spending on multifamily development was 6.1% greater than a yr in the past, as a massive inventory of multifamily housing is beneath development. Personal residential enchancment spending inched up 0.2% in February however was 5.3% decrease in comparison with a yr in the past.

The NAHB development spending index is proven within the graph beneath (the bottom is February 2000). The index illustrates how spending on single-family development skilled stable development since Might 2023 beneath the stress of supply-chain points and elevated rates of interest. Multifamily development spending development stayed nearly unchanged within the final three months, whereas enchancment spending has slowed since mid-2022.

Spending on personal nonresidential development was up 12.6% over a yr in the past. The annual personal nonresidential spending improve was primarily on account of greater spending for the category of producing ($53.7 billion), adopted by the facility class ($0.7 billion).

[ad_2]