[ad_1]

Making good progress on the guide, about 60-70% completed (I really feel good about it). I needed to come out of hiding to share just a few charts/tables that ought to elevate your confidence ranges that — regardless of media protection on the contrary — we’re not on the breaking point.

I need to direct your consideration to the newest missive from Savita Subramanian, who runs the Fairness and Quant Technique group at BAML.

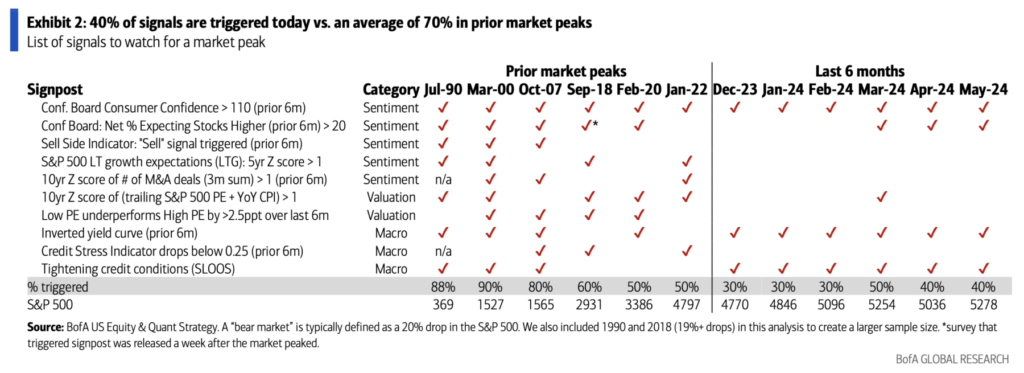

In response to repeated inquiries from BofA shoppers, Savita checked out quite a few indicators that collectively counsel markets are topping. She observes it’s much less concerning the issues traders are likely to give attention to — “technical evaluation, geopolitics, behavioral finance and even skirt hemline traits” — and extra about particular measures she tracks in sentiment, valuation, macro-economic areas.

The desk above reveals the foremost market peaks going again to 1990. These embody July 1990 (1990-91 recession), March 2000 (dotcom prime), October 2007 (GFC), September 2018 (This fall 20% drop), February 2020 (COVID), and January 2022 (525 bps of fee hikes in 18 months).

Over that 35 12 months interval, the interval previous to market tops had been ranged from 50-90% of those indicators flashing pink, with a median of 70% earlier than prior market peaks. Savita notes: “In the present day, 40% of the signposts we’ve got discovered to be predictive have been triggered vs. a median of 70% earlier than prior market peaks.”

For these whoa re fearful about an imminent crash, her work counsel we’re not there but.

I desire to assume by way of possibilities, not binary consequence predictions. A decrease chance of an imminent crash and a better chance of a continuation, regardless of occasional setbacks, of the continued secular bull market, is what this implies.

However as prior historical past has taught us, all bull markets finally come to an finish. It is likely to be untimely to jot down this bulls eulogy simply but…

Beforehand:

MiB: Savita Subramanian, US Fairness & Quantitative Technique, Financial institution of America (Could 17, 2024)

Transcript: Savita Subramanian (Could 21, 2024)

Supply:

FAQs How do bull markets finish?

Savita Subramanian

Fairness and Quant Technique, 14 June 2024

[ad_2]