[ad_1]

Common readers will know that I’m not enamoured with the British Labour Celebration management and its obsession with its so-called fiscal rule, which is de facto only a continuation of the rule that the Tory’s had been supposedly operating with. How can a self-styled progressive social gathering (so-called) that’s about to take over a nation that has been shattered by 14 years of the worst Tory rule that one can think about, and which would require billions of kilos to be spent to even put a dent within the degradation in infrastructure, providers, to not point out addressing the forward-looking challenges (well being, local weather, and so forth), declare {that a} fiscal rule that’s biased in direction of austerity be acceptable? It beggars perception. By persevering with with such guidelines, the Labour Celebration is guaranteeing that it’s going to both fail to make a lot headway in redressing the harm and inserting Britain in a greater place to cope with the carbon challenges or will fail to fulfill the fiscal guidelines or each. It’s recipe for not a lot. Pity the British individuals who have already endured the implications of supporting, first Blair’s Labour, then the lengthy exhausting years of the bumbling and incompetent Tories. In at present’s put up I wish to spotlight one facet of the fiscal rule absurdity, and truly say that Nigel Farage is correct about one factor, though not for the best causes. Learn on – a narrative of company welfare and financial fictions unfolds.

I’ll do extra detailed analyses of the fiscal rule dynamics within the weeks to come back.

However with the – Labour Manifesto – now launched there are some apparent issues one can say at a superficial degree.

First, whereas politicians are all the time speaking themselves up – and the Labour narrative about ‘my plan for change’ sounds aspirational – the fact is that the brand new authorities (if Labour) will do little or no on both aspect of the fiscal ledger.

Labour’s fiscal plan – suggests it’ll intention to take out of the economic system £7,350 million by 2028-29 and inject for offering “Labour’s further public providers” some £4,835 over the identical interval.

It additionally claims:

… that the present funds should transfer into steadiness, in order that day-to-day prices are met by revenues and debt have to be falling as a share of the economic system by the fifth 12 months of the forecast.

So that appears like a internet austerity influence over the interval “of the newest Workplace for Finances Accountability forecast”.

On development, the Labour Manifesto says it’ll “kickstart financial development” by delivering “financial stability with robust spending guidelines and counting on non-public companies to “enhance development in every single place”.

Excuse me if I take a second to have amusing.

The British Labour management has adopted such a defensive place structured across the fiscal guidelines that it’s exhausting to think about the huge void created by the Tories shall be reversed in any important manner.

All they appear to be telling the British individuals is that that they gained’t do that (tax will increase) or that (debt will increase over 5 years in opposition to GDP).

There are some exceptions to this.

First, the Celebration has promised to make some main modifications to the NHS however it’s exhausting to see them reaching their goals throughout the fiscal guidelines they wish to play by.

Second, essentially the most outlandish a part of the plan (joking) is the £4.7 billion every year promised to fund the ‘inexperienced prosperity plan’, which is reality a drop within the ocean to what shall be required over the instant interval forward if Britain is to do something significant about local weather change.

And bear in mind the preliminary promise was for £28 billion.

The scaled down plan simply mirrored the management operating petrified of the Metropolis and the mainstream economists.

They’ve mentioned they should borrow to fund this program over the quantity they’ll obtain from a brand new windfall tax on the oil and gasoline corporations.

Tough calculations counsel that they could need to borrow over the forecast interval, given the £4.7 billion every year promise, round £16-18 billion.

I’ve finished some preliminary calculations, which I’ll increase on in future posts as soon as I’ve accomplished them to my satisfaction, that inform me – that in the event that they persist with their phrase on the comparatively modest (learn largely inconsequential local weather plan), then at that price, to suit throughout the fiscal guidelines, they’ll have little or no scope for spending on the rest.

The actual development in expenditure, given the projected inflation price, is a few factors above what the present authorities has proposed.

So nothing a lot actually and it’s constrained by what they time period to be ‘protected’ areas of expenditure.

All which implies the ‘unprotected’ areas will undergo for positive, or the brand new authorities will fail to fulfill the bounds set by the fiscal guidelines.

Some calculations counsel that actual spending cuts of round 3 to 4 per cent within the unprotected areas could be required.

And that’s assuming a reasonably strong (learn most likely unattainable) GDP development price.

The Manifesto, in fact, claims it is not going to impose austerity cuts on different important areas of presidency.

My evaluation is that all of it fails so as to add up.

The entire plan rests of GDP development being so robust that Brtiain must bounce out of its pores and skin, relative to its efficiency over the previous couple of a long time.

Financial institution of England Funds on extra reserves – scrap them?

Which brings me to the talk on central financial institution help funds for extra reserves.

This can be a traditional instance of how the general public debate is so misled by the fiscal fictions propagated by mainstream economists.

The situation is that this.

The asset buying program (Asset Buying Facility) of the Financial institution of England – quantitative easing – which was scaled up in the course of the pandemic considerably expanded the steadiness sheet of the Financial institution.

The intention was held out to offer reserves to the banks which they’d mortgage out and stimulate the economic system.

The truth is that this logic was deeply flawed – banks don’t mortgage out reserves and don’t want reserves to be able to make loans to clients – loans create deposits.

You would possibly mirror on that time by studying this weblog put up – Quantitative easing 101 (March 13, 2009) – amongst many others that I’ve written.

The precise end result of the QE was that rates of interest within the maturity ranges of the debt that the Financial institution of England bought had been diminished and that may have been a stimulatory measure if debtors had been assured that they may prosper from elevated debt publicity.

Given how flat the economic system was on the time, that confidence was absent so the QE – which is simply an asset swap – debt for reserves – was largely ineffective.

But it surely did imply that the Financial institution of England constructed up a big inventory of presidency bonds on its steadiness sheet.

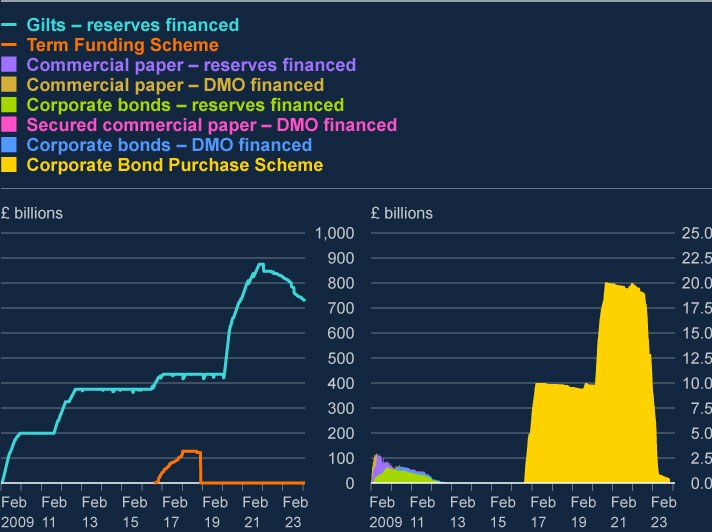

The latest – Asset Buy Facility Quarterly Report – 2024 Q1 (launched April 30, 2024) – reviews that the financial institution held (as at March 27, 2024) some £728,047 million price of Gilts and £89 million price of Company bonds.

This graph is supplied by the use of abstract:

The Financial institution is busy operating down the shares it has constructed up so the present shares of bonds held by the Financial institution of England are nearer to £700,000 million now.

The analogue of those purchases is that the business banks considerably elevated the reserve balances held on the Financial institution of England.

These are the clearing balances and earn nothing except the Financial institution of England pays a help price.

And as I’ve defined many instances beforehand, except that help price is paid, aggressive stress throughout the in a single day (or interbank market) by banks with extra reserves to earn something (by loaning them to different banks who’re in reserve deficit) will drive the in a single day price to zero.

Which might then compromise any non-zero coverage goal price and the Financial institution of England would successfully lose management over its financial coverage.

Okay.

So the Financial institution of England determined to pay a help price, which has needed to rise as its coverage price elevated – in its forlorn effort to ‘struggle inflation’.

Forlorn as a result of the speed hikes had been largely pointless on condition that the sources of the inflationary pressures had been provide positioned and insensitive to home rate of interest modifications.

The present help price on in a single day funds (reserve balances) is 5.25 per cent but the return on the federal government bonds delivers the Financial institution of England round 2 per cent every year.

In different phrases, in an accounting sense, the Financial institution of England is now making a ‘loss’ on its bond holdings.

And the federal government has promised the Financial institution of England to reimburse the financial institution (learn pay itself) for the ‘loss’.

And such funds then present up as ‘authorities spending’.

So the stress has been on the Labour management to scrap the help funds to ‘get monetary savings’.

And all types of economists, together with a few of these self-styled progressives who wrote a letter to the UK Guardian at present supporting Labour’s financial credibility (Supply) have then claimed there could be dreadful penalties if the Financial institution stopped paying the business banks this return.

Nigel Farage has really helpful the Financial institution of England cease paying the speed (which I help) as a result of it might “stem the circulate of money out of the Treasury” (Supply), which proves he doesn’t have a clue about the best way the financial system truly operates.

There have been proposals to introduce a tiered system with respect to financial institution reserves – some get the help cost, different bits don’t.

The economists then scream that that is taxing the banks.

Poor banks – these poor companies which have been gouging billions from their clients during the last decade and handsomely rewarding their homeowners and executives.

All of which is the stuff of nonsense.

And the Labour management has run scared and declared it is not going to change the present strategy.

And her reasoning suggests she has no actual understanding of what’s going on.

The very fact is that the Financial institution of England, being a part of the consolidated authorities sector (the currency-issuing sector), may merely kind 0 in opposition to that £700 billion price of bonds it holds and no-one would actually be the wiser.

All of the fictional posturing about central financial institution losses, and the necessity for the best pocket of presidency (H.M. Treasury) to compensation the left pocket of presidency (the Financial institution of England), and all the opposite bizarre proposals to ‘save’ the Financial institution and provides the federal government extra respiratory area inside its ridiculous fiscal guidelines are nonsensical and simply present how far the talk has moved into the land of the pixies.

The ‘losses’ the Financial institution of England are accounting for at current are meaningless.

Please learn my weblog put up – Central banks can function with destructive fairness ceaselessly (September 22, 2022)- for extra dialogue on this level.

The Financial institution will not be a personal company that faces insolvency if it report destructive fairness.

Completely none of its operations could be compromised if it recorded on-going losses or took the higher step and simply wrote off all of the debt held.

And all of this nonsense is as a result of these characters assume the fiscal guidelines are vital for the federal government to keep away from insolvency.

The British authorities can by no means grow to be bancrupt.

It could by no means go broke.

It may scale back the debt ratio instantly by simply writing off the debt holdings it has of its personal debt.

After which proceed to cut back it by declining to turnover the maturing debt held within the non-government sector.

That’s, simply cease issuing gilts altogether.

After which it may simply cease paying the ‘company welfare’ help funds to the business banks for his or her extra reserve holdings.

That might push the in a single day price right down to zero – and the yield curve would recalibrate down accordingly.

Then the federal government may use its fiscal capability throughout the limits of the actual assets obtainable to foster a greater degree of well-being.

Conclusion

The Metropolis would scream – however so what – who would care about that.

That’s sufficient for at present!

(c) Copyright 2024 William Mitchell. All Rights Reserved.

[ad_2]