[ad_1]

Bitcoin has been trending decrease after failing to interrupt above $66,000 in early Could, deflating hopes of speedy value positive factors post-Halving. Taking to X, one analyst shared on-chain knowledge that paints a extra nuanced image than a easy lack of confidence in current weeks.

Bitcoin Open Curiosity Stays Low: Bullish?

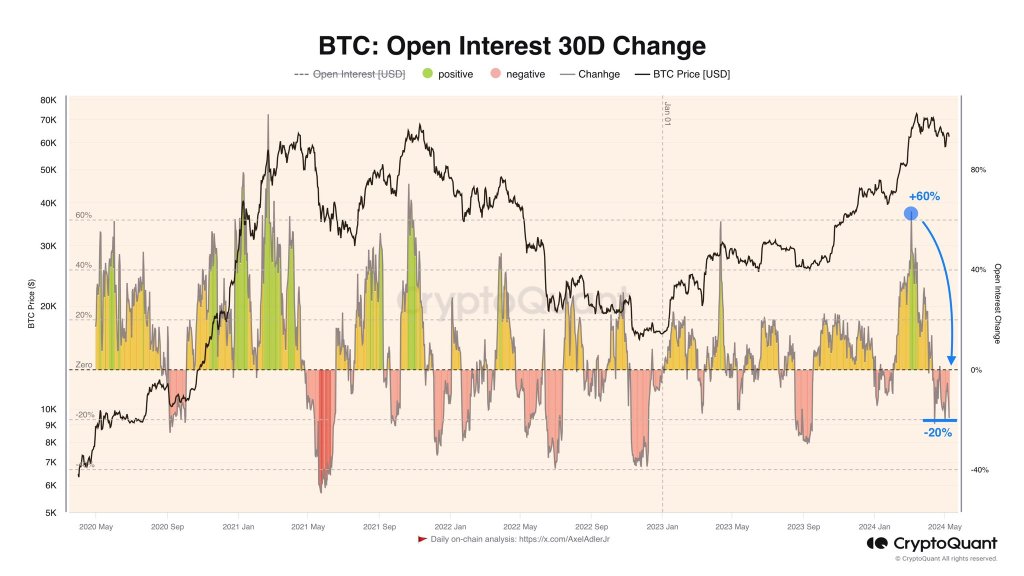

The analyst, pointing to CryptoQuant knowledge, observes that leveraged merchants on perpetual buying and selling platforms like Binance look like closing their positions greater than opening new ones. The analyst notes that the studying is at -20% on the month-to-month change in Open Curiosity.

At this stage, it reveals that extra merchants are closing extra positions than opening new ones. This growth suggests that the majority merchants undertake a strategic wait-and-see, watching costs evolve.

Associated Studying

Regardless of the lower in positions opening, it’s essential to notice that this isn’t an indication of BTC’s downfall or the invalidation of a possible surge. The analyst interpreted this contraction as a strategic transfer by merchants, who’re cautiously optimistic and never exiting the market on account of bearish expectations.

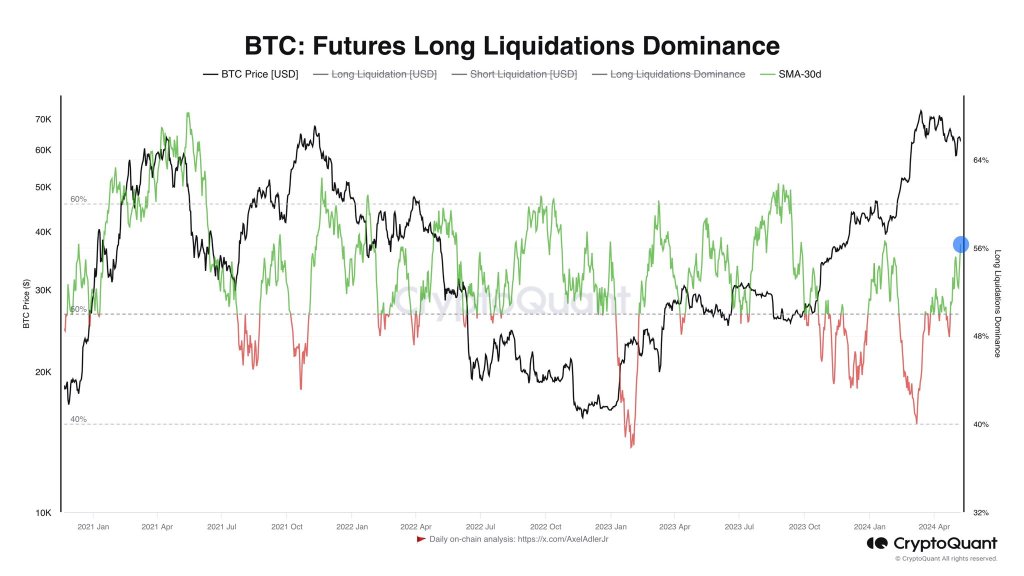

In a separate submit, the analyst added that the Bitcoin market wants the present wave of liquidation and “negativity” for accumulating brief positions. All brief positions opened at spot ranges wager that BTC will proceed trickling decrease, even breaking beneath $56,500.

Nevertheless, the extra brief positions there are, the upper the potential for a “brief squeeze” forming. When this occurs, there will likely be a sudden value spike, liquidating shorts and forcing sellers to purchase again into the market to stop additional injury.

BTC Inside A Commerce Vary: Will $60,000 Fail?

Regardless of the potential upside hinted by on-chain knowledge, costs stay confined inside a slim vary. Final week, bulls failed to shut above $66,000, confirming the spectacular march from Could 3.

Bitcoin discovered resistance and is shifting decrease towards the psychological $60,000 stage. From value motion, losses beneath this line would possibly fast-track the collapse towards $56,500 registered in early Could.

Going ahead, merchants will carefully monitor how costs evolve after the all-important Halving on April 20. Contemplating the approval of spot Bitcoin exchange-traded funds (ETFs) and the involvement of establishments, some analysts anticipated costs to shoot increased instantly.

Associated Studying

Nonetheless, this has not been the case. Costs proceed to hold amid fluctuating inflows to identify ETFs, and america Federal Reserve remains to be not slashing rates of interest.

Function picture from Shutterstock, chart from TradingView

[ad_2]