[ad_1]

Fast Take

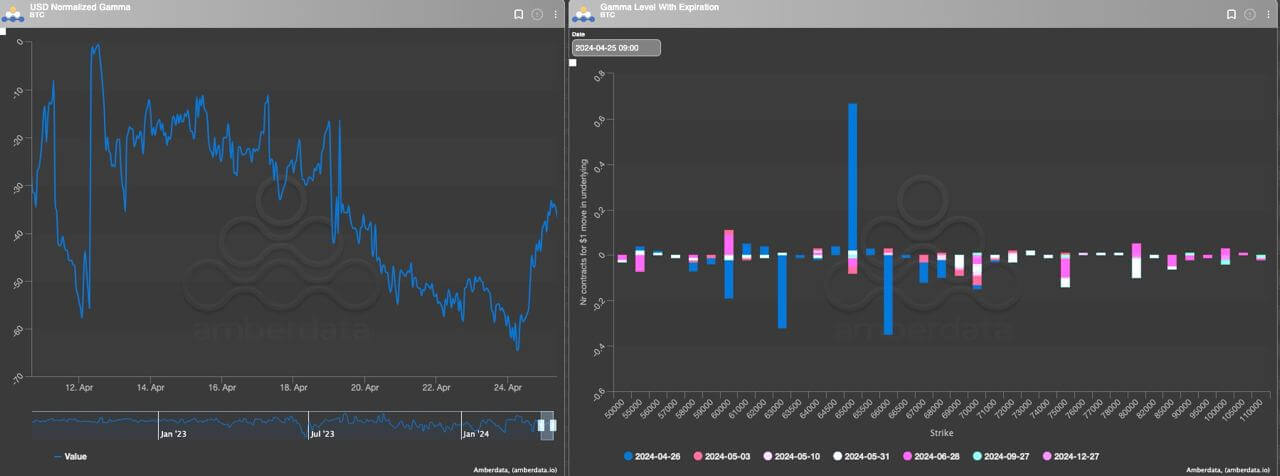

As Bitcoin’s worth hovers round $63,000, barely down over the previous 24 hours, the choices market is offering insights into shifting investor sentiment forward of the expiration on April 26. A key growth has been the discount in optimistic gamma publicity as Bitcoin declined by means of the closely traded $65,000 name strike.

In accordance with Imran Lakha, a 20-year skilled choices dealer notes:

Quick gamma lowered on the best way down as we went by means of the massive lengthy strike at 65k suggesting quantity has been smashed decrease, calls are getting dumped

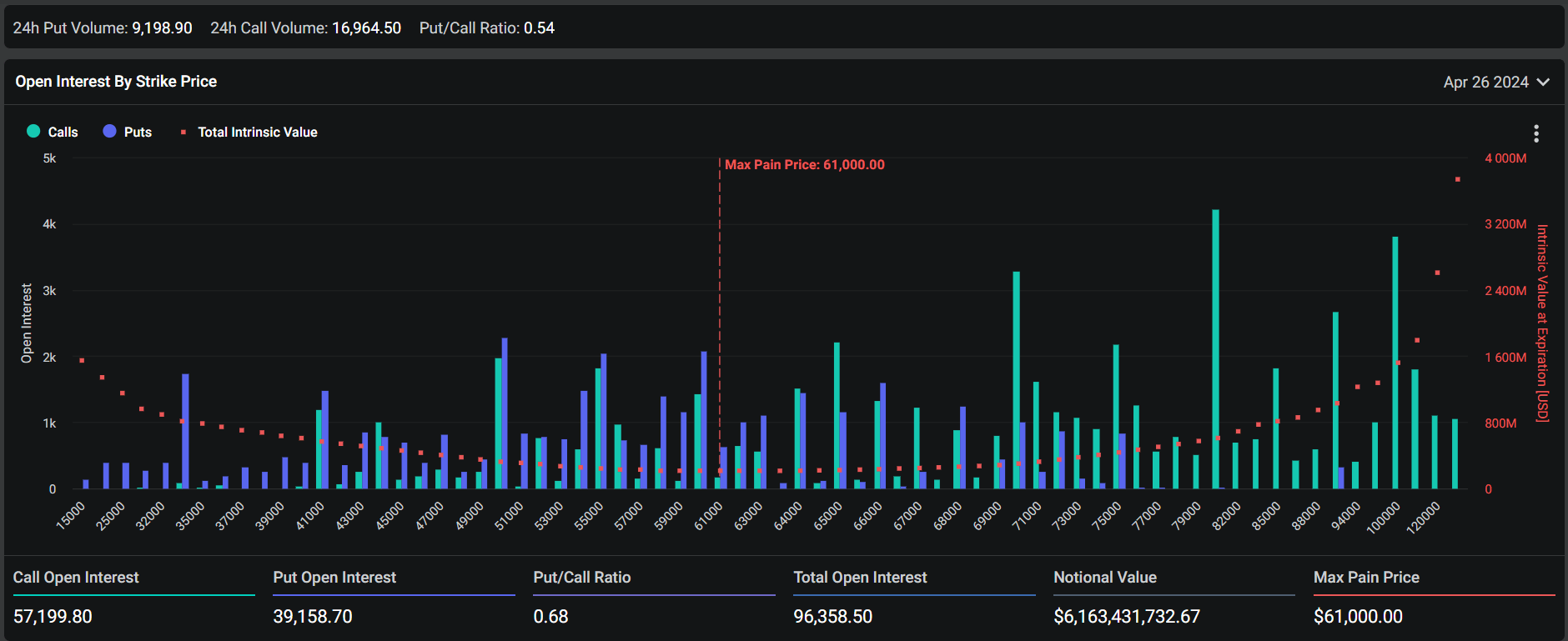

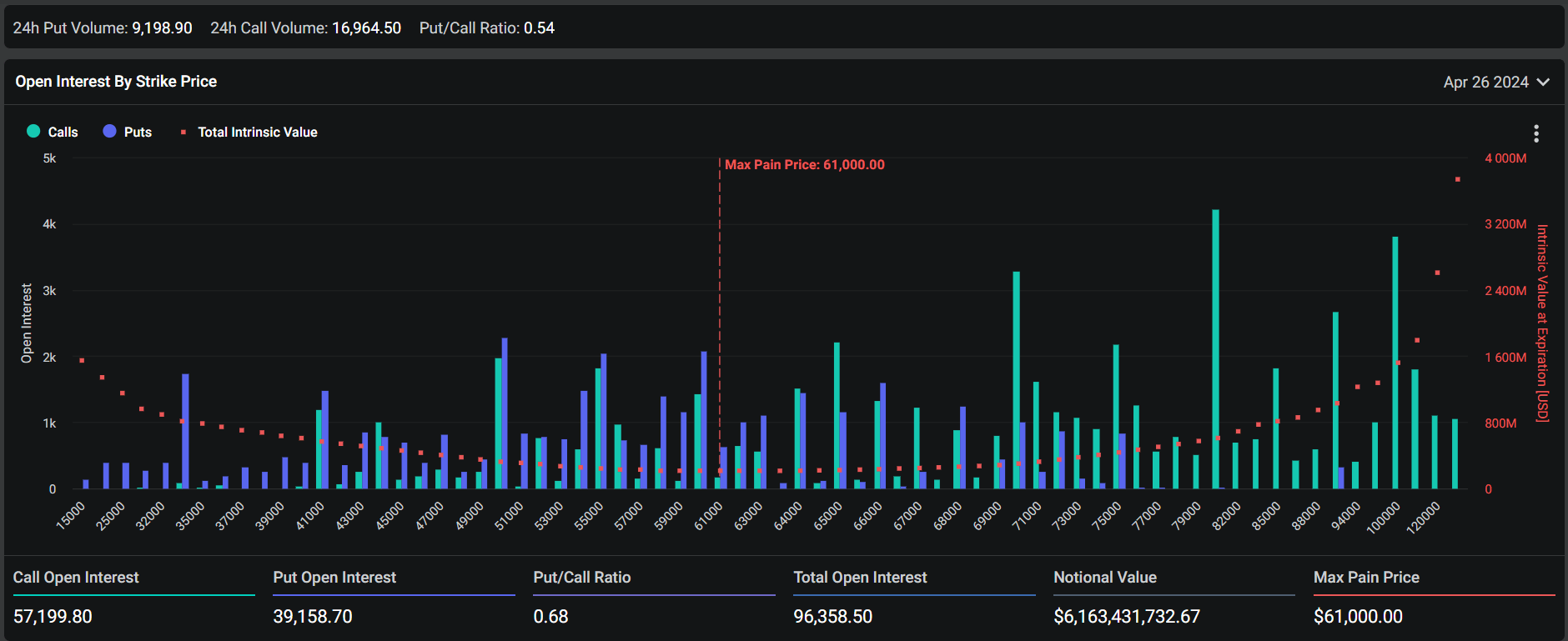

The choices open curiosity knowledge supplied by Deribit reveals a max ache worth of $61,000, which may doubtlessly function a short-term help degree. Whereas vital open curiosity stays in calls above the present spot worth, the shortage of put open curiosity under $60,000 signifies an absence of draw back safety. CryptoSlate has pinpointed this worth degree as an important help threshold.

The put/name ratio of 0.68 displays a modest bias in direction of calls, however this has decreased notably on account of seemingly profit-taking on draw back hedges.

In conclusion, the choices market knowledge suggests a cooling of bullish sentiment as Bitcoin pulled again from current highs. Nonetheless, the remaining upside choice holdings may nonetheless affect short-term worth motion, with the max ache degree as a possible help zone to watch.

[ad_2]