[ad_1]

At the moment (June 5, 2024), the Australian Bureau of Statistics launched the most recent – Australian Nationwide Accounts: Nationwide Revenue, Expenditure and Product, March 2024 – which exhibits that the Australian economic system grew by simply 0.1 per cent within the March-quarter 2024 and by 1.1 per cent over the 12 months (down from 1.5 per cent). If we prolong the March consequence out over the yr then GDP will develop by 0.4 per cent, effectively under the speed required to maintain unemployment from rising. GDP per capita fell for the fifth consecutive quarter and was 1.3 per cent down over the yr. It is a tough measure of how far materials residing requirements have declined but when we issue the unequal distribution of earnings, which is getting worse, then the final 12 months have been very harsh for the underside finish of the distribution. Family consumption expenditure was steady however solely as a result of the saving ratio fell additional. There’s now a really actual chance that Australia will enter recession within the coming yr until there’s a change of coverage path. Each fiscal and financial coverage are squeezing family expenditure and the contribution of direct authorities spending, whereas constructive, won’t be ample to fill the increasing non-government spending hole. On the present development fee, unemployment will rise. And that might be a deliberate act from our coverage makers.

The primary options of the Nationwide Accounts launch for the March-quarter 2024 have been (seasonally adjusted):

- Actual GDP elevated by 0.1 per cent for the quarter (down from 0.3 per cent final quarter). The annual development fee was 1.1 per cent (down from 1.5) however the annualised December-quarter fee would solely be 0.4 per cent

- GDP per capita fell by 0.4 per cent for the quarter, the fifth consecutive quarter of contraction. Over the yr, the measure was down 1.3 per cent – signalling declining common earnings.

- Australia’s Phrases of Commerce (seasonally adjusted) rose by 0.2 per cent for the quarter however have been down by 7.3 per cent over the 12 month interval.

- Actual internet nationwide disposable earnings, which is a broader measure of change in nationwide financial well-being, fell by 0.2 per cent for the quarter and 0.5 per cent over the 12 months, which implies that Australians are worse off (on common) than they have been at that time 12 months in the past. Averages are deceiving when the underlying distribution is extremely skewed.

- The Family saving ratio (from disposable earnings) fell to 0.9 per cent from 1.6 per cent – as households run down their saving to remain afloat.

Total development image – development continues at a lot slower fee

The ABS – Media Launch – stated that:

Australian gross home product (GDP) rose 0.1 per cent within the March quarter 2024 and 1.1 per cent since March 2023 …

GDP development was weak in March, with the economic system experiencing its lowest by the yr development since December 2020. GDP per capita fell for the fifth consecutive quarter, falling 0.4 per cent in March and 1.3 per cent by the yr …

Whole capital funding fell 0.9 per cent … Personal funding fell by 0.8 per cent pushed by a decline of 4.3 per cent in non-dwelling funding …

Public capital funding fell for the second straight quarter …

Web commerce detracted 0.9 proportion factors from GDP development this quarter, with stronger imports (+5.1 per cent) than exports (+0.7 per cent) …

Compensation of staff (COE) rose 1.0 per cent within the March quarter, the smallest development since September 2021. This means slowing development within the labour market …

The family saving ratio fell to 0.9 per cent within the March quarter after rising final quarter … Family earnings obtained grew at its lowest fee since December 2021, reflecting the comparatively small rises in compensation of staff and funding earnings obtained this quarter …

Authorities expenditure elevated 1.0% and contributed 0.2 proportion factors to GDP. Authorities expenditure was pushed by elevated spending by the Commonwealth on social help advantages to households, together with well being packages by Medicare and the Pharmaceutical Advantages Scheme, and vitality invoice aid funds by some state governments. Worker bills rose with elevated headcount throughout numerous Commonwealth businesses.

The quick story:

1. The weak point in home demand that we noticed growing in the direction of the tip of 2023 has worsened.

2. GDP development is not any so low that unemployment will begin rising extra rapidly than earlier than. The tough rule of thumb developed by Arthur Okun, which says that GDP development has to equal the sum of labour productiveness and labour drive development for the unemployment fee to stay fixed, would indicate that unemployment will rise sharply within the coming yr on the present GDP development fee.

Productiveness development is now operating at round 0.1 per cent over the yr and the labour drive is rising at round 1.5 per cent, which implies on the present GDP development fee, there’s a 0.4 per cent shortfall, which is able to present up as a rising unemployment fee.

3. Households are being squeezed by the cost-of-living will increase and the RBA fee hikes, and the latter, is partially, inflicting the previous.

4. Web exports at the moment are undermining development and the Exterior stability (commerce and earnings accounts) have lastly gone again into damaging territory after a really massive swing from a $A2,667 million surplus within the December-quarter 2024 to a $A4,896 million deficit within the March-quarter 2024. With the earnings account shifting additional into deficit.

5. Per capita GDP has been in decline for 5-quarters which implies on common every particular person is turning into poorer however as a result of the impression of this slowdown is disproportionately endured by decrease earnings households, the state of affairs could be very dire for some.

6. Authorities consumption expenditure saved the economic system from shifting into damaging development territory.

7. Nevertheless, given the decline in non-government spending development, the present fiscal settings are manner too restrictive and when mixed with the tight financial settings, it’s clear that the Authorities, total, is intentionally sabotaging the fabric well-being of thousands and thousands of Australians beneath the veil of ‘preventing inflation’, which might have returned to pre-COVID ranges anyway, with out the austerity.

The primary graph exhibits the quarterly development during the last 5 years.

Right here is similar graph with the acute observations in the course of the worst a part of the COVID restrictions taken out.

To place this into historic context, the following graph exhibits the last decade common annual actual GDP development fee because the Sixties (the horizontal crimson line is the common for your entire interval (3.26 per cent) from the December-quarter 1960 to the December-quarter 2008).

The 2020-to-now common has been dominated by the pandemic.

However because the earlier graph exhibits, the interval after the most important well being restrictions have been lifted has generated decrease development, than if we embody the interval when the restrictions have been in place.

If we take the observations between the March-quarter 2020 and the March-quarter 2022, then the common since 2020 has been 1.7 per cent every year.

It is usually apparent how far under historic tendencies the expansion efficiency of the final 2 a long time have been because the fiscal surplus obsession has intensified on either side of politics.

Even with a large family credit score binge and a once-in-a-hundred-years mining increase that was pushed by stratospheric actions in our phrases of commerce, our actual GDP development has declined considerably under the long-term efficiency.

The Sixties was the final decade the place authorities maintained true full employment.

A GDP per capita recession – deepening

GDP per capita fell for the fifth consecutive quarter, which implies that complete output averaged out over your entire inhabitants contracted for the final 15 months of 2023.

Some contemplate this to be a deepening recession though what the common really means is questionable.

With the extremely skewed earnings distribution in the direction of the highest finish, what we will say if the common is declining, these on the backside are doing it very robust certainly.

The next graph of actual GDP per capita (which omits the pandemic restriction quarters between March-quarter 2020 and December-quarter 2021) tells the story.

Evaluation of Expenditure Parts

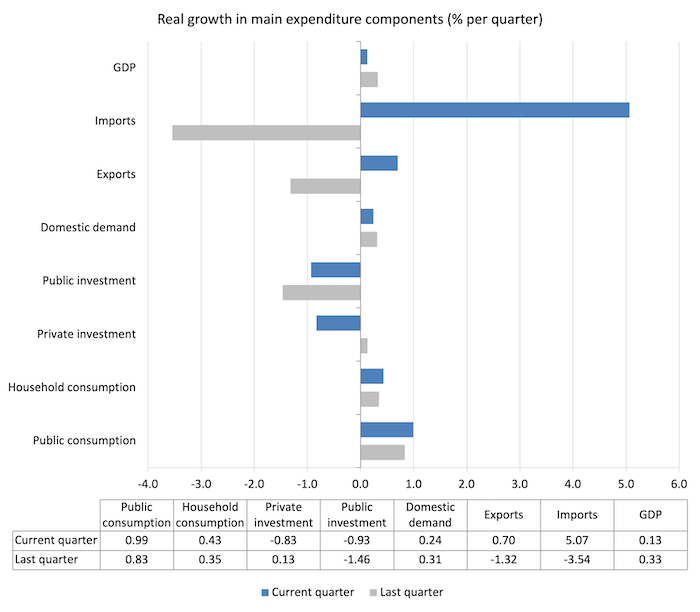

The next graph exhibits the quarterly proportion development for the most important expenditure parts in actual phrases for the December-quarter 2023 (gray bars) and the March-quarter 2024 (blue bars).

Total: Australia is heading in the direction of recession at this fee.

Contributions to development

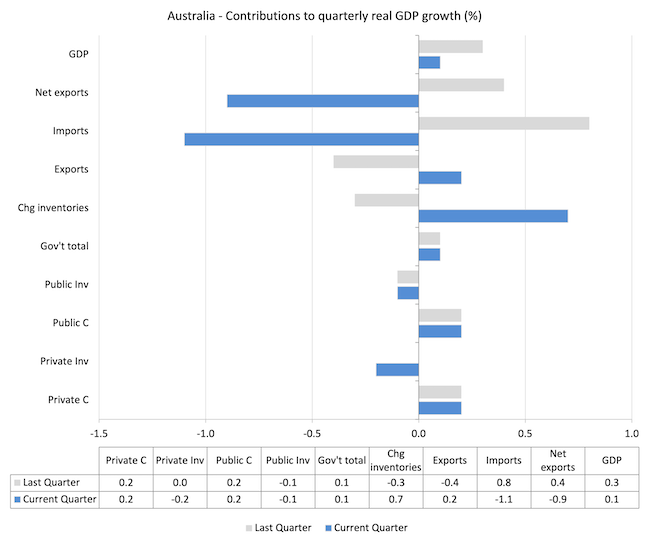

What parts of expenditure added to and subtracted from the change in actual GDP development within the March-quarter 2024?

The next bar graph exhibits the contributions to actual GDP development (in proportion factors) for the primary expenditure classes. It compares the March-quarter 2024 contributions (blue bars) with the earlier quarter (grey bars).

The rise in inventories was pushed by what the ABS stated:

Modifications in inventories contributed 0.7 proportion factors to development, recording a $2.2 billion construct up within the March quarter. Non-mining inventories noticed a construct up from broad power in imports of intermediate and consumption items, whereas mining inventories elevated as manufacturing outpaced export demand.

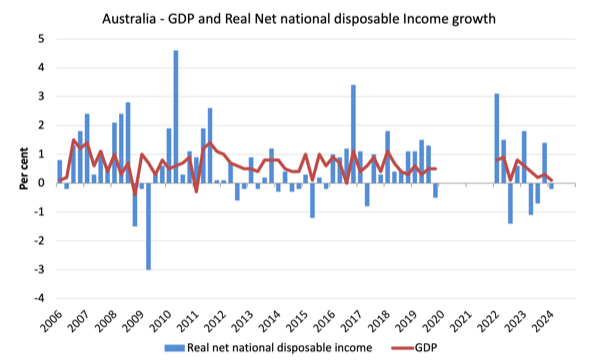

Materials residing requirements declined in March-quarter and for the yr total

The ABS inform us that:

A broader measure of change in nationwide financial well-being is Actual internet nationwide disposable earnings. This measure adjusts the amount measure of GDP for the Phrases of commerce impact, Actual internet incomes from abroad and Consumption of fastened capital.

Whereas actual GDP development (that’s, complete output produced in quantity phrases) rose by 0.1 per cent within the March-quarter, actual internet nationwide disposable earnings development fell by 0.2 per cent.

How can we clarify that?

Reply: The phrases of commerce rose by 0.2 per cent within the March-quarter however fell by 7.3 per cent for the final 12 months.

Family saving ratio fell to 0.9 per cent from 1.6 per cent

The ABS famous that:

The family saving ratio fell to 0.9 per cent within the March quarter after rising final quarter … Family earnings obtained grew at its lowest fee since December 2021, reflecting the comparatively small rises in compensation of staff and funding earnings obtained this quarter …

In comparison with final quarter, the expansion in earnings tax payable didn’t detract as a lot from complete earnings payable by households, leading to a decrease family saving ratio …

The RBA has been attempting to wipe out the family saving buffers because it hiked rates of interest hoping that this would cut back the chance of recession.

After all, that course of has attacked the lower-end of the wealth and earnings distribution, given the rising rates of interest have poured thousands and thousands into these with interest-rate delicate monetary property.

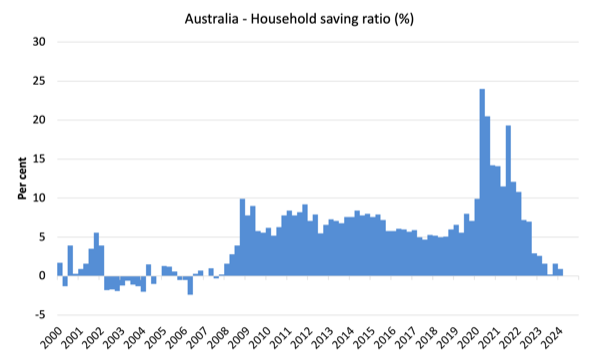

The next graph exhibits the family saving ratio (% of disposable earnings) from the December-quarter 2000 to the present interval.

It exhibits the interval main as much as the GFC, the place the credit score binge was in full swing and the saving ratio was damaging to the rise in the course of the GFC after which the newest rise.

The present place is that households are being squeezed by a mixture of rising residing prices, elevated rates of interest and low wages development, which is forcing households to scale back their financial savings fee to take care of expenditure on necessities.

Going again to the pre-GFC interval when the family saving ratio was damaging and consumption development was sustained by growing debt – which is a technique that isn’t sustainable, provided that family debt so excessive.

Households will proceed to chop again on consumption spending and that can drive the economic system in the direction of recession.

It is going to be a deliberate act of sabotage engineered by the RBA.

The next desk exhibits the impression of the neoliberal period on family saving. These patterns are replicated around the globe and expose our economies to the specter of monetary crises rather more than in pre-neoliberal a long time.

The consequence for the present decade (2020-) is the common from June 2020.

| Decade | Common Family Saving Ratio (% of disposable earnings) |

| Sixties | 14.4 |

| Seventies | 16.2 |

| Nineteen Eighties | 11.9 |

| Nineteen Nineties | 5.0 |

| 2000s | 1.4 |

| 2010s | 6.7 |

| 2020s on | 9.4 |

| Since RBA hikes | 2.4 |

Actual GDP development rose however hours labored fall – thus GDP per hour labored simply creeps up

Actual GDP rose 0.1 factors within the quarter, whereas working hours fell 0.7 per cent.

Which implies that GDP per hour labored rose by 0.1 factors for the quarter – that’s, a rise in labour productiveness.

That decreased the annual slide in productiveness development to -0.52 per cent

The next graph presents quarterly development charges in actual GDP and hours labored utilizing the Nationwide Accounts knowledge for the final 5 years to the March-quarter 2024.

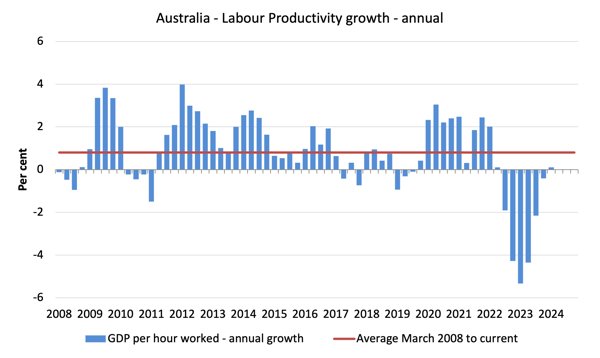

To see the above graph from a distinct perspective, the following graph exhibits the annual development in GDP per hour labored (labour productiveness) from the March-quarter 2008 quarter to the March-quarter 2024.

The horizontal crimson line is the common annual development since March-quarter 2008 (0.8 per cent), which itself is an understated measure of the long-term development development of round 1.5 per cent every year.

The comparatively sturdy development in labour productiveness in 2012 and the largely above common development in 2013 and 2014 helps clarify why employment development was lagging given the actual GDP development. Progress in labour productiveness implies that for every output degree much less labour is required.

GDP per hours labored fell for six consecutive quarters earlier than rising by 0.1 level within the March-quarter however solely as a result of hours of labor has declined sharply.

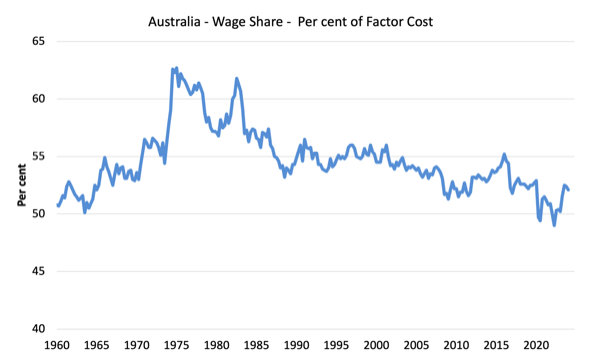

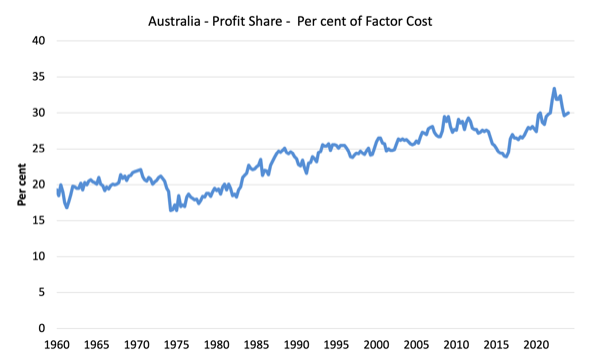

The distribution of nationwide earnings – wage share falls as revenue share rises

The wage share in nationwide earnings fell barely to 52.1 per cent (down 0.3 factors) whereas the revenue share rose to 30 per cent (up 0.2 factors).

Actual unit labour prices fell for the second consecutive quarter redistributing nationwide earnings in the direction of earnings.

The primary graph exhibits the wage share in nationwide earnings whereas the second exhibits the revenue share.

The declining share of wages traditionally is a product of neoliberalism and can in the end must be reversed if Australia is to take pleasure in sustainable rises in requirements of residing with out document ranges of family debt being relied on for consumption development.

Conclusion

Do not forget that the Nationwide Accounts knowledge is three months outdated – a rear-vision view – of what has handed and to make use of it to foretell future tendencies isn’t simple.

The info tells us that after the preliminary rebound from the lockdowns, development has now stalled at effectively under the development fee.

Furthermore, there’s now a really actual chance that Australia will enter recession within the coming yr until there’s a change of coverage path.

Recurrent authorities spending – largely resulting from transfers to ease the cost-of-living-pressures – stored GDP development from falling into the damaging territory.

However total fiscal coverage and financial coverage are squeezing family expenditure and the contribution of direct authorities spending, whereas constructive, won’t be ample to fill the increasing non-government spending hole.

On the present development fee, unemployment will rise.

And that might be a deliberate act from our coverage makers.

That’s sufficient for at this time!

(c) Copyright 2024 William Mitchell. All Rights Reserved.

[ad_2]