[ad_1]

The monetary markets all over the world have during the last week demonstrated, as soon as once more, that they’re topic to wild swings in irrationality regardless of mainstream economists holding out the concept these kinds of transactions exhibit pure rationality. Among the capital actions are defined by a shift within the rate of interest unfold between Japan and the US as the previous nation determined to extend rates of interest modestly. That altered the profitability of monetary belongings in every foreign money and so there have been margins to take advantage of. However the large seings got here when the US Bureau of Labor Statistics (BLS) launched their newest labour market information final Friday (August 2, 2024) – Employment State of affairs Abstract – July 2024 – which confirmed payroll employment growing by solely 114,000 (nicely down on expectation) and the unemployment charge rising by 0.2 factors to 4.3 per cent. All of a sudden, the headlines had been calling an imminent recession within the US and that triggered a flight into safer belongings (authorities bonds) away from shares and so forth, which drove down bond yields (as bond costs rose) and left some short-run carnage within the share markets. A couple of days later the panic subsided and one has to ask what was all of it about. On this weblog submit, I study the labour pressure information and add some new further ‘recession predictors’ to see whether or not the panic was justified. The conclusion is that it was not.

Overview for July 2023 (seasonally adjusted):

- Payroll employment elevated by 114,000 (down from 150,000 final month).

- Complete labour pressure survey employment rose by 67 thousand web (0.04 per cent).

- The labour pressure rose by 420 thousand web (0.25 per cent).

- The participation charge rose 0.1 level at 62.7 per cent.

- Complete measured unemployment rose by 352 thousand to 7,163 thousand.

- The official unemployment charge rose 0.2 factors to 4.3 per cent however with out the participation improve it will have remained at 4.1 per cent..

- The broad labour underutilisation measure (U6) rose 0.4 factors to 7.8 per cent – partly as a result of underemployment rose.

- The employment-population ratio fell 0.1 factors to 60 per cent.

For many who are confused concerning the distinction between the payroll (institution) information and the family survey information you need to learn this weblog submit – US labour market is in a deplorable state – the place I clarify the variations intimately.

Some months the distinction is small, whereas different months, the distinction is bigger.

Payroll employment tendencies

The BLS famous that:

Complete nonfarm payroll employment edged up by 114,000 in July, under the common month-to-month achieve of 215,000 over the prior 12 months …

Well being care added 55,000 jobs in July, much like the common month-to-month achieve of 63,000 over the prior 12 months …

Employment continued to pattern up in development in July (+25,000), in keeping with the common month-to-month achieve over the prior 12 months (+19,000) …

In July, employment continued to pattern up in transportation and warehousing … Transportation and warehousing has added 119,000 jobs since a latest low in January

of this 12 months.Employment in social help continued its upward pattern in July (+9,000), however at a slower tempo than the common month-to-month achieve over the prior 12 months (+23,000).

Info employment declined by 20,000 in July however has modified little over the 12 months.

Authorities employment was little modified in July (+17,000). Employment development in authorities has slowed in latest months, following bigger job good points in 2023 and the primary quarter of 2024.

Employment confirmed little change over the month in different main industries …

In abstract, month-to-month payroll employment development, whereas slowing lately, remains to be above pre-pandemic ranges because the US labour market adjusts to the brand new regular.

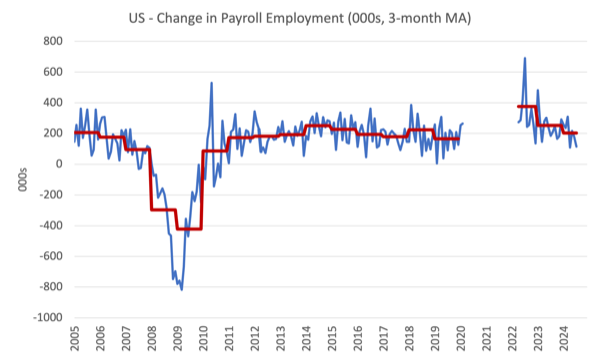

The primary graph exhibits the month-to-month change in payroll employment (in 1000’s, expressed as a 3-month shifting common to take out the month-to-month noise). The pink traces are the annual averages. Observations between March 2020 and March 2022 had been excluded as outliers.

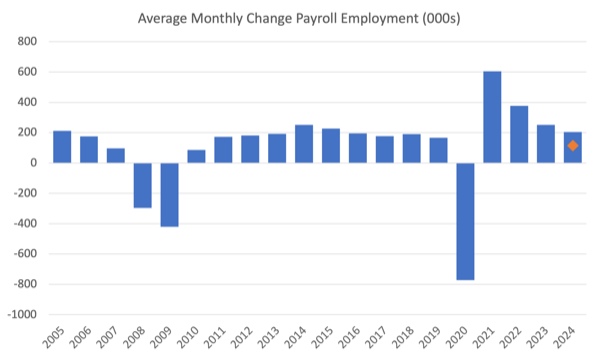

The subsequent graph exhibits the identical information another way – on this case the graph exhibits the common web month-to-month change in payroll employment (precise) for the calendar years from 2005 to 2023.

The pink marker on the column is the present month’s consequence.

Common month-to-month change – 2019-2023 (000s)

| Yr | Common Month-to-month Employment Change (000s) |

| 2019 | 163 |

| 2020 | -774 |

| 2021 | 606 |

| 2022 | 399 |

| 2023 | 251 |

| 2024 (to this point) | 203 |

Non permanent employee indicator

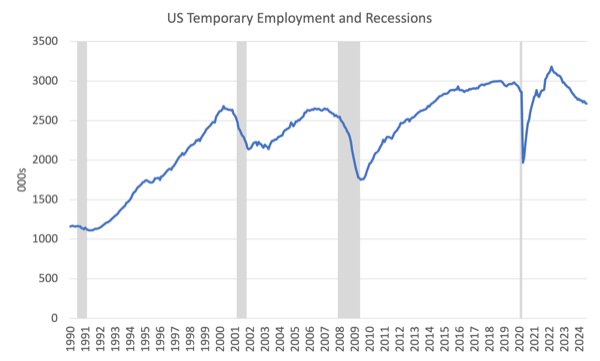

Previously (up till the 2008 recession), the shifts in short-term assist employment has been a comparatively dependable indicator {that a} main downturn was coming.

The logic was that corporations used these employees as the primary adjustment to take care of downturns in demand for his or her merchandise as a result of they had been cheaper to put off than the everlasting employees.

The next graph exhibits the motion in short-term employment since January 1990 to July 2024.

The gray bars depict the NBER Recession intervals.

It’s clear that previous to the pandemic the connection between short-term employment and subsequent recessions was pretty pronounced.

However within the interval for the reason that pandemic one thing fairly dramatic has occurred.

Non permanent employment has been in decline since late 2021 and if the previous relationship was repeated there would have been a recession in early 2022.

Fairly clearly that relationship is now modified and it’s potential that the pandemic has altered employers’ attitudes in direction of coping with cyclical fluctuations.

It’s believable that the difficulties that corporations had attracting employees throughout the pandemic has meant they should present extra safety to employees and are in search of alternative routes of adjusting to the flux and uncertainty of demand.

I’m analyzing this difficulty in additional element and can report again if I discover out something that’s attention-grabbing.

The purpose is that we are able to not use this employment cohort as a number one indicator of recession within the US.

Prime-age Employment-Inhabitants ratio indicator

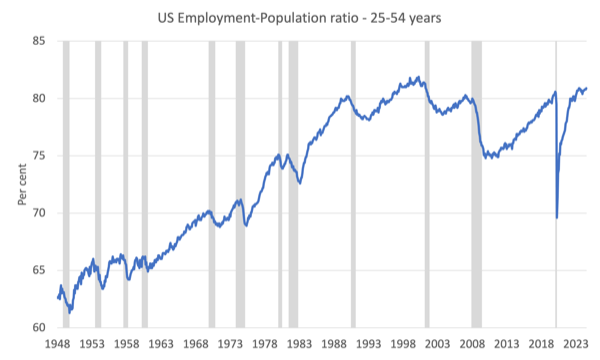

One other pretty dependable indicator of an impending recession is the Employment-Inhabitants ratio for prime-age employees (25-54 years outdated).

The next graph exhibits that information from January 1948 alongside the NBER recession dates.

This collection is a lagging indicator provided that corporations are reluctant to lay-off their core workforce earlier than they’ve made different adjustents.

Nevertheless, at current, the collection is constant to extend, which is an effective signal that there isn’t a employment collapse imminent.

Labour Pressure Survey information – employment development weaker

The seasonally-adjusted information for July 2023 reveals:

1. Complete labour pressure survey employment rose by 67 thousand web (0.04 per cent) – substantial slowing.

2. The labour pressure rose by 420 thousand web (0.25 per cent).

3.The participation charge rose by 0.1 level 62.7 per cent.

4. Consequently (in accounting phrases), whole measured unemployment rose by 352 thousand to 7,163 thousand.

5. The official unemployment charge rose 0.2 factors to 4.3 per cent.

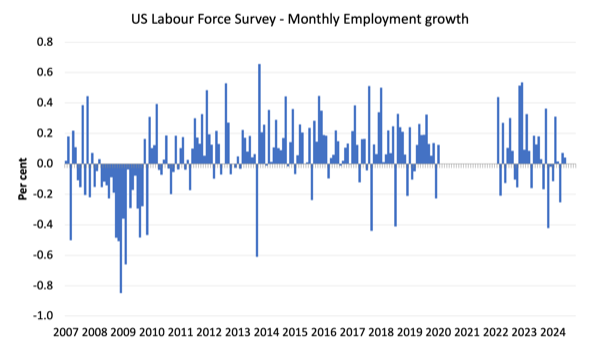

The next graph exhibits the month-to-month employment development since January 2008 and excludes the acute observations (outliers) between March 2020 and March 2022, which distort the present interval relative to the pre-pandemic interval.

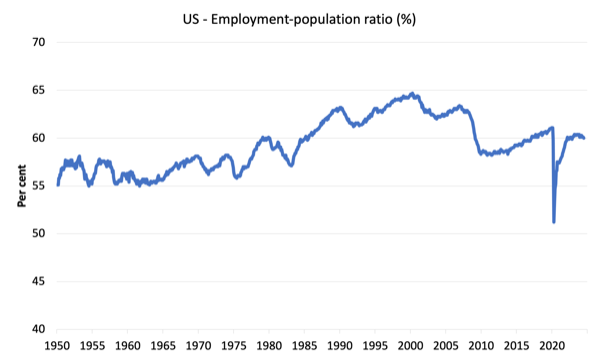

The Employment-Inhabitants ratio is an effective measure of the energy of the labour market as a result of the actions are comparatively unambiguous as a result of the denominator inhabitants just isn’t significantly delicate to the cycle (in contrast to the labour pressure).

The next graph exhibits the US Employment-Inhabitants from January 1950 to July 2024.

In July 2024, the ratio fell 0.1 level to 60 per cent.

The height degree in September 2020 earlier than the pandemic was 61.1 per cent.

The ratio has been secure round 60 per cent and a bit above for the final two years.

There isn’t a signal of a significant collapse which might point out that the demand-side is falling nicely behind the supply-side of the labour market.

Unemployment and underutilisation tendencies

The BLS notice that:

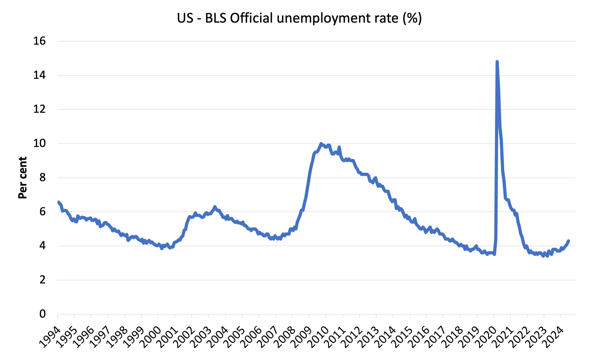

The unemployment charge rose by 0.2 proportion level to 4.3 p.c in July, and the variety of unemployed individuals elevated by 352,000 to 7.2 million. These measures are greater than a 12 months earlier, when the jobless charge was 3.5 p.c, and the variety of unemployed individuals was 5.9 million. …

The variety of individuals employed half time for financial causes rose by 346,000 to 4.6 million in July. These people, who would have most well-liked full-time employment, had been working half time as a result of their hours had been diminished or they had been unable to seek out full-time jobs.

The primary graph exhibits the official unemployment charge since January 1994.

The official unemployment charge is a slender measure of labour wastage, which implies that a strict comparability with the Sixties, for instance, when it comes to how tight the labour market, has to keep in mind broader measures of labour underutilisation.

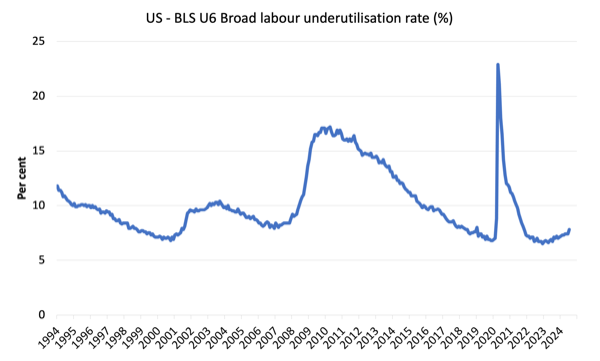

The subsequent graph exhibits the BLS measure U6, which is outlined as:

Complete unemployed, plus all marginally connected employees plus whole employed half time for financial causes, as a p.c of all civilian labor pressure plus all marginally connected employees.

It’s thus the broadest quantitative measure of labour underutilisation that the BLS publish.

Pre-COVID, U6 was at 6.8 per cent (January 2019).

In July 2024, the U6 measure was 7.8 per cent (up 0.4 factors) – partly as a result of unemployment elevated and likewise as a result of underemployment fell.

The rise in individuals employed half time for financial causes is an effective indicator of the rising underemployment.

Taken collectively, it’s clear that the labour market has deteriorated considerably.

Corporations are adjusting hours of labor first and have laid off some employees.

However it’s too early to name this a recession provided that GDP development continues, albeit at a slower tempo.

Participation impression

The participation charge rose from 62.6 per cent to 62.7 per cent in July 2024.

The query is what would the unemployment charge have been, if the participation charge had not risen and dragged extra employees in to the labour pressure?

Ideas:

- The labour pressure is a subset of the working-age inhabitants (these above 15 years outdated). The proportion of the working-age inhabitants that constitutes the labour pressure is known as the labour pressure participation charge. Thus modifications within the labour pressure can impression on the official unemployment charge, and, because of this, actions within the latter must be interpreted rigorously. A rising unemployment charge might not point out a recessing financial system.

- The labour pressure can develop on account of normal inhabitants development and/or will increase within the labour pressure participation charges (and vice versa).

Calculations:

The change within the labour pressure in July 2024 was the end result of two separate components:

- The underlying inhabitants development added 151.6 thousand individuals to the labour pressure. The inhabitants development impression on the labour pressure mixture is comparatively regular from month to month; and

- The rise within the participation charge meant that there have been 268.6 thousand MORE employees getting into the labour pressure (relative to what would have occurred had the participation charge remained unchanged).

- The online consequence was that the labour pressure rose by 420 thousand.

Evaluation:

1. If the participation charge had not have risen in July 2024, whole unemployment, given the present employment degree, would have been 6,894 thousand fairly than the official depend of seven,163 thousand – a distinction of 268.6 thousand employees (the ‘participation impact’).

2. With out the rise within the participation charge, the official unemployment charge would have been 4.1 per cent (rounded) fairly than its present official worth of 4.3 per cent).

3. In different phrases, the angst over the unemployment charge rise as an indication that the labour market was getting into recession is considerably untimely.

Conclusion

The newest month-to-month US employment information exhibits payroll employment slowing fairly considerably.

The unemployment charge additionally rose on the again of a reasonably brisk tempo of labour pressure development (with a slight uptick in participation).

The participation charge rose by 0.1 level and with out that the unemployment charge would have remained at 4.1 per cent fairly than the official charge of 4.3 per cent.

Different indicators of recession are both not dependable (short-term employees) or a nonetheless not suggesting a significant downturn (employment-population charge of prime-age employees).

Total, with GDP development nonetheless optimistic, I believe it was untimely to hurry right into a recession mindset.

That’s sufficient for as we speak!

(c) Copyright 2023 William Mitchell. All Rights Reserved.

[ad_2]