[ad_1]

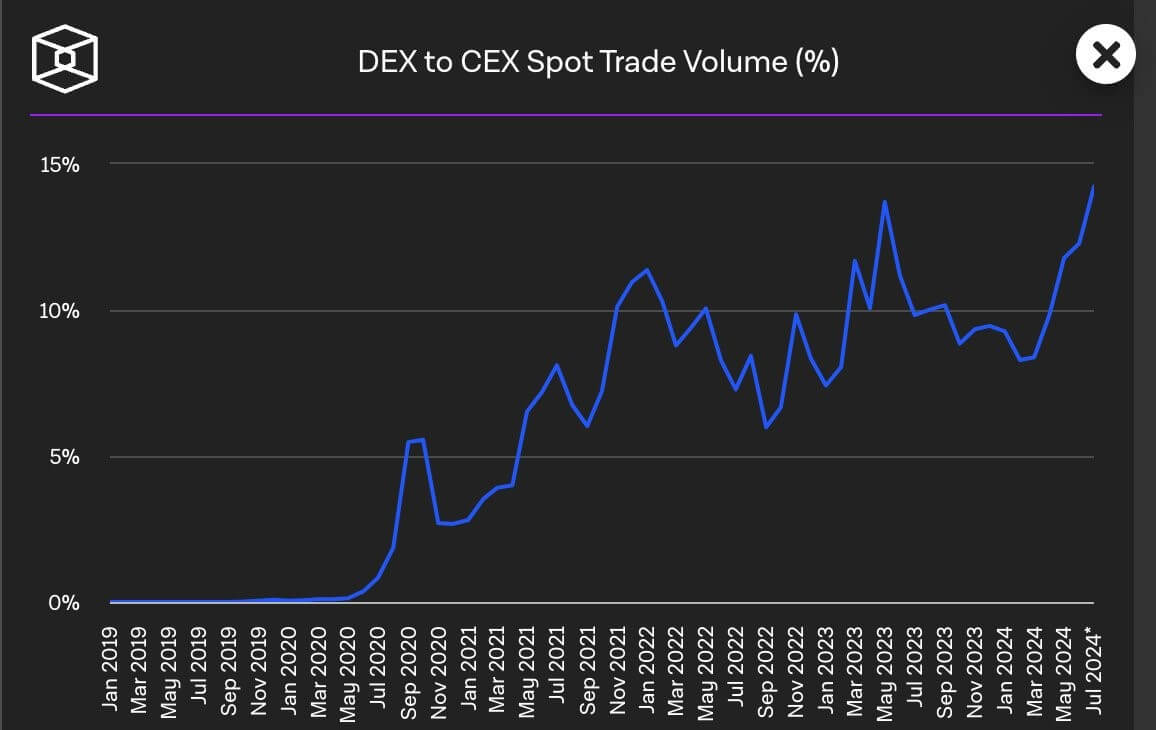

Decentralized exchanges (DEXs) now have their highest-ever buying and selling quantity ratio in comparison with centralized exchanges (CEXs).

On July 29, Uniswap founder Hayden Adams highlighted this achievement, noting that “DEX market share is at an all-time excessive relative to CEX.”

Adams referenced a chart from The Block displaying that DEX buying and selling volumes have been rising for the reason that begin of this yr.

This pattern correlates with a broader bullish market, pushed by the US Securities and Change Fee’s (SEC) approval of spot exchange-traded funds (ETFs) for main digital belongings, together with Bitcoin and Ethereum.

Notably, the expansion in DEX exercise additionally comes throughout elevated institutional and political curiosity within the crypto market, particularly because the US election approaches.

DEX quantity rising

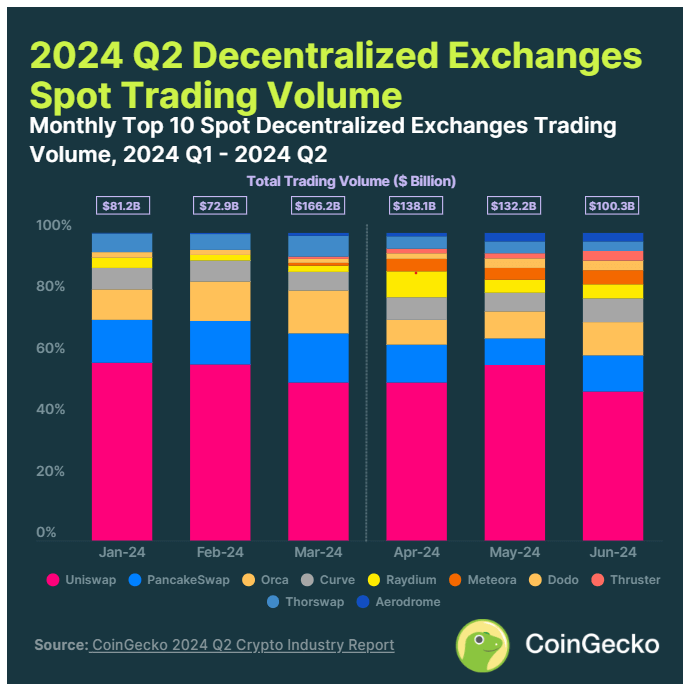

The above confirms findings from CoinGecko’s lately launched second-quarter report, which exhibits a big shift in crypto buying and selling patterns. The information signifies a decline in spot buying and selling quantity on centralized exchanges, whereas DEXs have skilled a notable improve.

Through the second quarter, buying and selling quantity on the highest 10 DEXs surged 15.7% from the earlier quarter, reaching $370.7 billion. This progress is essentially attributed to an increase in memecoins and a flurry of airdrops throughout this era.

Uniswap remained the main DEX, commanding 48% of the market share by the tip of June. New entrants like Thruster and Aerodrome additionally noticed substantial progress, difficult established gamers within the decrease tier of the DEX market.

Conversely, centralized exchanges noticed a 12.2% drop in spot buying and selling quantity, totaling $3.4 trillion for the quarter. Regardless of this decline, Binance continued to guide the market with a forty five% share, whereas different exchanges reminiscent of Bybit, Gate.io, Bitget, and HTX carried out properly.

Talked about on this article

[ad_2]