[ad_1]

After the Far Proper Nationwide Rally (RN) took the prizes within the current European Parliament elections and significantly dented the electoral attraction of Emmanual Macron’s grouping, the French President determined to observe the British script and dissolved the French Parliament and known as a snap election, the primary spherical of which is able to happen on June 30, 2024 and the second spherical per week later. Far proper events additionally did properly in Germany, Italy and Austria, however all of the speak of a pointy swing to the suitable in Europe was overstated, on condition that in different nations, the Proper vote was not as robust. The offers to present the European Fee presidency to VDL for an additional time period had been then in full sway. And inside days we began to watch some unusual behaviour within the bond markets with the 10-year bond spreads towards the German bund rising sharply with accompanying warning bells from the mainstream politicians – some even venturing to assert in France’s case that it might expertise a ‘Truss second’ if Macron was not returned to workplace, regardless of his authorities floundering attributable to its poor coverage making. None of this could come as a shock. The European Union is probably the most superior instance of neoliberalism, on condition that the ideology is constructed into its authorized constructions and the establishments are required to implement it. There are numerous examples, of the primary establishments – the Fee and the ECB – performing individually and collectively to drive political outcomes that they deem to be fascinating from the attitude of sustaining the established order. All of the angst in the previous couple of weeks about interference within the upcoming French election is absolutely stunning given the monitor report of those our bodies. The entire system has been designed and run to keep up the company pursuits of the elites. Pure and easy. The present state of affairs isn’t any exception.

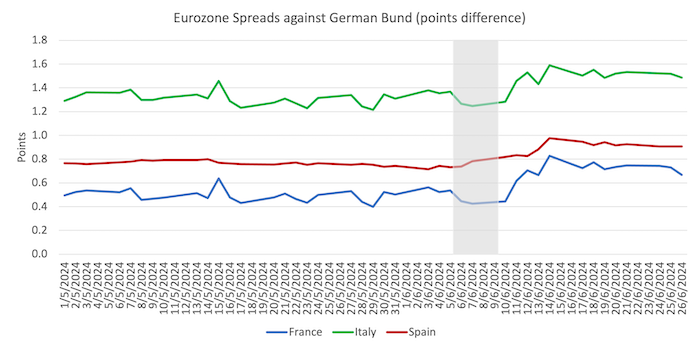

The graph under reveals the 10-year bond spreads for France, Italy and Spain from the beginning of Could 2024 as much as yesterday (June 26, 2024).

Italy and Spain diverged from France in the course of the GFC, after which Italy diverged from Spain round 2018.

The newest knowledge reveals that the hole between France and Spain has narrowed significantly over the past month.

The gray space is the interval of the European elections (June 6-9, 2024).

Over the interval proven, the 10-year bond yield for the German bund has barely moved, falling barely, whereas the opposite nations proven have seen their bond yields (and deficit financing prices) rise marginally.

Don’t be deceived by the size of the graph – the bond yields in France rose from 2.988 per cent on June 6, 2024 to a peak of three.239 per cent on June 11, 2024 after which fell again to three.119 per cent on June 26, 2024.

For Italy, they rose from 3.807 per cent on June 6, 2024 to a peak of 4.081 per cent on June 11, 2024 after which fell again to three.93 per cent on June 26, 2024.

For Spain, they rose from 3.282 per cent on June 4, 2024 to a peak of three.493 per cent on June 10, 2024 after which fell again to three.358 per cent on June 26, 2024.

These shifts are nothing like we witnessed in the course of the GFC when Spain and Italy diverged from the German 10-year bond yield by at the very least 6 proportion factors and France by greater than 1 level.

The coincidence between the tip of the election interval and the revelations that accompanied the publication of the outcomes led many Leftish commentators to pronounce that it was a conspiracy led by the monetary markets to derail something aside from pro-euro (centrist) governments in order that Ursula VDL would return to the Presidency and the elites would proceed to benefit from the smug prosperity that the frequent foreign money has delivered to them – on the expense of the various.

There have been reasonably inflammatory remarks within the press that the ECB was manipulating markets to permit the centrists (a misnomer if there ever was one) to stay in management.

There have been modifications on the ECB entrance with the phasing out of the Asset Buying Packages which have dominated financial coverage for the reason that GFC and the 2022 introduction of the so-called – Transmission Safety Instrument (TPI) – or anti-fragmentation device to switch the bond yield management that the APPs gave the ECB.

The ECB claimed the TPI was important to permit for a normalisation of financial coverage – which is identical type of justification it gave for every of the assorted asset buying packages that started in Could 2010 with the introduction of the Securities Markets Program.

It was a ridiculous argument – pretending that the ECB wanted to purchase billions of euro value of presidency bonds to permit for clean open market operations and repos to be performed.

Solely a small fraction of what they really ended up shopping for was wanted for these financial coverage functions.

The justifications had been a smoke display screen to obscure the fact that the ECB, because the currency-issuer was not directly funding fiscal deficits within the Eurozone for concern that if it didn’t many countries together with Italy and Spain could be compelled to default on its excellent authorities debt, which might finally end in a break-up of the frequent foreign money.

The ECB couldn’t come clear as a result of it might have meant they had been publicly acknowledging a violation of their authorized obligations below the European treaties pertaining to no bail outs.

However that’s all historical past.

Extra just lately, because it phased out the asset purchases, it realised that the Member State bond markets had been nonetheless vulnerable to monetary instability as a result of everybody is aware of the debt issued by these nations carries credit score danger.

The reason being that the Member States use what’s successfully a overseas foreign money and should borrow from the bond markets to run deficits.

If the deficits get too giant, the default danger rises and the bond markets demand greater yields as much as some level, after which they’ll cease shopping for the debt.

However as I’ve famous many occasions earlier than, the ECB can forestall this type of monetary instability very simply – by buying the debt within the secondary bond markets after it has been issued, which drives up the demand for the belongings (and the worth) and drives down the yields on the paper.

The TPI thus permits the ECB to assert that it’s normalising its stability sheet by phasing out the sooner bond purchases.

However that’s smoke and mirrors too – as a result of the TPI is simply one other model of the identical asset buying packages which have change into a type of alphabet soup because the ECB modifications the names to present the impression it’s evolving its coverage stance.

The ECB tells us that the TPI signifies that:

… the Eurosystem will be capable to make secondary market purchases of securities issued in jurisdictions experiencing a deterioration in financing circumstances not warranted by country-specific fundamentals, to counter dangers to the transmission mechanism to the extent obligatory. The size of TPI purchases would depend upon the severity of the dangers going through financial coverage transmission. Purchases should not restricted ex ante.

In English – the ECB and its accomplice Member State central banks can purchase up the debt of any Member State authorities in limitless portions if the bond spreads rise and threaten monetary stability.

Clear sufficient.

As traditional, there’s conditionality – “The Governing Council will think about a cumulative listing of standards to evaluate whether or not the jurisdictions during which the Eurosystem could conduct purchases below the TPI pursue sound and sustainable fiscal and macroeconomic insurance policies.”

So:

… (1) compliance with the EU fiscal framework: not being topic to an extreme deficit process (EDP), or not being assessed as having did not take efficient motion in response to an EU Council advice … (2) absence of extreme macroeconomic imbalances … (3) fiscal sustainability: in ascertaining that the trajectory of public debt is sustainable … (4) sound and sustainable macroeconomic insurance policies: complying with the commitments submitted within the restoration and resilience plans …

This the place the politics enters.

The EU has not been constant in its utility of any of the fiscal enforcement guidelines.

Completely different nations have been handled otherwise regardless of having comparable rule breach magnitudes.

Which is, partially, why individuals are accusing the ECB of being political.

The query they ask is why the ECB didn’t invoke the TPI within the days following the European elections when the spreads began to rise?

The French financial system is in dire form after years of the neoliberal insurance policies which have stifled innovation and decreased productiveness development in addition to residing requirements.

After which France already reeling from the coverage abuse got here up towards the pandemic, the availability constraints, the Ukraine warfare and the ensuing the inflationary pressures.

Life for the common employee in France in materials phrases has deteriorated considerably over the course of Macron’s tenure.

However the claims that the monetary markets had been “spooked” by the fiscal state of affairs and that led to the bond yields rising (Supply) don’t stack up.

The fiscal state of affairs has been recognized for some years (for the reason that pandemic) and has been absorbed by the monetary markets.

The RN chief has additionally been clear that the Get together is just not about to go on a spending spree ought to it acquire a parliamentary majority within the upcoming election.

The Get together has promised to (Supply):

… convey France’s deficit again to three per cent of gross home product by 2027, which is the extent set out by EU guidelines.

In reality, he’s promising extra extreme austerity than Macron has introduced.

The European Fee additionally entered the fray and determined that it might do what it might do affect the election consequence by saying that France was being positioned within the – Extreme Deficit Process.

On June 19, 2024, the Fee launched a – Report below Article 126(3) of the Treaty on compliance with the deficit and debt standards – which represents:

… the primary report below Article 126(3) TFEU after the deactivation of the overall escape clause on the finish of 2023, is in accordance with the principles of the reformed framework.

So the relief of the fiscal guidelines in the course of the pandemic is over and the Fee is now targetting Belgium, Czechia, Estonia, Spain, France, Italy, Hungary, Malta, Poland, Slovenia, Slovakia and Finland for extreme deficits.

The query that’s inconceivable to reply clearly is whether or not they lumped all the opposite nations into this edict to cover the very fact they needed to affect the French election.

My reply is that the Fee was not discriminating in that manner.

The French authorities although hasn’t helped issues.

The Economic system Minister, the bumbling Bruno Le Maire claimed that if the voters selected RN within the upcoming election:

A Liz Truss-style situation is feasible …

Somebody ought to have identified to Le Maire that evaluating France, with no foreign money, to Britain with its personal foreign money and limitless capability to create it, simply demonstrates the ignorance of the individual making the comparability.

However you may see how shortly the sound finance sorts undertake ‘strains within the sand’ or ‘lurid examples’ to push into the political fray at any time when it appears handy, regardless of the validity.

The Left does this typically – the Britain compelled to borrow from the IMF in 1976 lie, the Mitterand needed to impose austerity in 1983 lie, the Black Wednesday lie, and, now it appears the “Liz Truss-style situation” lie.

The state of affairs in Britain arose as a result of the monetary markets knew that Truss was on shaky political floor and would again down on the slightest downside.

So that they knew they may drive the weak authorities to ratify their monetary market bets of their favour.

The identical type of actions have been tried in Japan for years with out success as a result of the authorities stare the markets down.

However the French authorities can not simply stare anybody down as a result of it doesn’t have its personal foreign money sovereignty and is reliant on an ideologically-obsessed ECB (the foreign money issuer) for monetary solvency.

The ECB and the EC then mix (with the IMF added typically) to bully the Member States into submission.

Nothing just like the political state of affairs within the UK.

The markets know that it might impose a Greek-style compliance on France and the French authorities has little volition – just because it surrendered its personal foreign money.

So what concerning the ECB’s reluctance to invoke its TPI?

The official line, which was expressed by the chief economist and board member to an viewers in London on June 17, 2024 was:

What we’re seeing within the markets is, in fact, a repricing … It’s not, you already know, the world of disorderly market dynamics … So it’s essential that the ECB makes clear that we are going to not tolerate unwarranted and disorderly market dynamics that may pose a critical menace to the transmission of financial coverage … We can not have a case the place primarily market panic, market illiquidity, market sentiment disrupts our financial coverage.

Was {that a} affordable evaluation?

Nicely in case you take a look at the graph above it’s clear that the bond market pressures are abating considerably, with out the TPI getting used.

That doesn’t recommend that the ECB by its reluctance to do something because the spreads rose is making an attempt to orchestrate some chaos in France.

The extra possible interpretation is that the monetary markets are skittish at one of the best of occasions and responded to the election ends in early June by promoting off bonds they deemed to be dangerous till additional data emerged.

The sell-off impacted not solely France however different weaker Eurozone Member States.

And as soon as issues grew to become a bit clear, the state of affairs stabilises.

In fact, the ECB in all probability realised that leaving the spreads to rise for a number of days would heap stress on possible unfastened cannons (learn RN in France) to appease the markets.

Certain sufficient RN, for instance, has been at pains to guarantee everybody that they aren’t a wild spending outfit.

That shouldn’t shock anybody.

The ECB has constantly, by its conditionalities, acted in a political technique to backup the Fee in its austerity bias.

The entire Greek fiasco in June 2015, when the ECB successfully deserted its remit to keep up monetary stability, is an excessive instance of its political position.

The entire frequent foreign money is a political construction to maximise the management of the company elites of Europe.

The neoliberal ideology is embedded within the authorized construction of the union, which is why I’ve known as the European Union probably the most superior instance of neoliberalism.

Which, in flip, is why I supported Brexit.

That actuality is why the progressive arguments for reform of the treaties is bunk.

Within the present state of affairs, the stress is being positioned on RN, which is on the reverse finish of the spectrum from the Left-wing events that aspire to energy.

However any political group that doesn’t toe the road and help the established order in Europe will probably be punished by the bond markets and the EC and ECB will manipulate that to make sure the message is shipped however to not the extent that insolvency and exit turns into a actuality.

The conduct of those establishments for the reason that GFC makes that very clear.

Which suggests, that any progressive aspirations should embody exit and the reintroduction of foreign money sovereignty, which might free the nation from the bond markets and the neoliberal ECB and EC.

Conclusion

No actual surprises in any of this.

That’s sufficient for as we speak!

(c) Copyright 2024 William Mitchell. All Rights Reserved.

[ad_2]