[ad_1]

Single-family and multifamily housing begins fell in Could as excessive rates of interest for building and improvement loans and elevated mortgage charges held again each housing provide and demand.

General housing begins fell 5.5% in Could to a seasonally adjusted annual price of 1.28 million items, in response to a report from the U.S. Division of Housing and City Improvement and the U.S. Census Bureau.

The Could studying of 1.28 million begins is the variety of housing items builders would start if improvement saved this tempo for the subsequent 12 months. Inside this total quantity, single-family begins decreased 5.2% to a 982,000 seasonally adjusted annual price. Nevertheless, on a year-to-date foundation, single-family begins are up 18.8%, albeit off weak early 2023 knowledge. Mortgage charges averaged 7.06% in Could per Freddie Mac, the very best studying since November 2023. This excessive rate of interest surroundings is inflicting many potential patrons to stay on the sidelines.

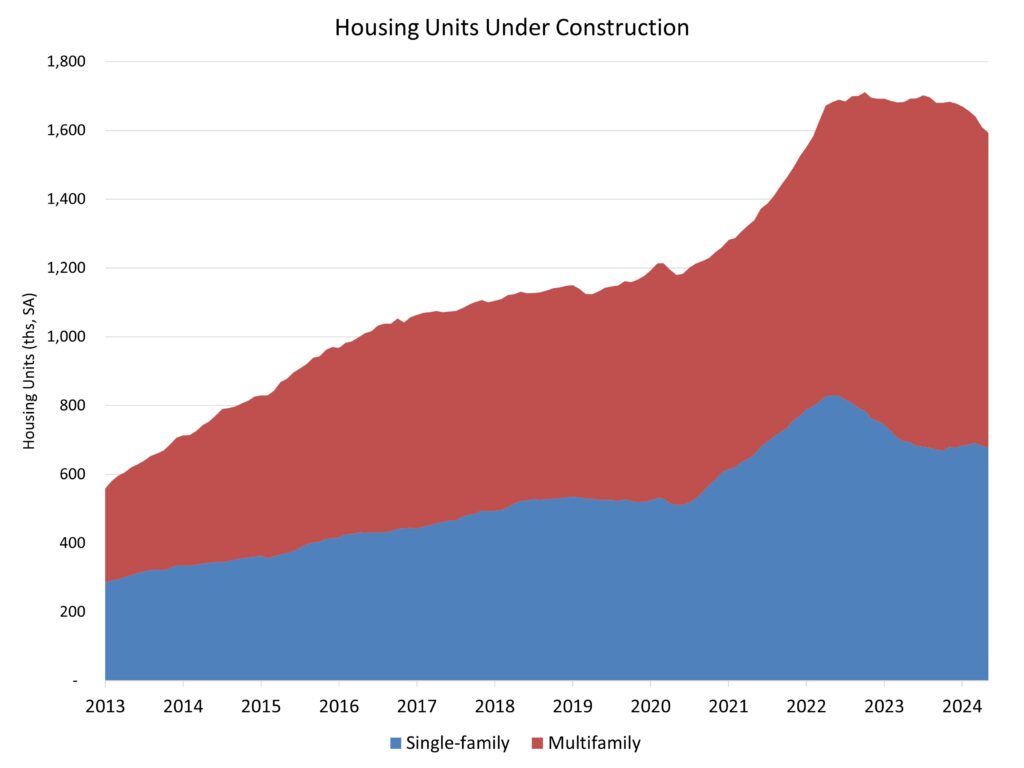

The multifamily sector, which incorporates residence buildings and condos, declined 6.6% to an annualized 295,000 tempo. That is the bottom tempo for residence building since April 2020. The three-month shifting common for multifamily begins is the bottom because the fall of 2013 because the multifamily improvement deceleration continues.

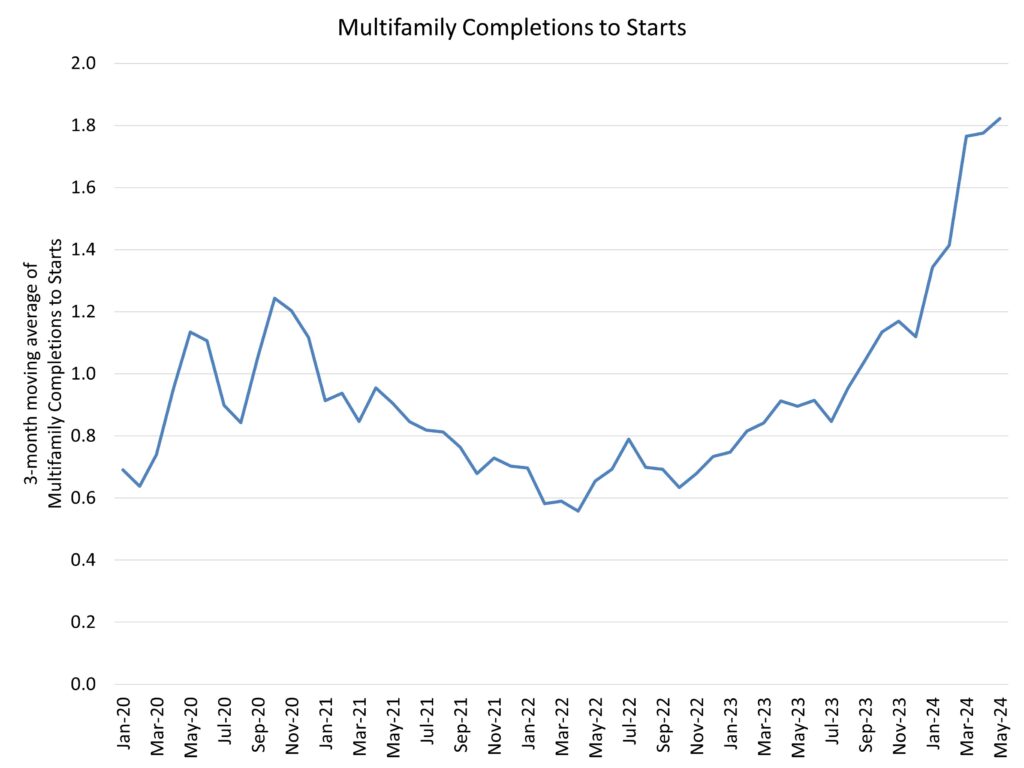

The ratio of multifamily completions to begins (the full variety of residences finishing building in comparison with these beginning building) was 1.8 in Could, near tied with April for the very best ratio since COVID-19. This ratio was 0.6 in April 2022, when many extra residences have been beginning building in comparison with ending building, demonstrating the numerous reversal for the multifamily building pipeline.

The variety of residences underneath building is now all the way down to 914,000, the bottom rely since September of 2022 and down 11% because the peak price in July 2023. There are 679,000 single-family properties underneath building, off 18% since late Spring 2022.

On a regional and year-to-date foundation, mixed single-family and multifamily begins are 22.2% decrease within the Northeast, 8.0% decrease within the Midwest, 2.3% decrease within the South and a pair of.6% increased within the West. Declines for multifamily building are driving the weak spot for these areas exhibiting year-to-date complete housing begins declines.

General permits decreased 3.8% to a 1.39-million-unit annualized price in Could. Single-family permits decreased 2.9% to a 949,000 unit price; that is the bottom tempo since June 2023. Multifamily permits decreased 5.6% to an annualized 437,000 tempo.

regional knowledge on a year-to-date foundation, permits are 0.7% increased within the Northeast, 5.3% increased within the Midwest, 0.8% increased within the South, and 1.5% decrease within the West.

Uncover extra from Eye On Housing

Subscribe to get the newest posts to your electronic mail.

[ad_2]