[ad_1]

Nothing actually happens in a vacuum.

All occasions have previous elements, with many prior components effervescent under the floor, most of which you didn’t even know existed. Unintended penalties of this motion right here could create results over there. If the flapping of a Butterfly’s wings might be felt midway around the globe, think about the affect of the biggest central financial institution intervention and emergency authorities fiscal program within the trendy period.

Individuals desire definitive, clear solutions about massive points. Sadly for these people, the economic system and markets are and — will at all times be — rather more complicated than that. We could desire easy sure or no, black-and-white, binary analyses, however all that oversimplification does is affirm your priors. To get a deeper understanding of what’s taking place at any second requires nuance, permits for a number of causation of occasions, and accepts simply how a lot uncertainty there may be over what the longer term could convey.

I discover it helpful to interact in a thought experiment: Listing all the elements that would possibly be contributing to any explicit occasion; I’ve finished this with the dotcom implosion, 9/11, the nice monetary disaster, externalities, the pandemic economic system, 2020s inflation, and different main dislocations, and discover it to be useful to my thought course of.

The present state of financial occasions, so complicated to so many, has many sires. My high 10 of how we acquired to our present state of affairs seems one thing like this:

1. Nice Monetary Disaster: There have been many outcomes of the GFC, however a couple of stand out as particularly necessary: A large Financial Coverage response from the Federal Reserve, which itself was brought on (partially) by the punk Fiscal Coverage response from Congress. This led to a reasonably typical post-credit disaster restoration: Weak GDP, subpar job creation, lagging wages, and delicate client spending.

2. ZIRP/QE wasn’t all dangerous: Shares had their finest decade in a technology, bonds rallied as effectively, and the whole lot priced in {dollars} and credit score did effectively. The world was awash in capital, and in the event you had any to speculate, you probably did nice, but when all you had was your labor, you fell badly behind.

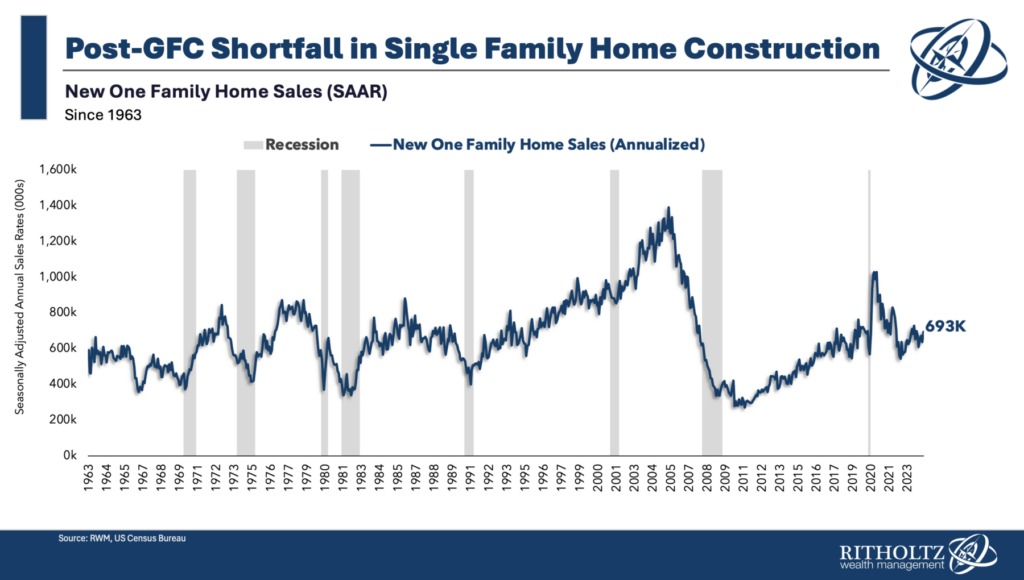

3. Dwelling Builders pivot to multi-family: The GFC devastated the graduating lessons within the late 2000s and even early 2010s. Jobs have been tougher to seek out, and so they paid much less. Family formation fell dramatically, and we heard infinite tales of grownup kids residing of their father or mother’s basements. Single-family dwelling development peaked in 2005-06 after which fell 80% to its nadir in 2010. It climbed slowly again to its prior common over the subsequent decade. The consequence was a nation wanting 2-4 million properties.

4. Wealth Inequality widened over the 2010s. When the principle coverage response to any disaster is Fed-driven, the main focus is on capital, markets, and liquidity. (This has very particular beneficiaries). The rescue of banks however not the general public and the widening of wealth/earnings inequality gave rise to political popularism, declining belief in establishments, and a drop off in optimism & sentiment.

5. Pandemic. Into this complicated brew comes the pandemic. The an infection and loss of life rely soared, and we have been terrified into washing our groceries. In occasions of Emergencies, governments are sometimes offered with two choices: Unhealthy or Worse. The appropriate selection was made to throw lots of money on the downside: Big enhance in unemployment funds and plenty of cash into Operation Warp Pace to create a vaccine.2

For the economic system, the “Unhealthy or Worse” selection was surging inflation (dangerous) or large unemployment (worse).

6. Labor Scarcity: A lot of elements contributed to the present shortfall of employees: Enormous decreases in authorized immigration, a spike in incapacity, and manner too many Covid-related deaths. However neglected is the affect of people that have been locked up at dwelling with nothing to do, however with money of their financial institution accounts. So much rose to the event to vary careers, launch new companies,(new enterprise formation have been close to record-breaking tempo) capitalize on their newfound abilities, and pursue a greater life for themselves.

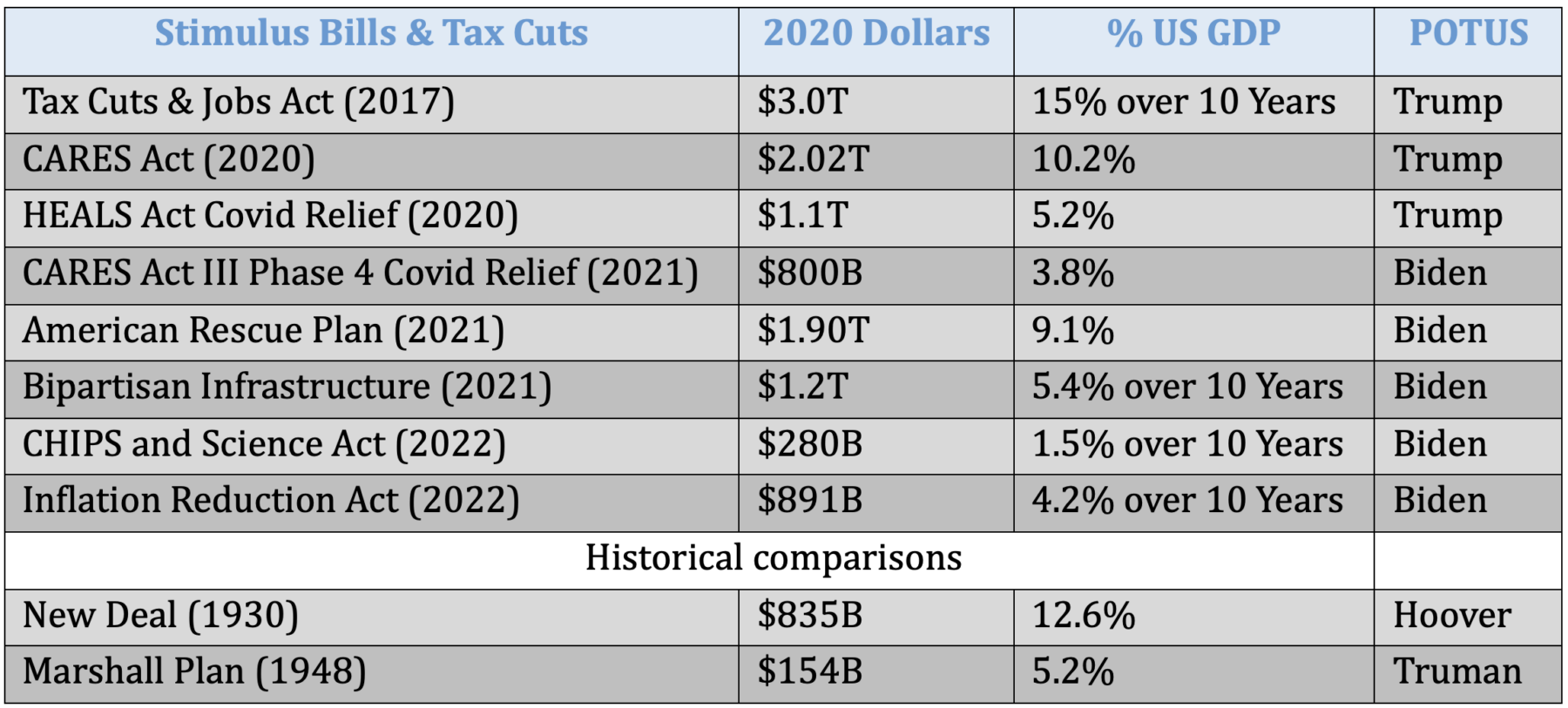

7. Regime Change: CARES Act 1 (2020) at $2T and 10% of GDP was the biggest fiscal stimulus since WW2. It was adopted by CARES Act 2 ($800B), after which (Beneath President Biden) CARES Act 3 ($1.7T) ). The practically $5 trillion in fiscal stimulus and the rise from 0 to five.25% in Fed funds charge signaled that the period of financial stimulus was over, changed by a brand new regime of fiscal stimulus.

7. Regime Change: CARES Act 1 (2020) at $2T and 10% of GDP was the biggest fiscal stimulus since WW2. It was adopted by CARES Act 2 ($800B), after which (Beneath President Biden) CARES Act 3 ($1.7T) ). The practically $5 trillion in fiscal stimulus and the rise from 0 to five.25% in Fed funds charge signaled that the period of financial stimulus was over, changed by a brand new regime of fiscal stimulus.

8. Inflation Surges: A couple of folks (notably Wharton’s Jeremy Siegel and Ed Yardeni) warned that the fiscal stimulus would result in a large (albeit transitory) surge in inflation. The Fed was late to acknowledge this, late to boost charges, late to see the height in inflation, and late to start reducing charge. (That is regular).

Wages and inflation each run up; CPI rises 20% for the reason that pandemic; Wages add 22%. The client continues to spend.

9. Inflation Peaks and Falls (however the Fed is late to acknowledge this). PCE falls to 3ish p.c yr over yr, as does CPI. Goal cuts costs on 5,000 gadgets; McDonald’s brings again the $5 meal deal.

10. Lagging Housing Information: Shelter is artificially retains CPI within the 3s; its 40% of the inflation measure, however the BLS mannequin is badly behind present measures.

There are extra sub-issues right here, particularly in the case of housing and inflation, wages, and sentiment. That is how we acquired right here; there are heaps extra nuances and points, however it’s exhausting to know at this time in the event you shouldn’t have a agency grasp of historical past…

Beforehand:

Who’s to Blame, 1-25 ( June 29, 2009)

Finish of the Secular Bull? Not So Quick (April 3, 2020)

Who Is to Blame for Inflation, 1-15 (June 28, 2022)

Elvis (Your Waiter) Has Left the Constructing (July 9, 2021)

How All people Miscalculated Housing Demand (July 29, 2021)

Revisiting Peak Inflation (June 29, 2022)

Why Is the Fed At all times Late to the Celebration? (October 7, 2022)

Which is Worse: Inflation or Unemployment? (November 21, 2022)

Why Aren’t There Sufficient Staff? (December 9, 2022)

The Least Unhealthy Selection (September 28, 2023)

Understanding Investing Regime Change (October 25, 2023)

Wages & Inflation Since COVID-19 (April 29, 2024)

Why the FED Ought to Be Already Slicing (Could 2, 2024)

__________

1. We will go additional again to the dotcom implosion or LTCM or the 1987 crash, however to maintain the size of our dialogue modest, I’ll solely return 15 or so years to the GFC.

2. Operation Warp Sped was essentially the most profitable program of the Trump administration. THey principally bungled the remainder of the pandemic, at first not taking it critically and by the point they did, we have been deeply behind, wanting important merchandise. I’ve but to see any good rationalization as to why the Emergency Protection Act was not used for PPE and different necessities.

[ad_2]