[ad_1]

I’ve recognized Josh for practically 15 years.

Regardless of his writing in public that total time, internet hosting two weekly exhibits on our YouTube channel, and exhibiting up on CNBC 3 times per week, you don’t know him. Public persona apart, he’s surprisingly personal.

I do know him in addition to anybody moreover Sprinkles and perhaps Batnick.

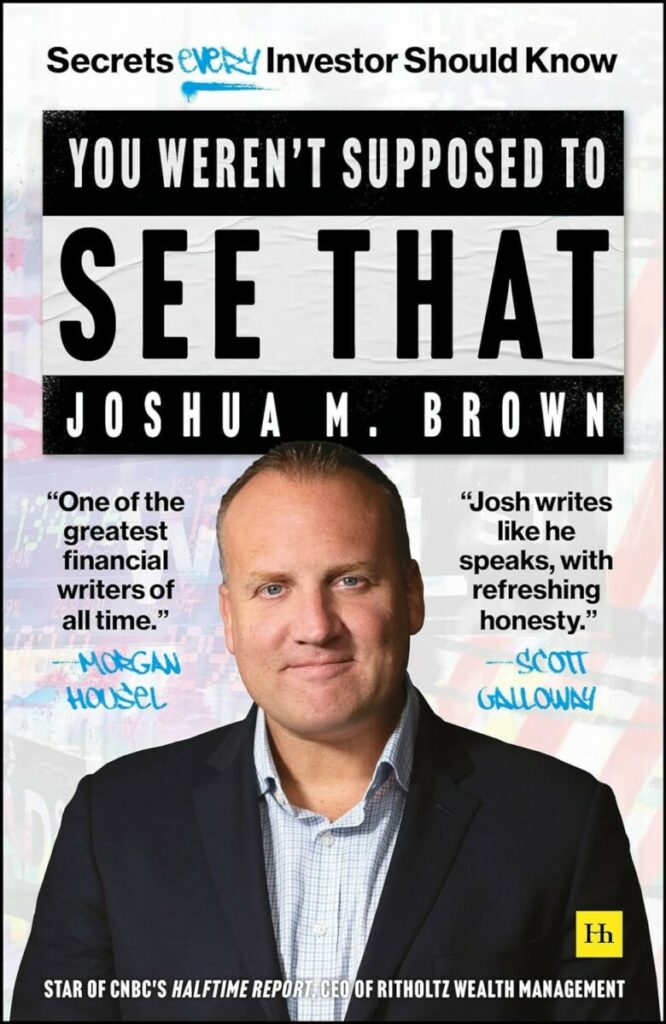

I’m going to share three issues about Josh that you simply don’t know. I’m snug outing him as a result of he already outed himself in his fabulous new guide, “You Weren’t Supposed To See That.”

It’s in contrast to some other finance (fin-nance?) guide I’ve ever learn: Compulsively devourable, fantastically written, and fairly revealing.

Somewhat than write a straight up evaluation, I’m going to make use of quotes from his guide as an excuse to share three issues about my accomplice you ought to know.

1. He’s a rare historian of Wall Road and the monetary companies trade:

There are few those who have a greater understanding of this trade than Josh. Not simply due to his private experiences as a stockbroker or an advisor, or as a supervisor (as soon as) of a brokerage agency and (now) an RIA – however due to his deep curiosity about what makes this trade tick.

He sees what others miss – he dives into the information, understands the personalities, and is an astute scholar of human conduct. All of that comes by means of within the guide.

Within the chapter “When every part that counts can’t be counted,” he explains why shopping for ever dearer shares is each the important thing to outperforming — and why no mutual fund supervisor is able to doing it:

“You don’t go house to Greenwich out of your Park Ave workplace in an excellent temper when the market makes it some extent to remind you of how vestigial your abilities have develop into day after day.”

He explains the impression of free capital, the refined shift from worth to progress, away from exhausting belongings and in the direction of mental property.

But it surely’s the information that drives how altering enterprise methods impression our understanding of market conduct. From “The Relentless Bid” comes the primary clarification that resonates as to how and why the market’s character modified a lot within the 2010s:

“Morgan Stanley wealth administration took in a large $51.9 billion in payment solely asset flows for the complete 12 months 2013; 37% of Morgan Stanley wealth administration’s complete consumer belongings at the moment are in payment primarily based accounts a report excessive.

Financial institution of America Merrill Lynch’s wealth division had equally astounding outcomes: $48 billion in flows to long run AUM in 2013; the brokerage reported that 44% of its advisers had half or extra of their consumer belongings underneath a payment=primarily based relationship.

Wells Fargo Advisors stated on the finish of 2013 it had $375 billion in managed account belongings, roughly 27% of the $1.4 trillion in complete AUM…”

As he observes, it wasn’t the shift from lively to passive – that had been ramping up for many years – moderately, it was the changeover from transactional fee enterprise to a fee-based fiduciary mannequin that made all the distinction.

Josh shares even deeper insights into the investing trade, in “8 Classes from Our First 12 months.” We have been all somewhat overwhelmed in 12 months one, however he was clear-eyed in regards to the challenges forward.

This additionally will get mirrored in his shows on Wall Road – should you ever get an opportunity to see one, Don’t-Stroll-Run to be in that viewers. Not solely are his decks hilarious, however you’ll go away a lot extra knowledgeable about this trade than you may think about.

2. Josh has one of many highest EQs of anybody you’ll ever meet. (This issues rather a lot).

This manifests in a few attention-grabbing methods: First, he has zero tolerance for bullshitters, charlatans, assholes, and anybody attempting to separate trustworthy traders from their cash. (All of us share this trait in frequent). However he has an uncanny capability to see into individuals’s souls and decide them for who they are surely deep down inside.

That is an enormously useful ability when you’re hiring individuals. I’ve misplaced depend of the variety of occasions that 30 seconds into an interview, I’ve gotten a side-eyed look from him that claims “Loser. I’m out.” It’s uncanny. Over time, I’ve discovered to belief his instincts as he has invariably been proper.

Second, his EQ is revealed in who he’s keen to belief: Visitors he has on The Compound & Pals, the associates we affiliate with, and numerous corporations we do enterprise with. Its evident in his admiration for individuals like David Tepper:

“In each market second, there’s one man – and it’s at all times a person – who’s deified by his friends and the media; an anointed one in each sense of the time period. His each phrase is held on, his pronouncements are the day’s dialogue, his off-the-cuff remarks develop into the enterprise press’s entrance web page headlines the next day. David Tepper now occupies this place within the firmament, wholly and fully…

All of his perception into who’s worthy of your time (or not) is on show within the guide; oh, and he names names:

“David Tepper is turning into right this moment’s Hedge Fund God. He’s youthful than Soros and Cooperman, much less cantankerous than Loeb and Icahn, can declare larger returns than Einhorn and Ackman, carries not one of the regulatory taint of Steve Cohen, and has all the garrulous authenticity that just about none of his friends possess when in a public setting.”

I can get starry-eyed about anyone’s large media profile or historical past at legendary corporations like Goldman Sachs, Merrill Lynch, or Morgan Stanley. He suffers from none of that. If you’re worthy, he lets us know; if you’re an asshole, you can’t conceal from him.

“Laborious cross, subsequent candidate.”

3. He’s an anguished poet, not a finance bro.

That is the deepest, darkest secret I’m sharing with you right this moment. And it’s his worst-kept secret as a result of all it’s essential to do is learn the gorgeous, elegant prose that flows from his pen. It isn’t simply the insights however his eloquence that’s unmatched in monetary writing. Ignore the Lengthy Island accent and the TV persona – simply learn the phrases he writes.

From The New Concern & Greed:

“Livermore had rivals and counterparties you noticed because the enemy, nevertheless it was small and it was shut quarters. A knife combat. This factor right this moment is nuclear battle. No survivors. It’s a Squid Sport occasion on a world scale. Tens of millions of anonymous, faceless strangers in an internet surroundings that actually is aware of no spatial or geographic limitations. It’s an surroundings during which the wealthiest most profitable gamers like Chamath and Steve Cohen might be publicly—day by day—accosted by the mob throwing fistfuls of horseshit at them from the alleyways. I don’t know if the heuristics Livermore performed the sport by could be so simply utilized…”

Brutal honesty.

To actually see the place the poet thrives, try the shortest chapter within the guide: “I Did Every part I Was Supposed To Do.” Somewhat than reiterate the lively versus passive debate, he tells the story from the angle of the dropping aspect of that debate, the true one who is getting steamrolled by the Relentless Bid:

“I might clarify how individuals don’t care in regards to the alternative to outperform by 100 foundation factors yearly. How the SPIVA scorecard calls us assholes each 90 days. So do the bloggers, however they don’t wait 90 days, they only go in all day lengthy. I might inform her how all of the brokers that used to promote our funds switched careers, they’re all monetary advisors now, they don’t ship consumer cash into something they could must defend. Cowl your individual ass. Nobody ever has to defend an index. It’s an absurd proposition. It’s like having to defend the climate. No person ever has to reply for the climate. The S&P 500 is the climate…”

Most of us don’t take into consideration the poor bastard on the opposite aspect of our trades, calling his spouse to inform her he simply acquired sacked. Josh does…

~~~

Do your self a favor, and get your self a replica of this guide. Learn it slowly. You gained’t remorse it.

[ad_2]