[ad_1]

In a current report analyzing the second quarter (Q2) efficiency of the Layer 1 (L1) blockchain Algorand (ALGO), knowledge analytics agency Messari highlighted a number of notable milestones achieved by the community in the course of the interval, with a report in transactions being one of the vital notable ones.

Speedy Community Development

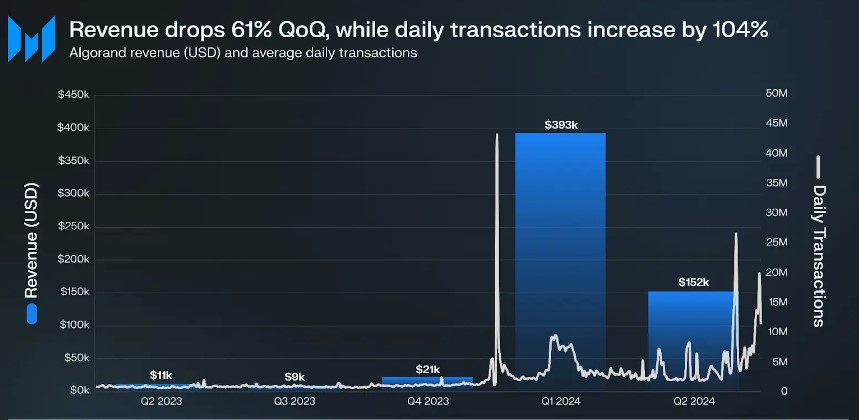

One of many key metrics that stood out was the surge in Algorand’s common day by day transactions, which skyrocketed by 104% to succeed in 4.7 million. The full transactions recorded a extra modest 6% quarter-over-quarter (QoQ) enhance, reaching 425 million.

Regardless of this heightened transaction quantity, Algorand’s income took a success, declining by 61% to $152,000. The report attributed this to a 46% depreciation within the worth of ALGO towards the US greenback in comparison with the earlier quarter. Though the common transaction charge rose by 44%, the general greenback income nonetheless declined.

Associated Studying

The 61% lower in quarterly income was additionally traced to a correction following ALGO’s 1,747% surge in Q1, pushed by a one-day spike of 43 million transactions linked to the ORA memecoin undertaking.

Nevertheless, on a year-over-year (YoY) foundation, Algorand’s income noticed a considerable 1,241% enhance, climbing from $11,000 to $152,000.

On a constructive notice, Algorand reached a major milestone of two billion transactions in the course of the quarter, showcasing the community’s progress and adoption. Notably, the community took 4 years to attain its first billion transactions, whereas the second billion was reached inside only one 12 months.

Algorand Staking Drops To Lowest Stage In A 12 months

In Q2 2024, the quantity of ALGO staked on the Algorand community declined 38% YoY and 6% QoQ, reaching its lowest stage at 1.6 billion ALGO staked in a 12 months. Messari believes this can be as a result of lowering rewards allotted per governance interval.

The share of Algorand’s eligible provide that was staked decreased by 4.7% QoQ and now stands at 20.2%. In the meantime, Algorand’s circulating provide elevated by 1.2% to eight.2 billion ALGO.

Lastly, knowledge reveals that the market cap for stablecoins on Algorand elevated by 15% QoQ, rising from $73 million to $85 million, primarily pushed by a 32% enhance in Circle’s USDC stablecoin market cap, which now accounts for 78% of the whole stablecoin market cap on Algorand.

Conversely, Tether’s USDT market cap dropped by 22%, making up 21% of Algorand’s stablecoin market share. EURD’s market cap remained at a 1% share of Algorand’s stablecoin market cap.

ALGO Value Faces Make-Or-Break Second

The ALGO token has seen important worth positive aspects in current weeks after a difficult Q2 for the value and the broader market. CoinGecko knowledge reveals that the token has seen a 14% worth enhance within the final two weeks and 12% within the final seven days alone.

This has resulted in ALGO buying and selling at $0.1357, slightly below its 200-day exponential shifting common (EMA), marked by the yellow line on the ALGO/USDT day by day chart beneath, which at present acts as a wall of resistance for the token.

Associated Studying

It will likely be important to clear this hurdle for a possible continuation of the value’s uptrend within the coming days and to determine the identical near-term help within the occasion of a correction.

Featured picture from DALL-E, chart from TradingView.com

[ad_2]