[ad_1]

We’re excited to share Bondora Group’s 2023 monetary outcomes, with the best spotlight being our seventh consecutive 12 months of profitability. Final 12 months was a affluent chapter in our monetary journey, showcasing what’s potential once you put your clients first. We’ve not solely sustained development but additionally delivered dependable returns to our buyers. Thanks for being part of our journey, and let’s dive into the main points!

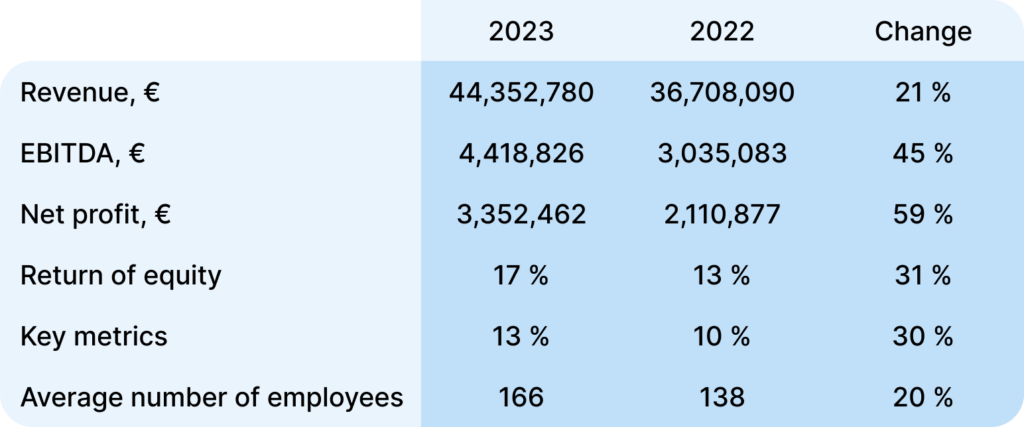

Key highlights from our 2023 monetary outcomes

- Income reached €44,4 million

- Internet revenue was €3,4 million

- Loans issued totaled €202,5 million

- €139 million of loans had been issued in Finland and €40,2 million in Estonia

Bondora Group’s 2023 in assessment

At Bondora Group, our mission is easy: to assist folks dwell the life they need with much less monetary stress. We provide user-friendly, safe options that make lending and investing accessible and easy. Our providers are totally on-line, making it as handy as potential for our clients to realize their monetary targets.

2023 additionally marked the sixth 12 months in a row that our Go & Develop buyers have loved a steady return of as much as 6.75%* p.a. on their funding. We’re pleased with our development and constant earnings, which have empowered us on this sustainable development observe.

With over 16 years of expertise, we offer credit score providers to clients in Estonia, Finland, the Netherlands, and Latvia. Most of our loans in 2023 got here from Finland.

Bondora Group 2023 Monetary Outcomes Desk

EBITDA – earnings earlier than curiosity, tax depreciation and amortization

Return on fairness (ROE) = internet revenue or loss for the interval / whole fairness

Return on property (ROA) = internet revenue or loss for the interval / whole property

We’re regularly increasing and enhancing our merchandise to succeed in extra folks. Our objective is to have 1 million energetic clients within the coming years. Regardless of challenges within the international fintech market, Bondora Group has continued to hit its development targets.

In 2023, we issued €179 million in loans in Estonia and Finland. We additionally expanded within the Netherlands and entered the Latvian market. Our mortgage origination charges had been €7 million, mortgage administration charges totaled €23.1 million, and income from extra merchandise reached €133 million.

To assist this development, we elevated our crew by 28 folks in 2023, bringing our whole worker rely to a mean of 166. Regardless of these extra bills, we ended the 12 months with a internet revenue of €34 million.

You may learn the total 2023 Monetary Outcomes Report right here.

[ad_2]